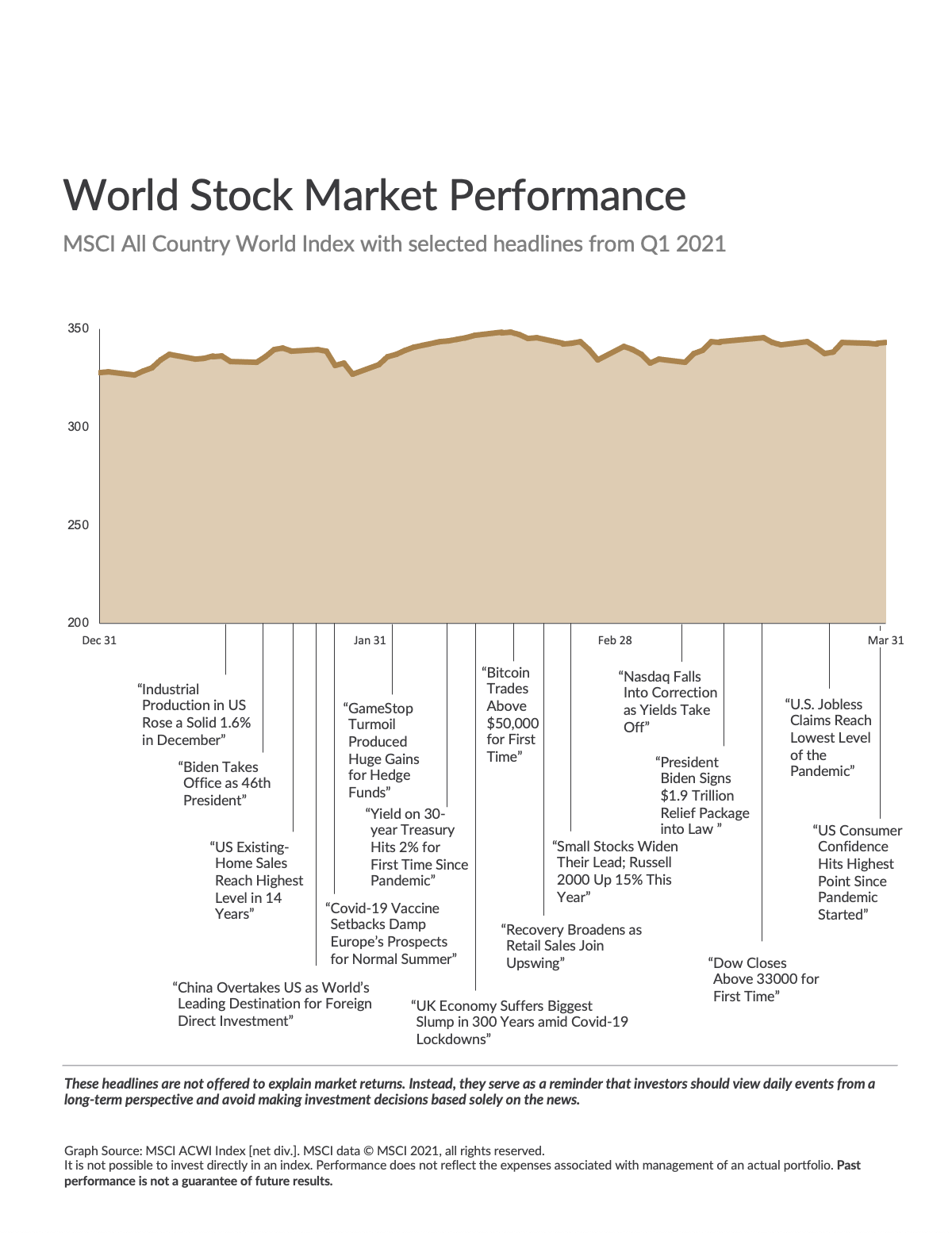

Even though the global stock and bond markets feel relatively calm as I write this, there’s been a whole heck of a lot that happened in Q1. In no particular order, we saw:

- A mob breach the capitol building

- The entire GameStop saga

- Virtually all crypto currencies post massive gains

- A $1.9 trillion stimulus package passed

- U.S. interest rates spike

- An NFT (piece of digital artwork) sell for over $69 million

Perhaps my senses have dulled a bit over the last year, because that’s a whopper of a list for feeling relatively calm.

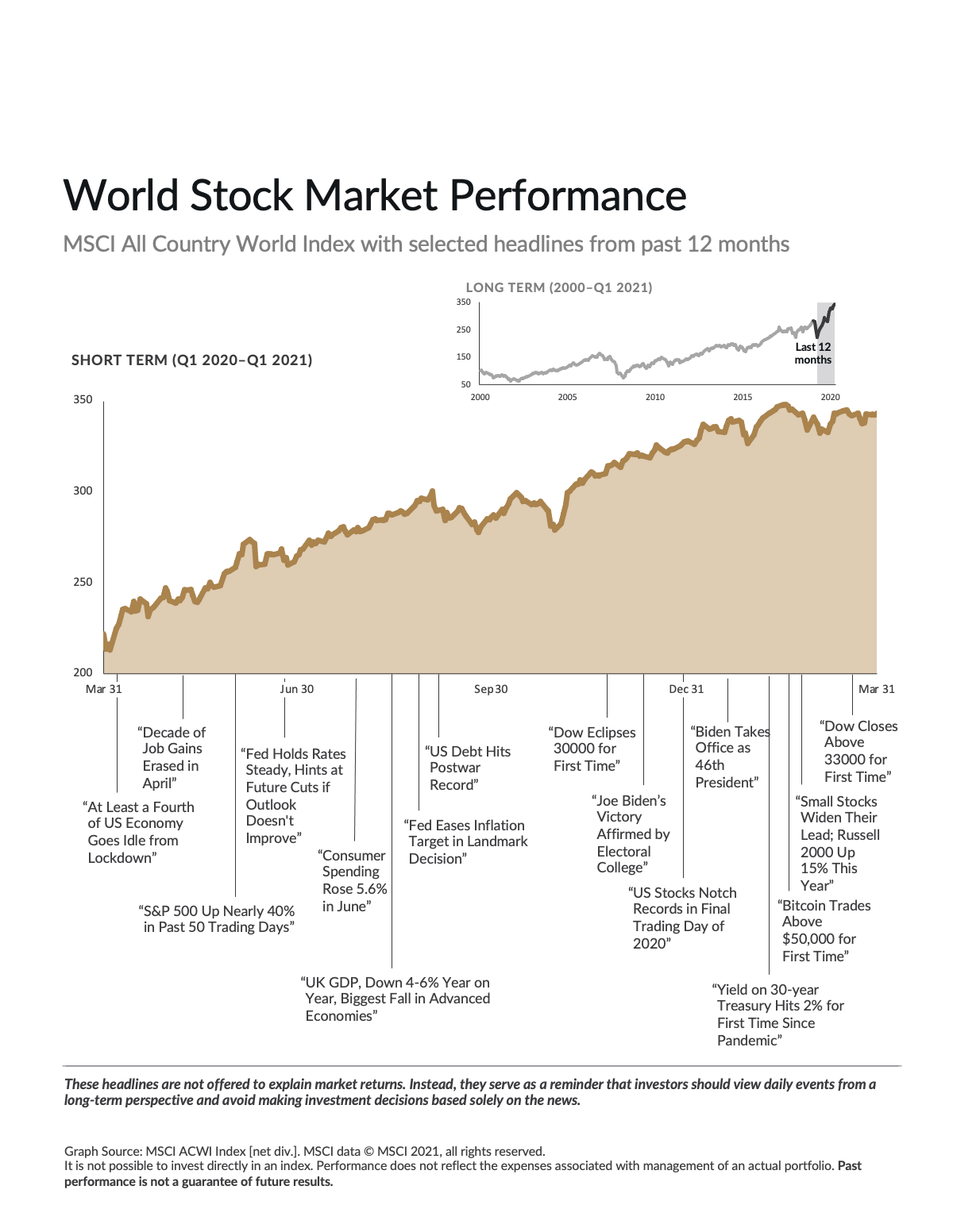

We are at a crossroads in the financial markets right now. Stock prices continue to climb higher and break records, as investors have priced in a substantial economic recovery over the coming 18-24 months. If the global economy is able to deliver that rebound the march upward should continue. But any misstep or hiccup could send us into correction territory at the drop of a hat.

Here’s this quarter’s market review.

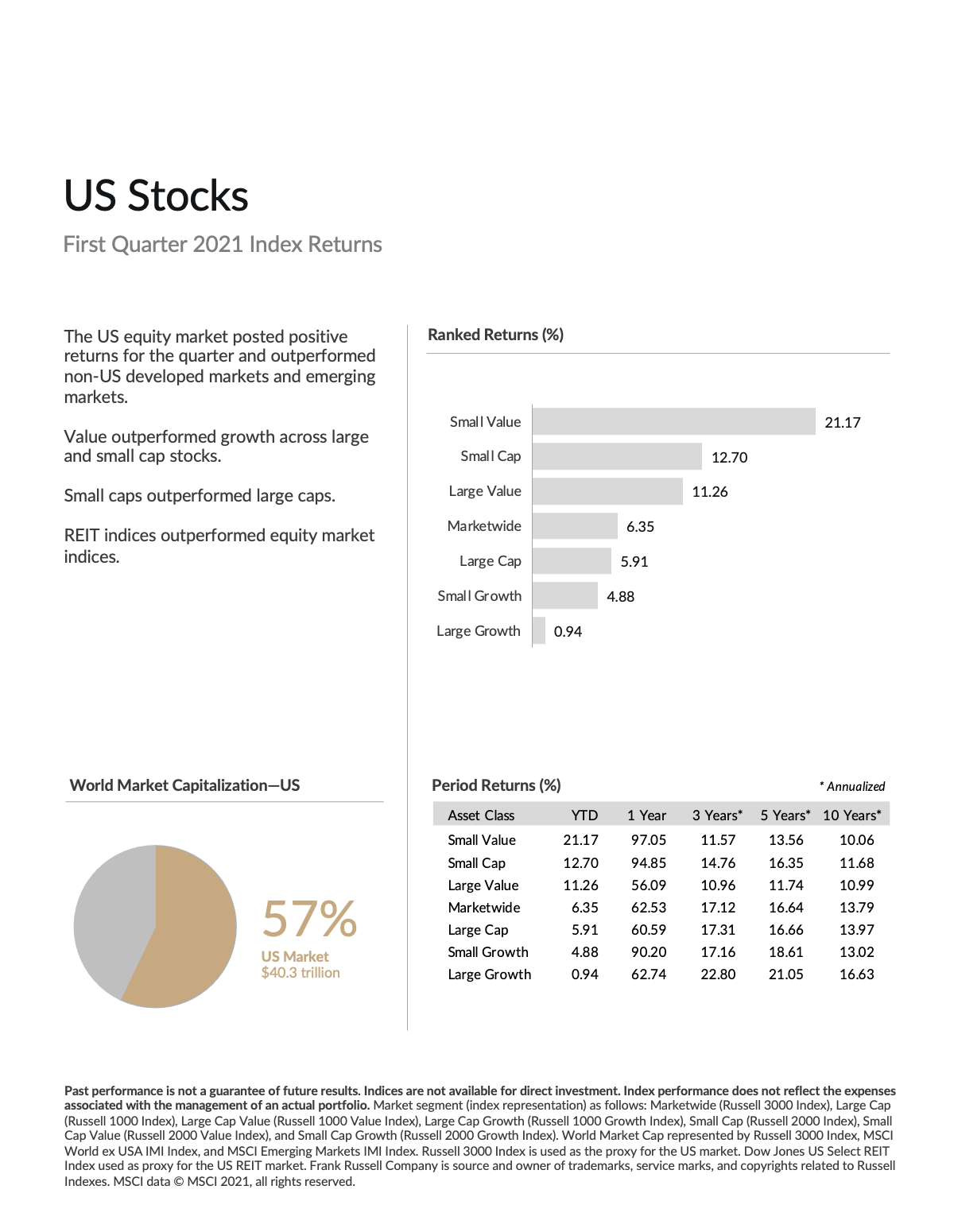

U.S. Stocks

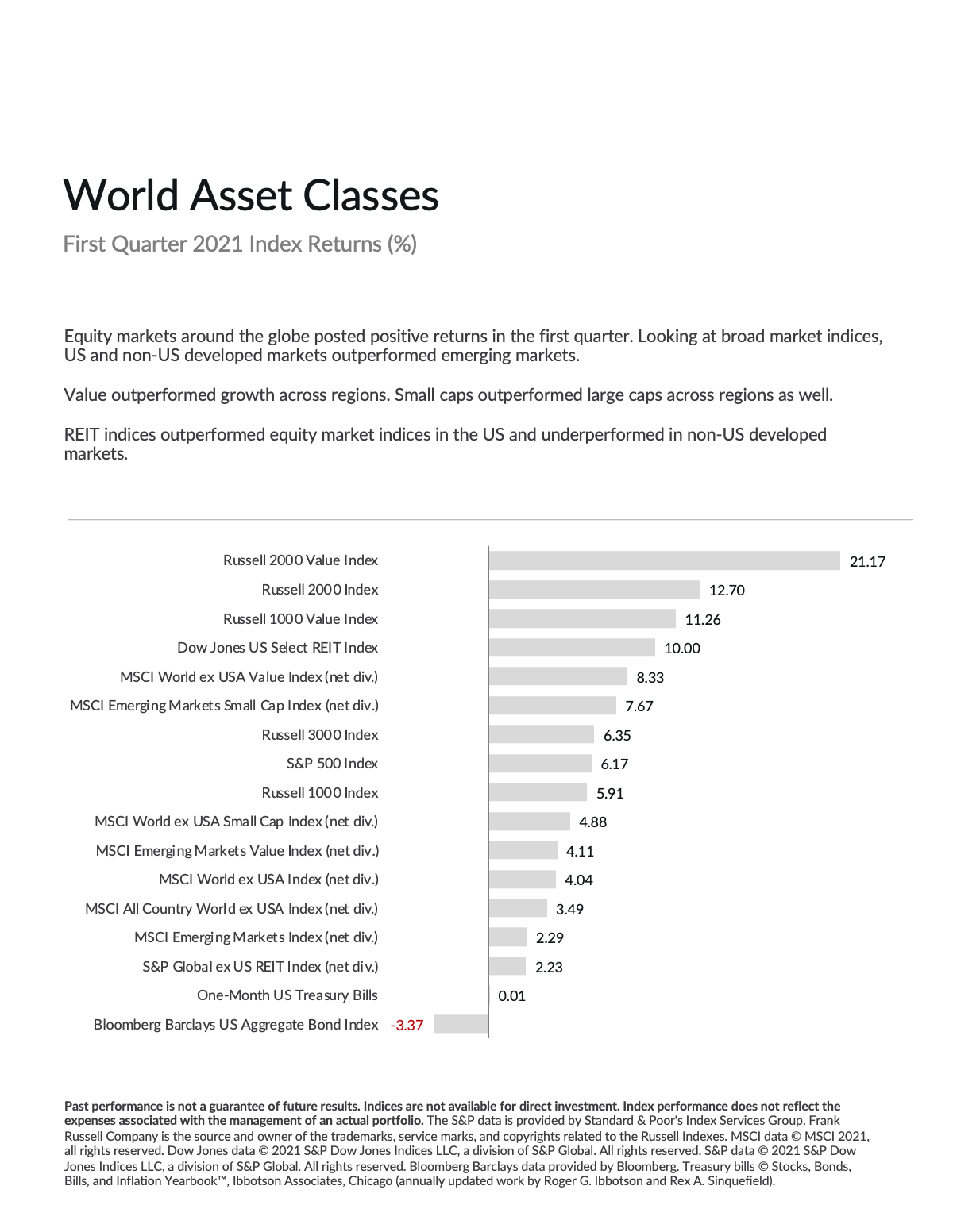

U.S. equities turned in another strong quarter to begin the year, and outpaced non-U.S. equities in both developed and emerging economies. The more interesting takeaway from U.S. stocks in Q1 is the disparity between value and growth – in both the large and small cap universes.

In the large cap space value returned 11.26% in Q1 compared to 0.94% for growth. Small cap value returned 21.17% on the quarter vs. 4.88% for its growth counterpart.

As I’ve been ranting about for a few years now, when value stocks outperform growth, they tend to do so by wide margins. While we’ve seen growth consistently widen the gap ahead of value stock returns over the last decade, value is now making up for lost time.

The timing of this turnaround is as typical as the magnitude. When economic times are good investors focus on growth opportunities and don’t care as much about the price they pay. But when the economy sours, investor sentiment tends to change at the flip of a switch. All of a sudden investors become concerned about valuations, earnings quality, and other fundamental factors. This may be what we’re seeing now, as the tenor surrounding mega cap tech stocks has cooled quite a bit recently.

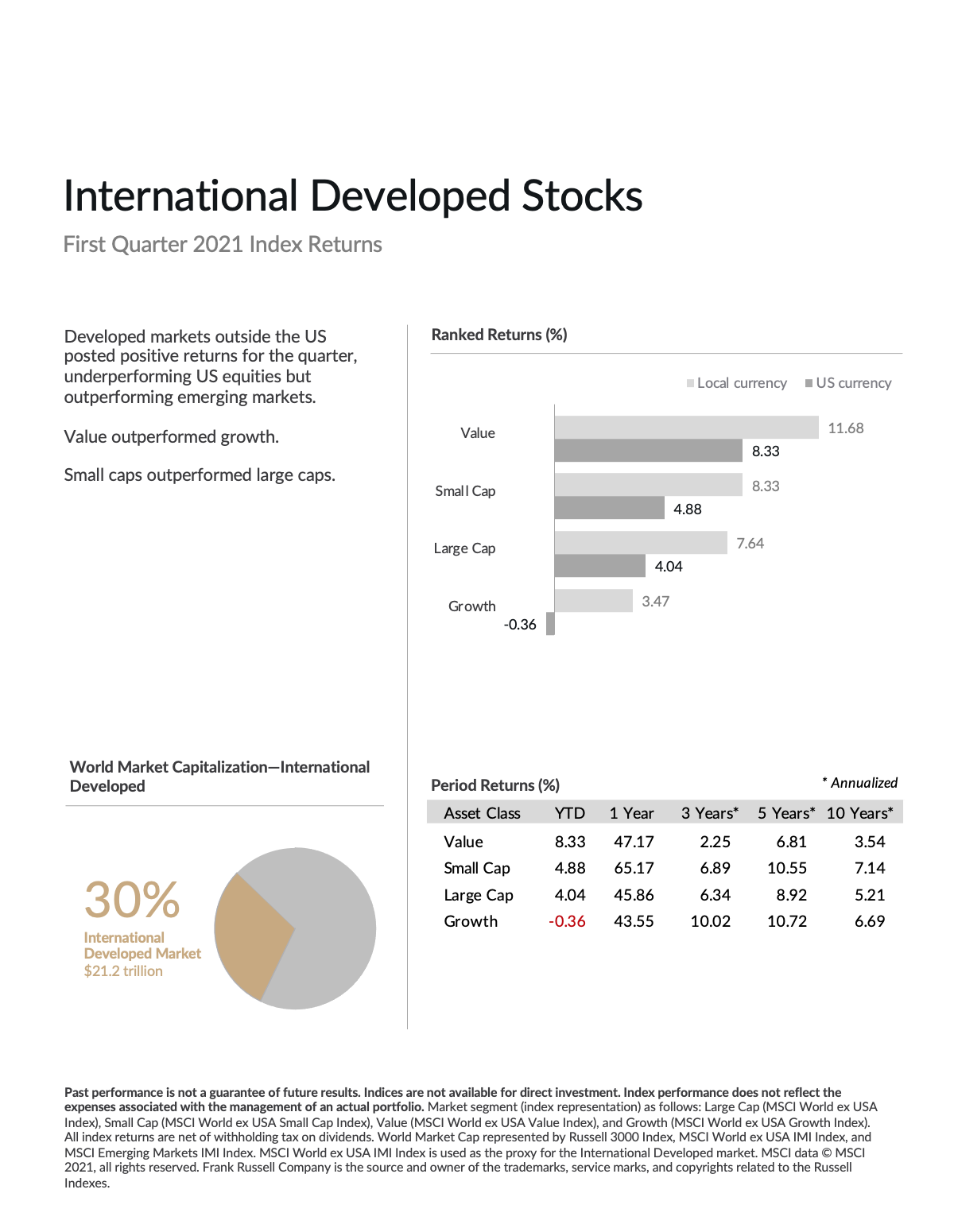

International Developed Stocks

The disparity between value and growth isn’t limited to the U.S. Equities in other developed economies showed a similar trend in Q1, with value returning 11.68% compared to 3.47% for growth.

There is still plenty of ground to be made up. Looking at the 10-year annualized returns below, international value still trails growth by 3.15% annualized (3.54% vs. 6.69%). Again, when value outperforms it does tend to make up lost ground in a hurry. So regardless of the direction that aggregate stock markets move in the coming quarters, we may be in for a period where value produces a far better investment outcome than growth.

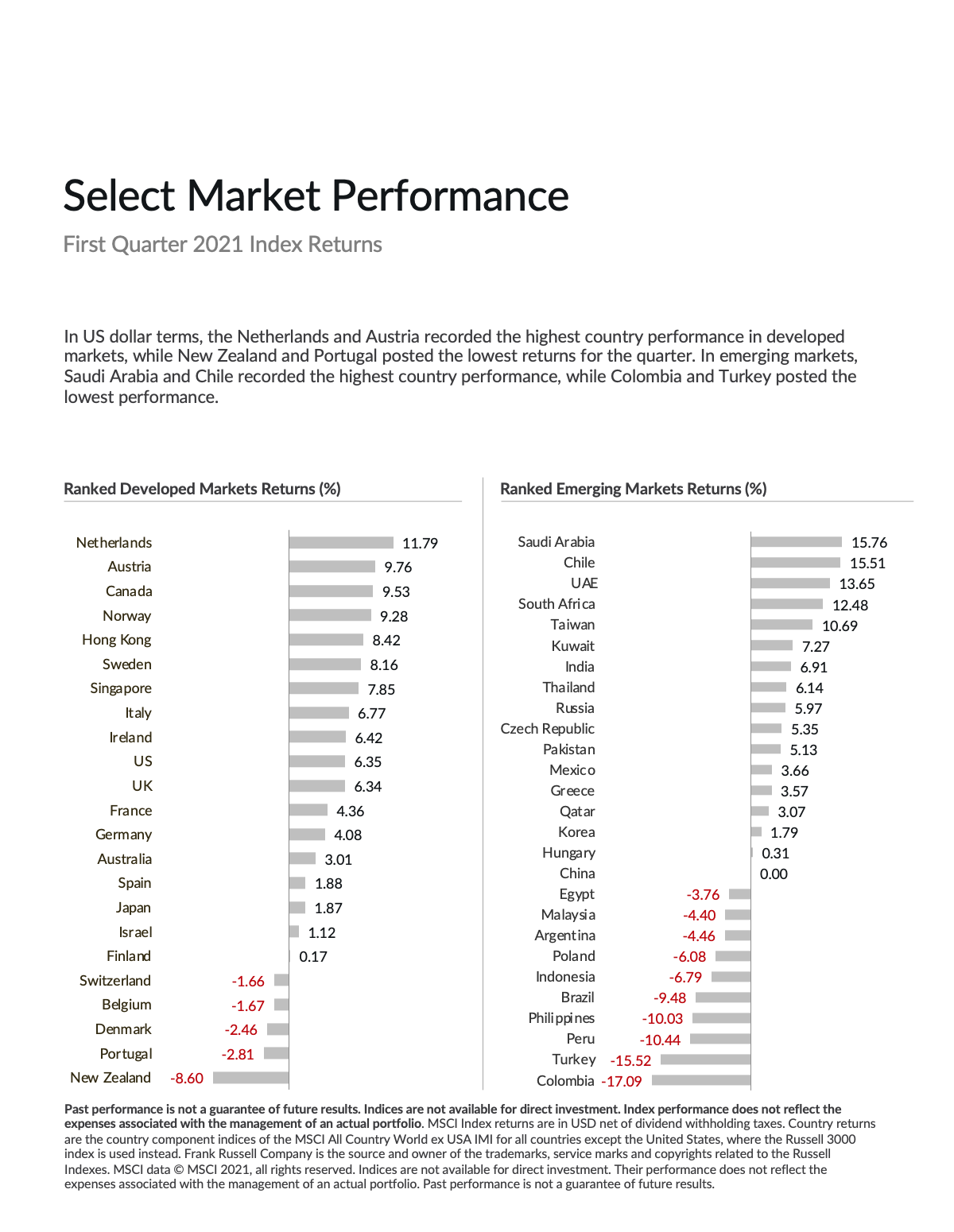

On an country by country basis the best Q1 performers were primarily in northern Europe, with Netherlands, Austria, and Norway taking three of the top four slots. New Zealand lagged, losing 8.6%.

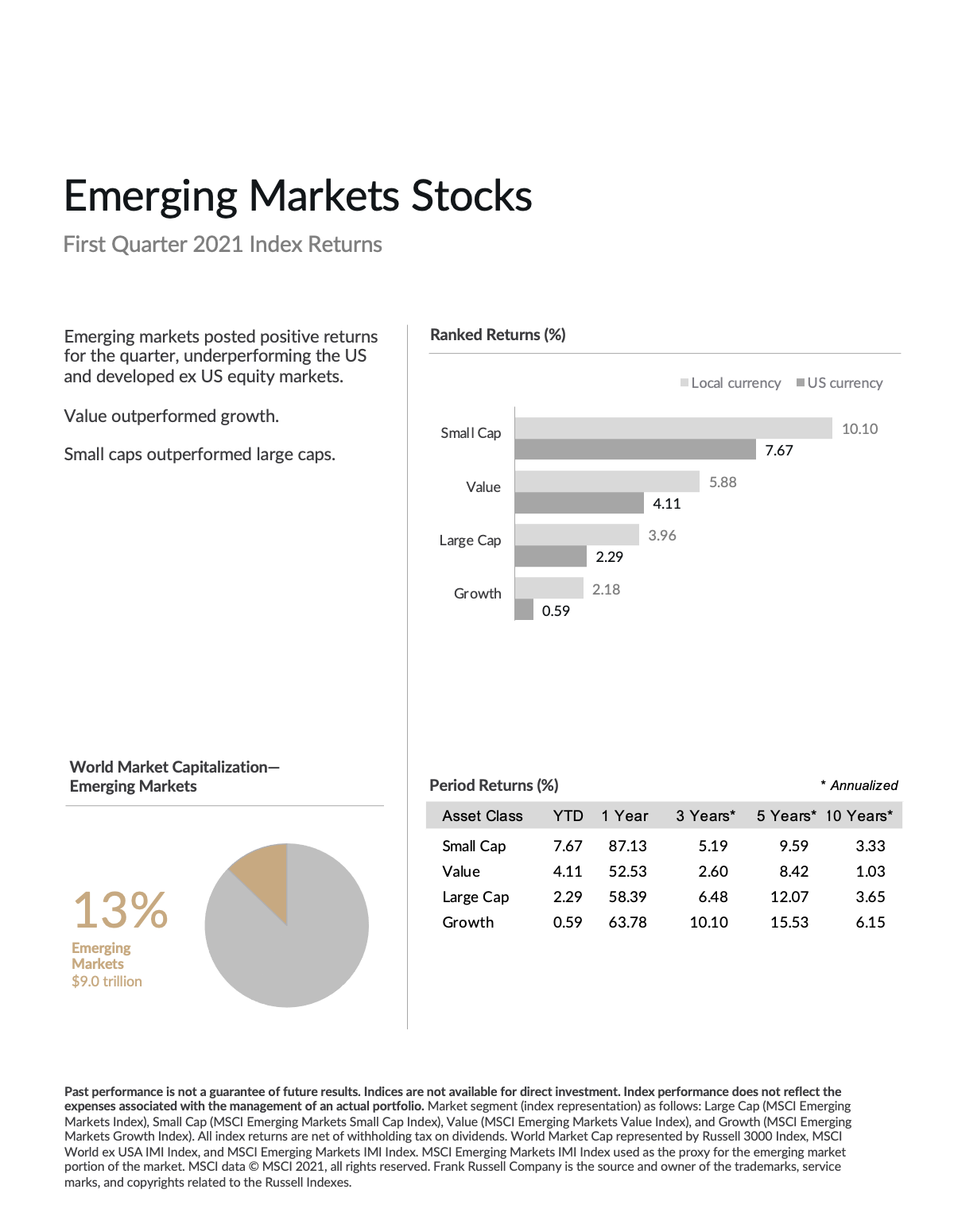

Emerging Markets Stocks

While emerging markets did wind up posting strong quarterly gains, the charts below don’t tell much of the asset class’s real story. Emerging markets have had a wonderful and steady recovery since March of last year when COVID-19 set in around the world. This rebound continued in the first half of Q1, but faltered in the second half.

Part of this is thanks to rising U.S. interest rates. When emerging economies borrow money to finance their governments, they’re often forced to do so in U.S. dollars. Since investors who might buy an emerging country’s bonds are already wary about its ability to pay them back, agreeing to lend funds in a volatile country’s home currency can have dramatic repercussions. This being the case, investors prefer to lend, and be paid back in U.S. dollars.

This also means that when interest rates in the U.S. spike, it makes borrowing costs for emerging economies go up. Which isn’t a problem for more developed countries, since they have more latitude to borrow in their home currency.

The other reason for the retreat in the second half of Q1 has to do with the COVID variants and vaccination rates. Whereas the U.S. currently has nearly a third of its population fully vaccinated, emerging economies are struggling to get to 10%. And with growing concern about variants (some of which are coming directly from these emerging economies), investor sentiment has cooled a bit on the asset class. As always, as a high risk/high reward proposition emerging markets could reverse course very quickly.

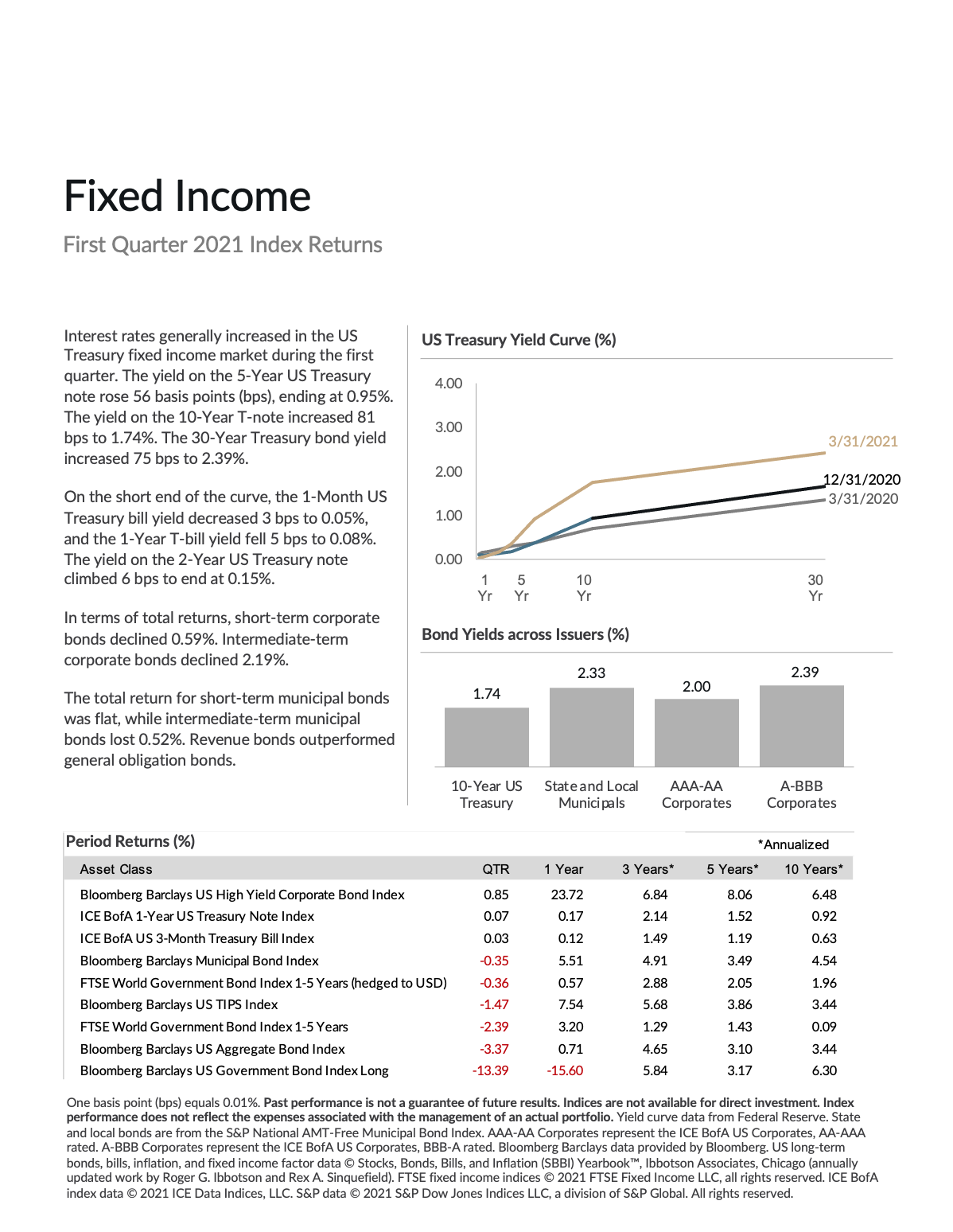

U.S. Fixed Income

We have liftoff!

Bond yields in the U.S. spiked in Q1 across pretty much the entire yield curve. The 5-year U.S. treasury note rose 56 basis points, from 0.39% to 0.95%. The 10-year U.S. treasury note rose 81 basis points, from 0.93% to 1.74%. The 30-year U.S. treasury bond rose 75 basis points, from 1.64% to 2.39%. While the aggregate level of rates is still quite low, these are very substantial jumps.

There are a few things going on here. First, the federal reserve communicated that they intend on keeping short term rates low through at least the end of 2023. The minutes from their most recent meeting showed that they do see signs of economic recovery, and that inflation is likely to tick up slightly due to supply constraints. (Think microchip shortages around the globe).

The spike in longer term yields has more to do with President Biden’s most recent stimulus package, and its price tag of $1.9 trillion. Market participants clearly believe that such a massive amount of government spending will inject enough dollars into the economy to kickstart inflation beyond what the federal reserve can control.

This is a valid concern. While the fed pulls all the strings when it comes to monetary policy and short term policy, fiscal policy is completely out of their hands. Fed officials track government spending in order to monitor inflation, of course. But the fear is that a stimulus package of this magnitude is beyond the Fed’s ability to control price stability.

Fed officials feel like they have a good handle on it. Only time will tell if they’re right.

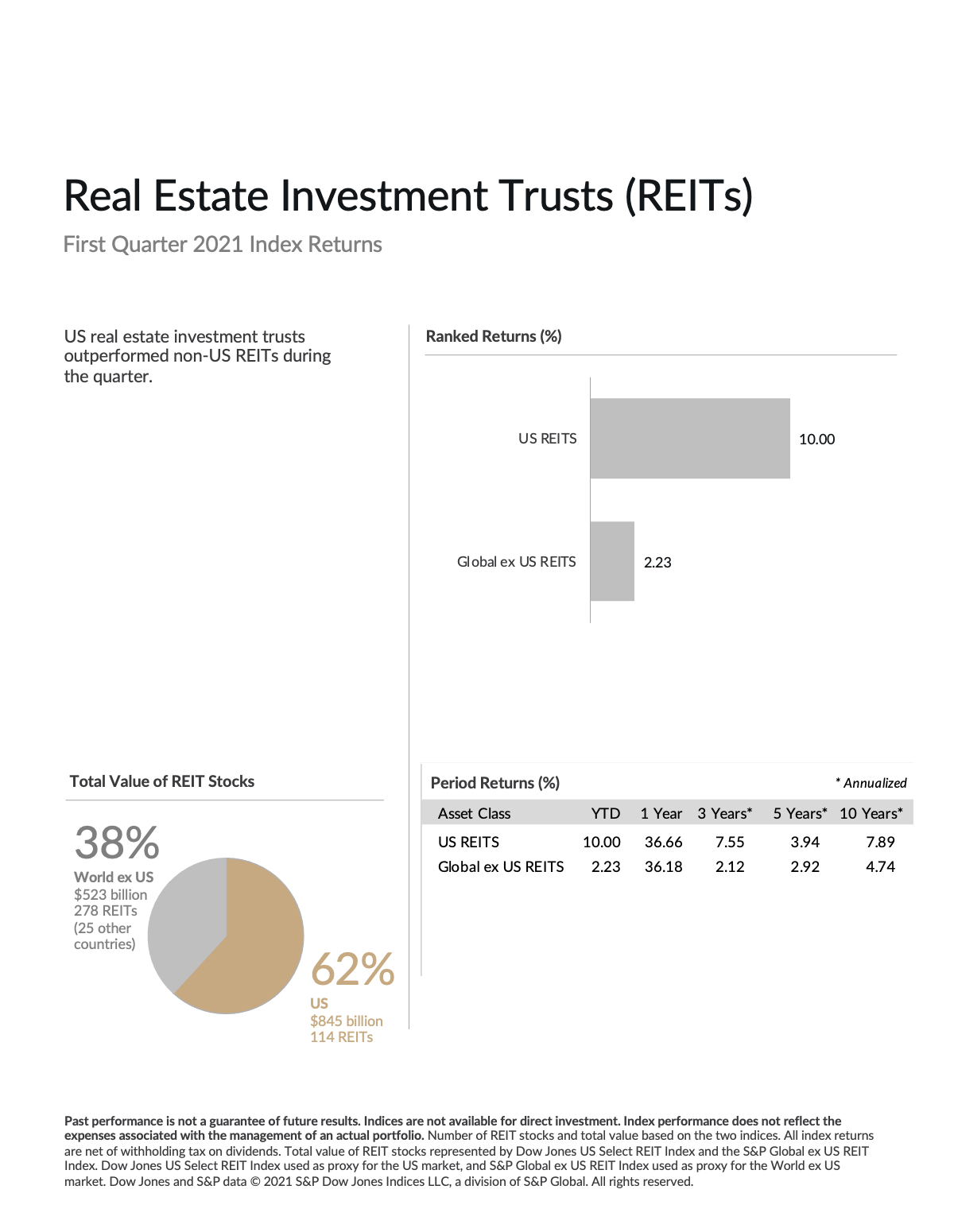

Real Estate Investment Trusts (REITs)

U.S. based REITs returned an even 10% in Q1, but there continues to be a large bifurcation of returns between different sectors.

Unsurprisingly hotels, malls, and retailers that were particularly sensitive to COVID related economic stress have been hit hard over the last year. Industrial sectors and self-storage (like your local storage unit business) have done substantially better, as they’re somewhat more insulated from the global economic contraction.

Since the vaccine announcements in early November, the hotel an retail sectors have rebounded & outperformed other real estate sectors. As more people around the globe become vaccinated, these operating centers will continue to become available to a larger portion of the population. And with all the pent up demand to travel and shop given long quarantine, this could be an area that outperforms over the next year or so too.