We’re now nearly a full month into 2021, and stocks, bonds, and virtually all other asset classes continue to post excellent returns. The question is…..why? We’re at a point where the market seems to be impervious to bad news. Meanwhile bitcoin and cryptocurrencies continue to post new highs, and college students are even becoming famous for posting their trading strategies on social media. As easy money central bank policies abound across the globe there is a lot of market froth out there. We’re starting to see all the classic signs of a bubble.

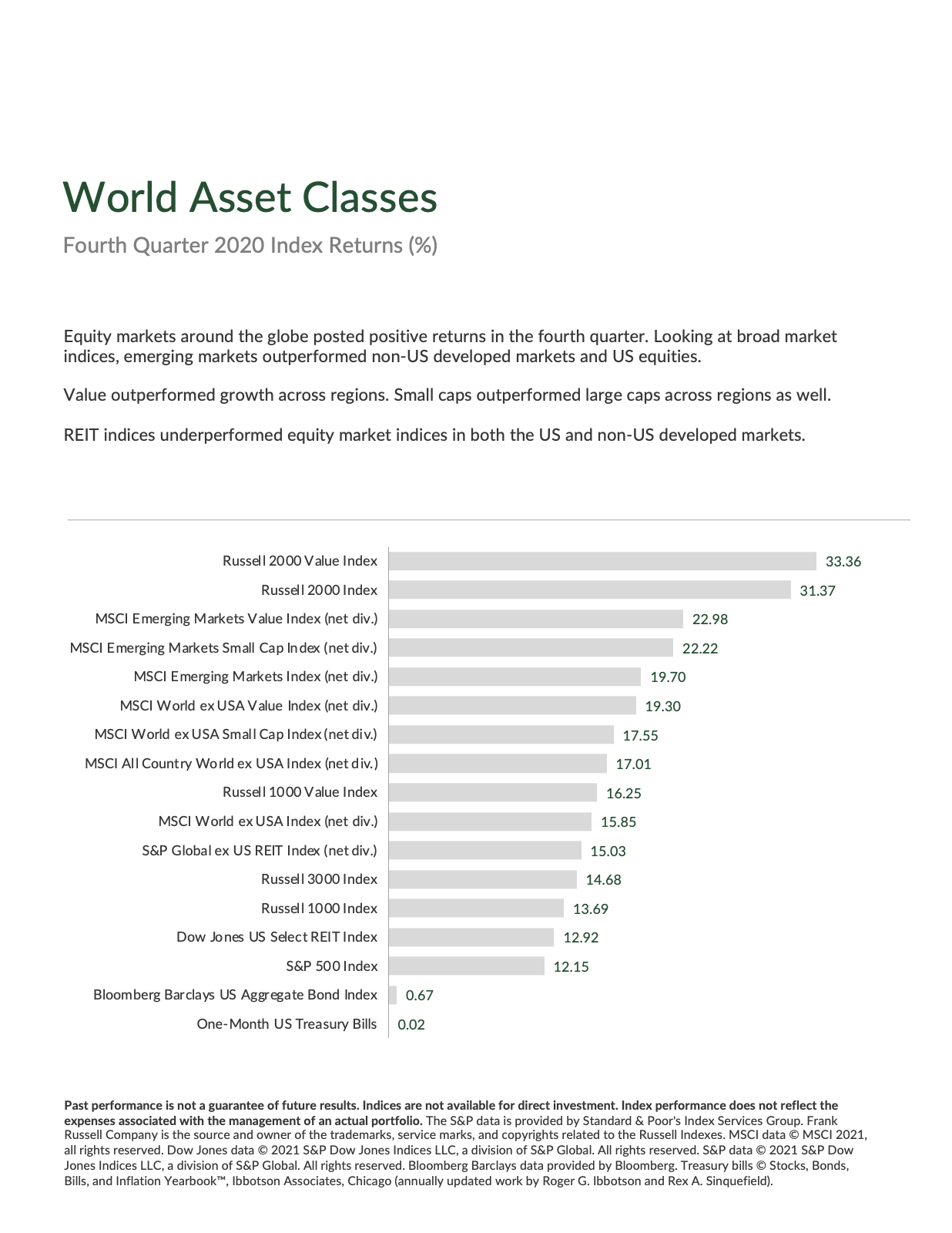

Interestingly, equities in small cap and value shares led the pack in the fourth quarter of 2020. This is the first quarter that’s happened for quite a while, but both areas have a lot more ground to cover if they’re to make up for the last decade.

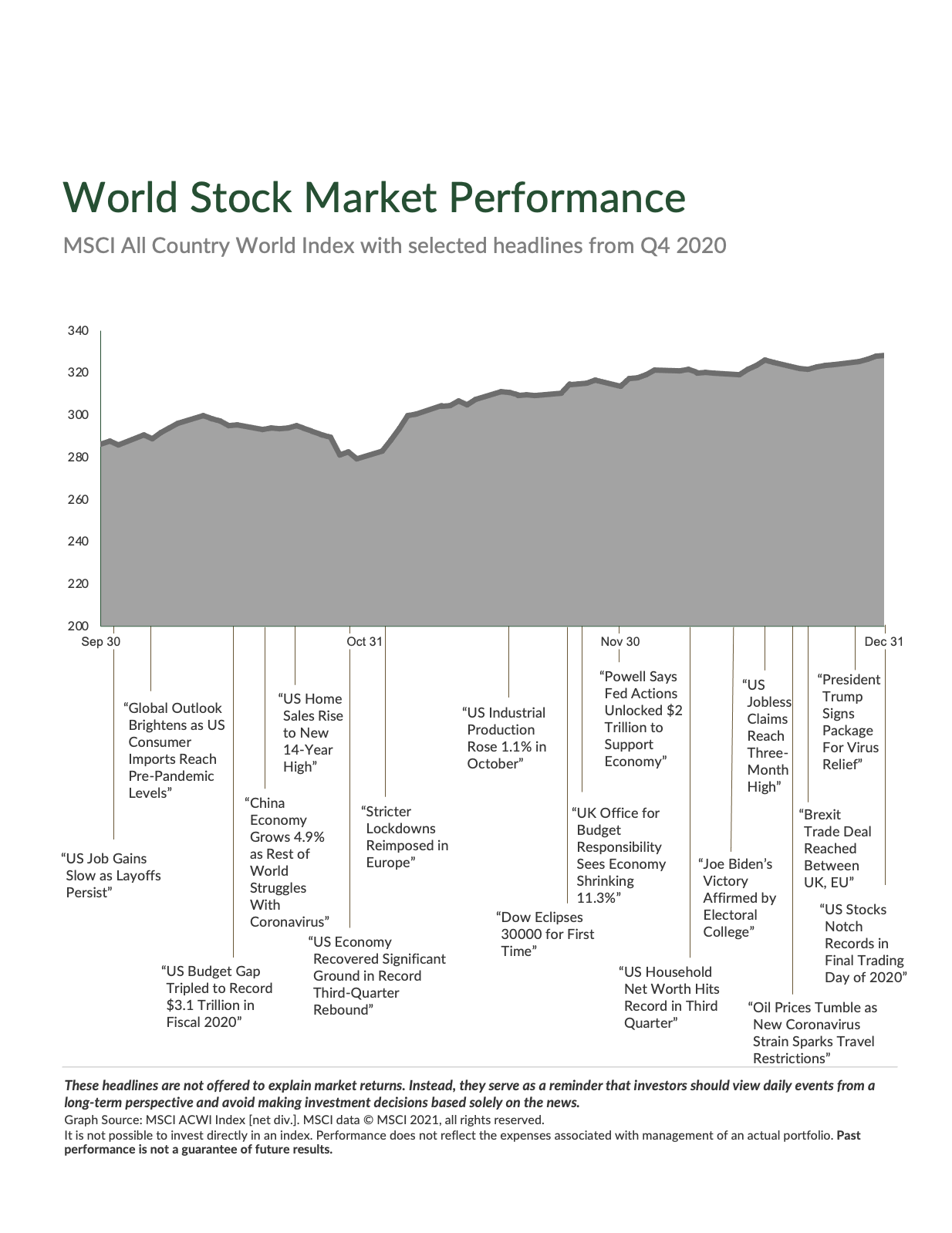

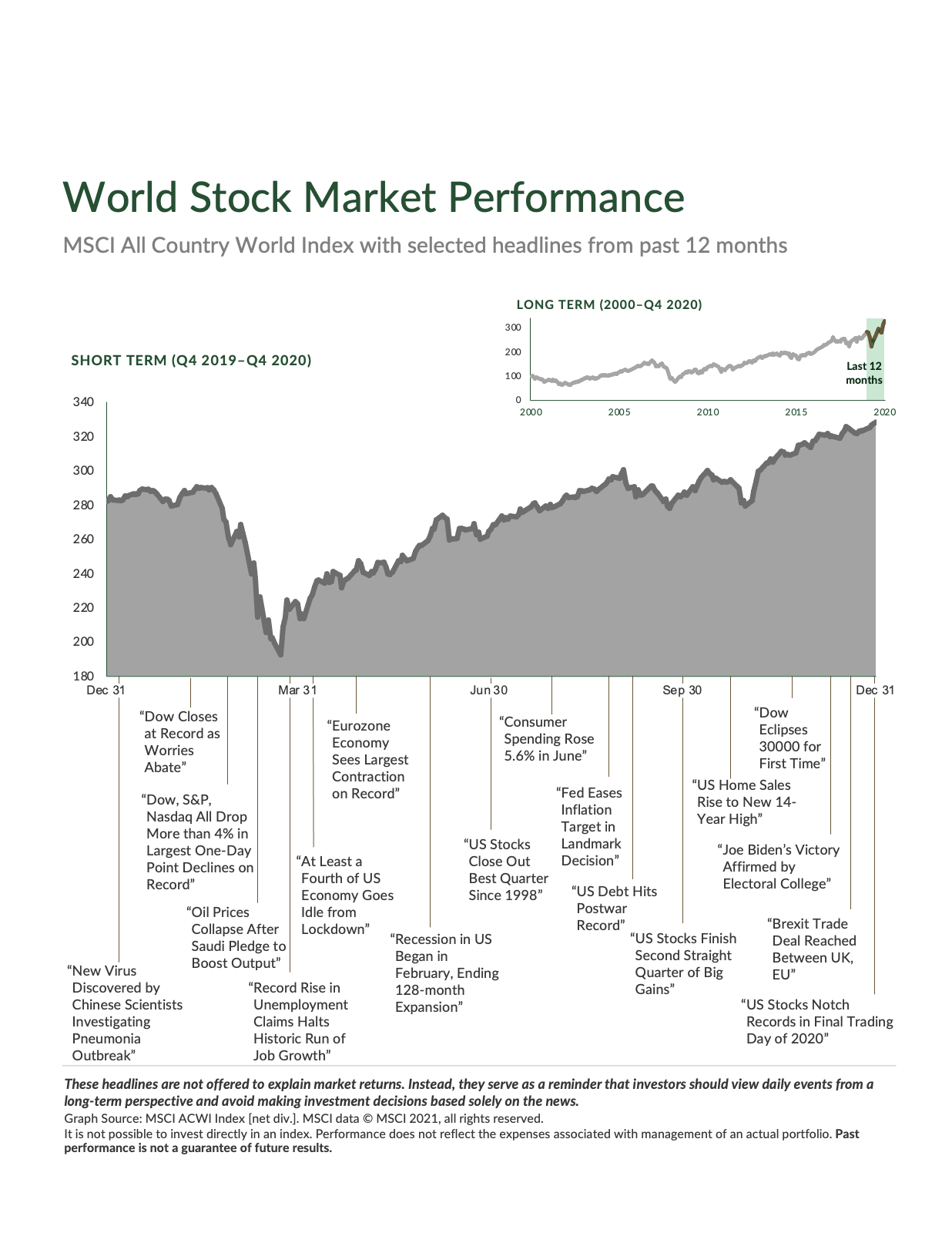

Here’s this quarter’s market update.

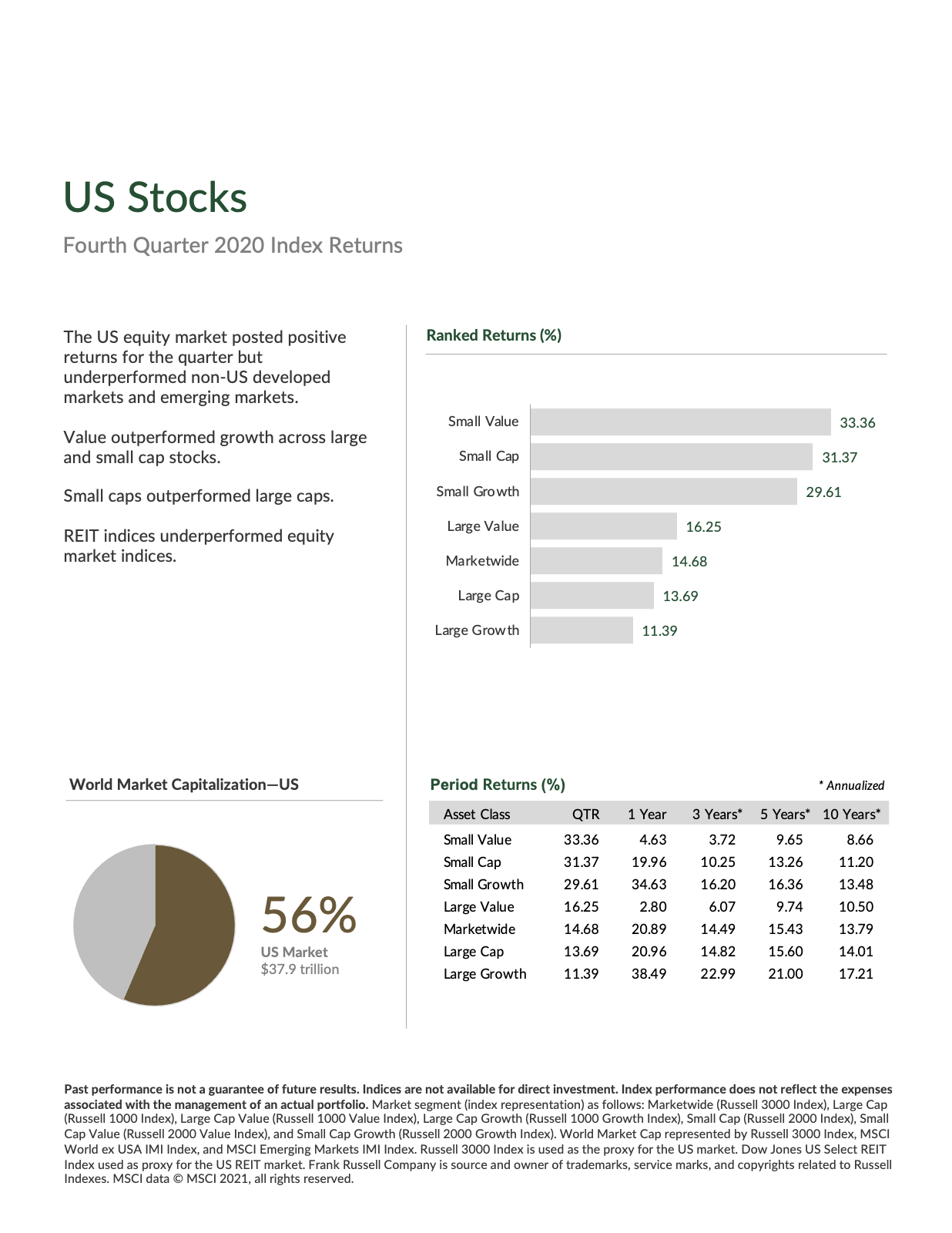

U.S. Stocks

Small cap shares roared back to relevancy in the fourth quarter of 2020. It’s been a while. The Russell 2000 index has lagged large companies for the better part of a decade. But as I’ve written about quite a bit in the last few years, when small cap and value shares catch up, they tend to do so very quickly. Value stocks fared better than growth in both small and large cap sizes as well, but not to the same degree that small caps outperformed large.

That’s not to say that neither stock style doesn’t have more catching up to do. You can see from the period returns chart below that while small caps and value shares fared better in Q4, they’re still lagging large caps and growth over 1, 3, 5, and 10 year periods.

Does that mean that this recent momentum will continue? Not necessarily. But both are far more reasonably priced in this frothy market, and we continue to weight client portfolios toward securities sharing those characteristics.

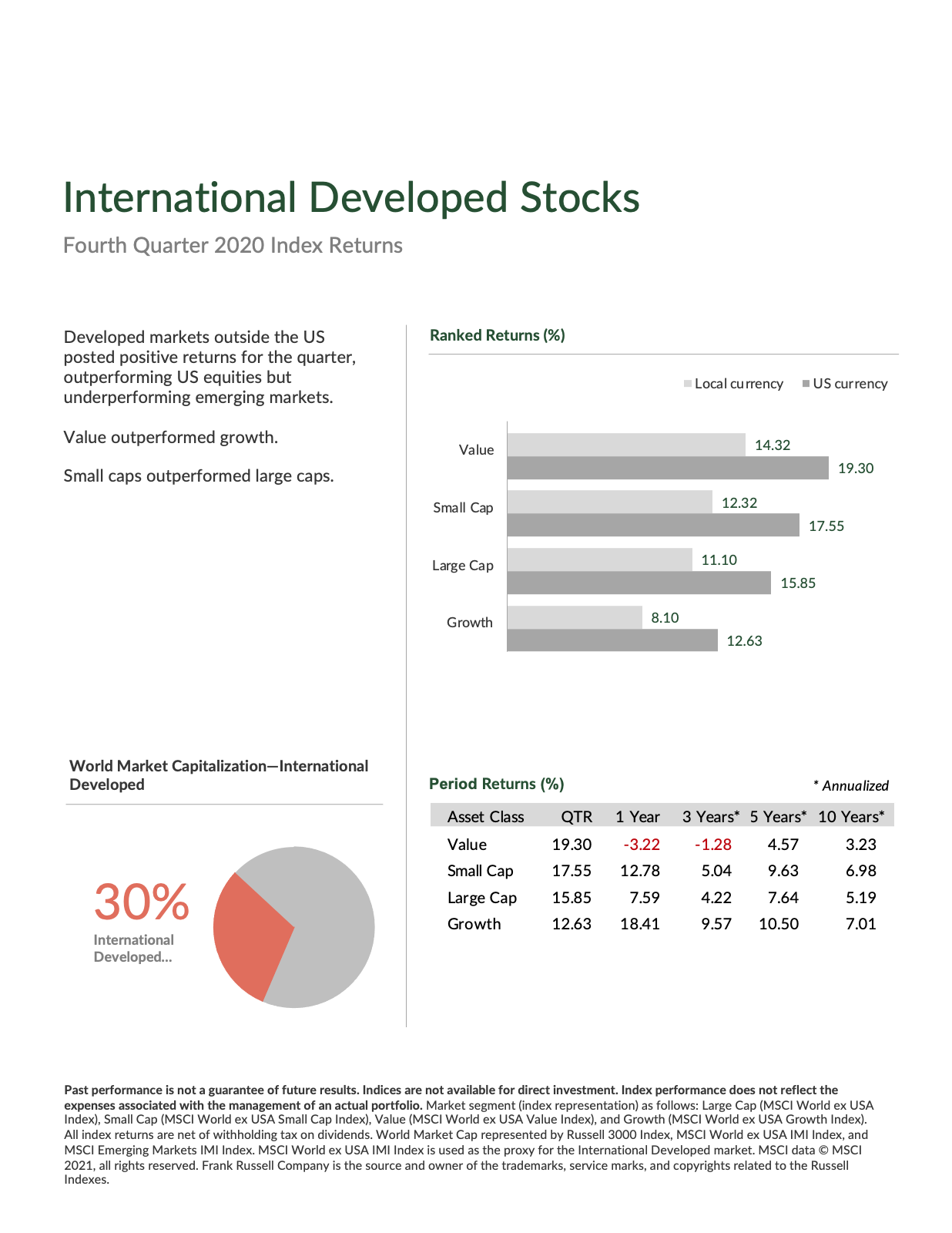

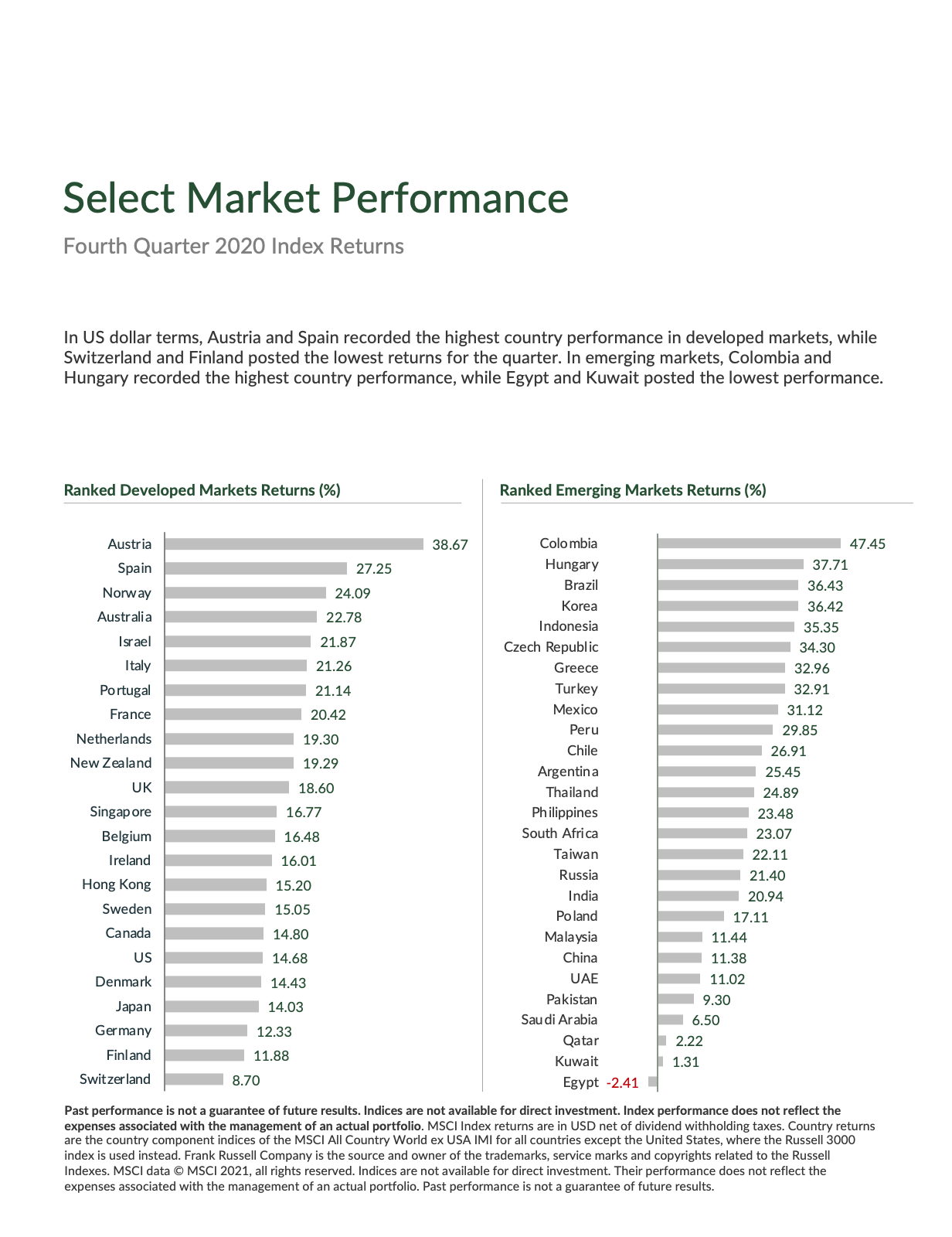

International Developed Stocks

Like their U.S. counterparts, small cap and value shares edged out both large cap and growth in international developed economies. Q4 was kind across the board, though. Virtually all countries saw substantial gains, ranging all the way up to over 38% in Austria. While the coronavirus risks to international economies haven’t gone away, many of these countries have been more effective at mitigating spread than the U.S.. Their economies have fared relatively better as a result.

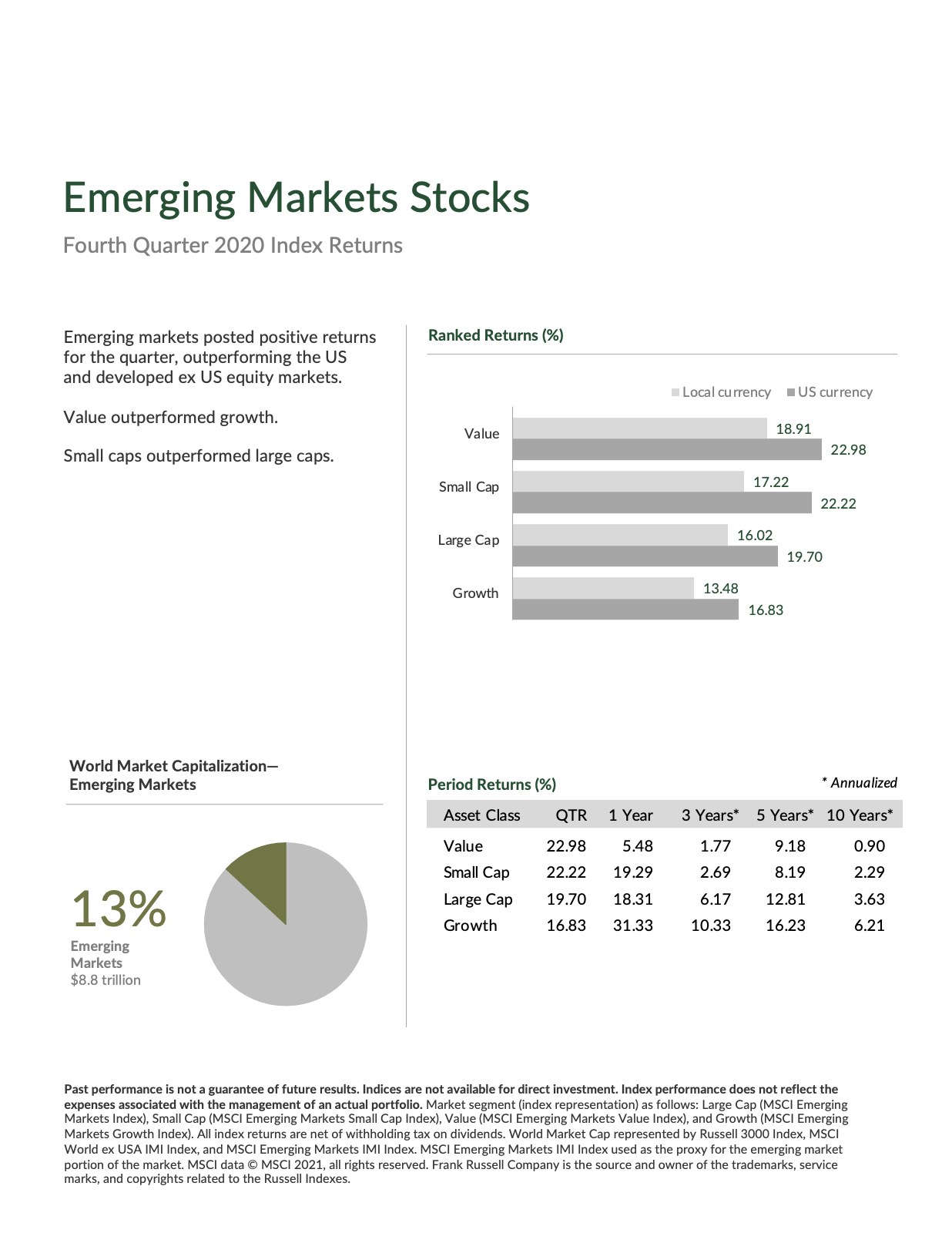

Emerging Markets Stocks

Stocks in emerging economies around the globe marginally outpaced those in developed economies in Q4 2020. There wasn’t much consistency to geographic region though, as top performing countries could be found in North America, South America, Europe, and Asia. The small cap and value trend was present across emerging markets as well, just as in the U.S. and international developed economies.

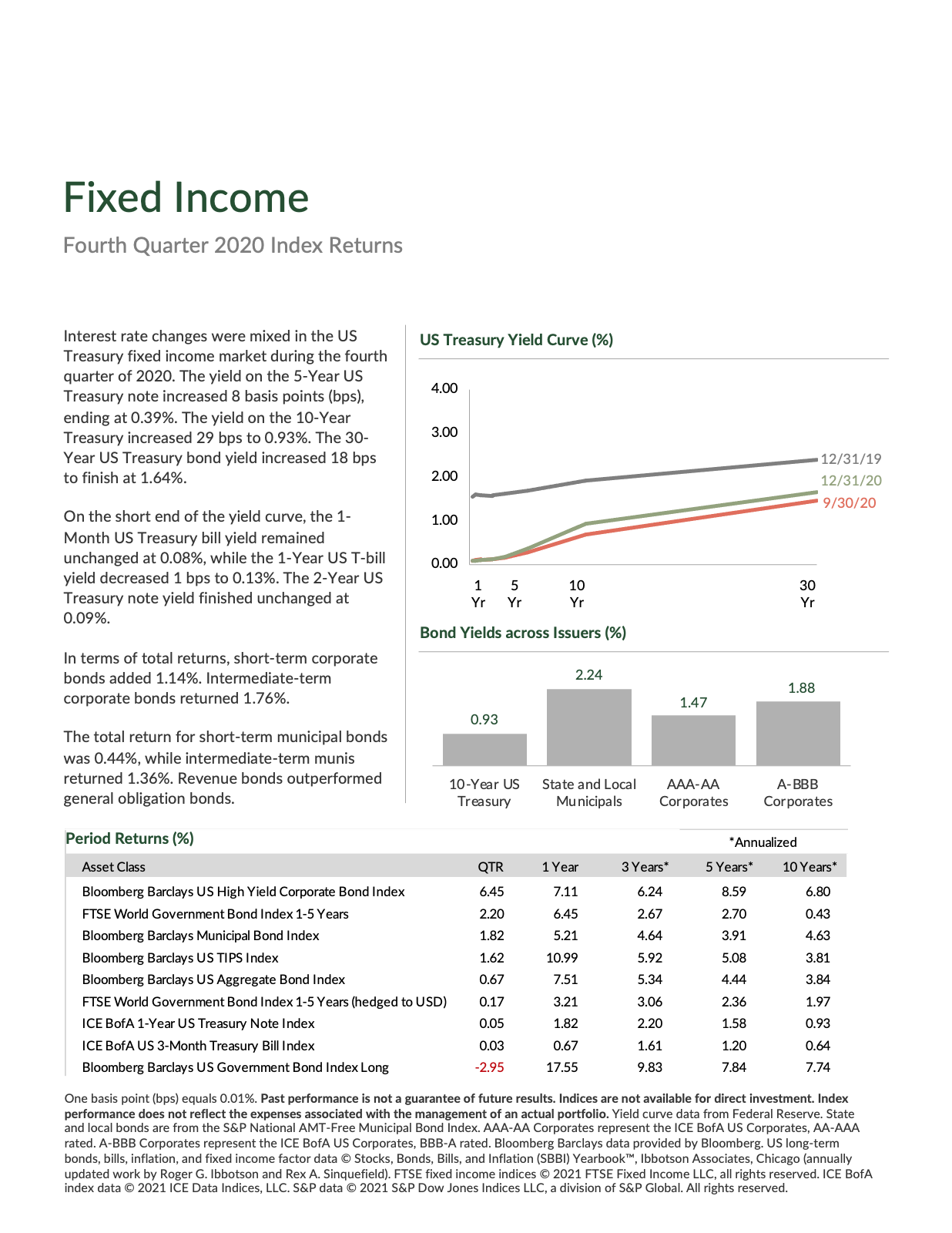

U.S. Fixed Income

While short term rates were largely unchanged in Q4, mid and longer term rates rose ever so slightly. They remain at substantially lower levels than they were one year prior, which has produced very strong bond returns over the last 12 months. The Q4 bump in mid and long term rates generally means the market expects better economic prospects, which aligns with the approval of several COVID-19 vaccines.

Like all other asset classes right now, investors are scouring the fixed income markets for yield. There’s a tendency to venture out farther on the risk curve when rates are as low as they are now, which is exactly what we’re seeing in the high yield sectors. With fewer options to find adequate mid to long term yields, investors have clamored into riskier bonds and driven up prices. Which means that future investors in the asset class will need to take more risk find the same yield. We can see this in the quarterly and annual return on the Bloomberg Barclays US Corporate High Yield Bond Index below. The 4th quarter produced a 6.45% return for the index, the last year produced 7.11%. These are exceptionally high returns for bonds – even with a substantial amount of credit risk involved.

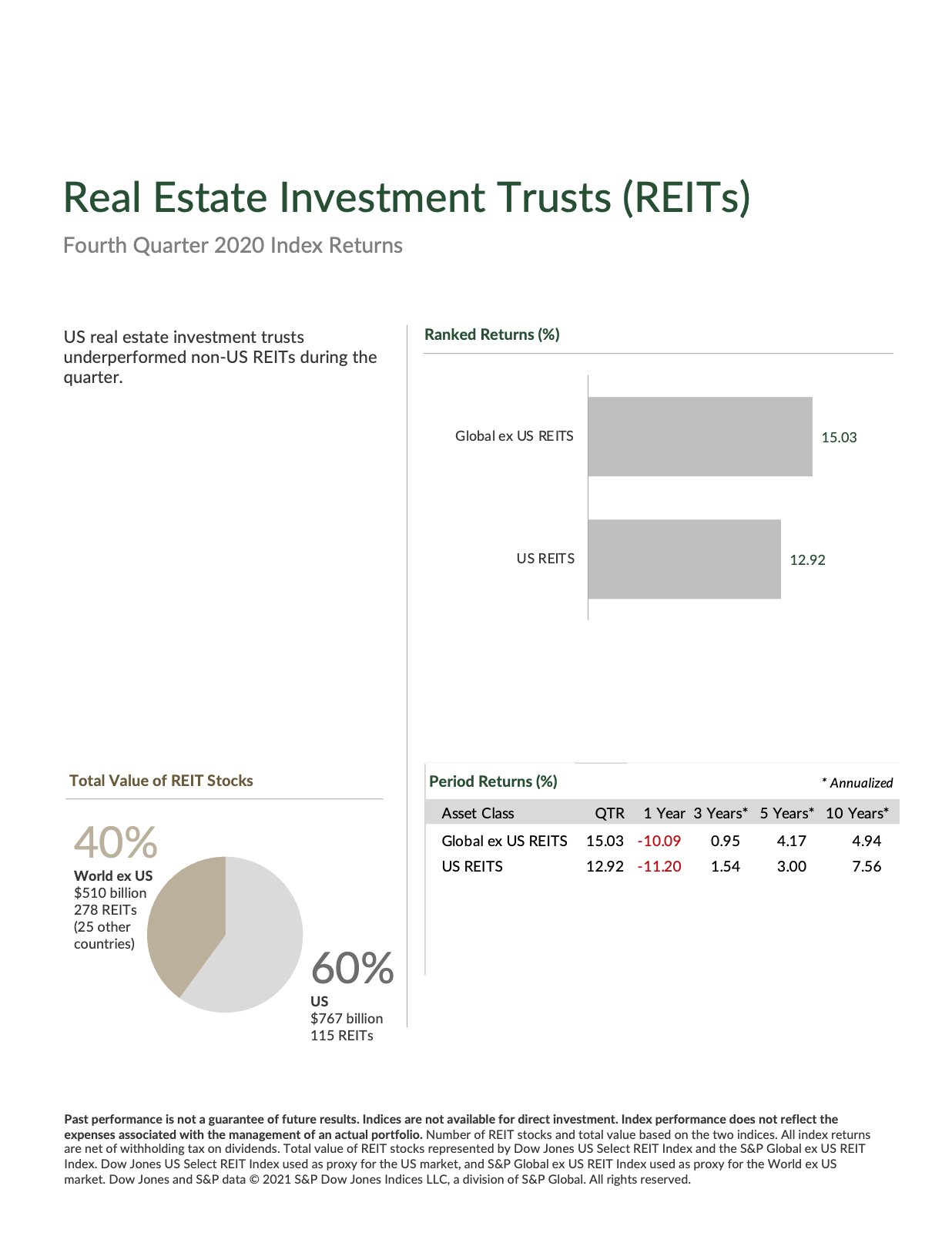

Real Estate Investment Trusts (REITs)

Like all other asset classes REITs rattled off a very strong quarter. It didn’t salvage the rest of the year though. REITs were still down over 11% on year here in the U.S., and a little over 10% globally. This is hardly unexpected. REITs have a substantial portion of their holdings in corporate office buildings and similar structures. And with so many of us working from home (and landlords having a hard time finding new tenants and renewing leases) the group has struggled mightily.

All is not lost for REITs though. REITs typically finance their real estate purchases just like any other investor. With interest rates still so low REITs are able to lock in very favorable financing terms, just like homeowners across the country. It will be interesting to see how much ground REITs can make up throughout 2021.