**Update: I wrote this draft on Saturday, and since then oil has dropped 30%, circuit breakers for the U.S. stock market fired this morning, and the 10-year U.S. bond yield has fallen below 0.5%. The charts and numbers you see here are as of Friday. My stance has not changed.

What do the following have in common?

- U.S. marginal tax rates are too low

- Central banks printing money will lead to asset bubbles

- Washington partisanship

- Political turmoil with Russia, the Middle East, or North Korea

- Trade war with China

These are the risks that could derail the decade long bull market and business cycle we’ve enjoyed since 2009, according to market pundits. Viral contagion? Nowhere to be found.

At this point there are over 100,000 cases of Coronavirus across the world, with 400 being here in the U.S. While the media has certainly fanned the flames of panic, COVID-19 will have a substantial negative impact on the global economy. The best epidemiologists in the world are forecasting that 40%-70% of the world’s population will contract the virus. People are beginning to cancel flights & vacations. Small businesses are scrambling to put together “work from home” contingency plans. All of which will be a drag on the economy.

The markets have…taken notice. After a tumultuous few weeks, the S&P 500 is now down 8% on the year and investors around the world have flocked to safe havens like long term U.S. treasury bonds.

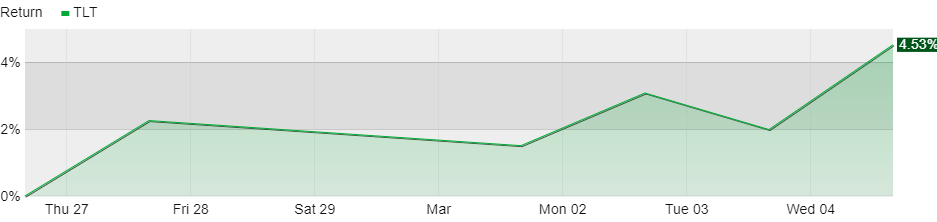

Here’s the return of TLT, a 20+ year U.S. government bond ETF over the last week and YTD.

TLT: 20+ Year US Bond ETF YTD Weekly Returns

Source: Kwanti

TLT: 20+ Year US Bond ETF YTD Returns

Source: Kwanti

Alongside this bond yields are plummeting. (Remember that when yields fall bond prices rise). The yield on the 10-year U.S. government bond fell below 0.8% on Friday – an all time low. (Also remember that the 10-year yield is a barometer of the bond market’s longer term economic expectations).

Here’s how 10-year U.S. government bond yields have changed since January 1, vs. since 1954:

YTD 10-Year US Treasury Yield

Source: cnbc.com

Long Term 10-Year US Treasury Yields

Source: cnbc.com

So is it time to panic? The federal reserve called an emergency meeting to cut short term interest rates by 50bps, to 1-1.25%. This is notable because they have a regularly scheduled meeting in just a few weeks, on March 17-18.

You might not be surprised at my stance here: as an investor it is NOT time to panic.

It’s been a while since we’ve seen a recession, but this is what business cycles do. Economic expansions don’t gently pull their foot off the gas, slowly depress the brake pedal and ease to a full stop on their own. They’re almost always pancaked by an unforeseen, external shock:

- December 2007 – June 2009: Great recession (mortgage crisis)

- March 2001 – November 2001: 9/11 recession (dot com bubble)

- July 1990 – March 1991: Gulf War recession (oil price spike)

If it wasn’t the Coronavirus, it would have been another type of unexpected black swan type event. Maybe not this month or this year, but sometime. This is how investment risk works. It’s the price of admission for the long term returns we should expect. And that’s not to say that the risks listed above evaporate due to the Coronavirus, either. Every one of them is still present and could deepen the growing market route further.

Prudent investors should be diversified against this type of exogenous shock, and have financial plans that accommodate such short term discomfort. We knew this would happen eventually. It is not time to panic.

This is What Would Make Me Worried

I took my son to the barber today for both of us to get our hair cut. There were three barbers working, and four people waiting in line before us, which is a pretty typical Saturday crowd at this place.

The Coronavirus did cross my mind before we walked in the door. This barber shop probably does at least 50-70 hair cuts each day. I assume they’re wiping down the scissors, clippers, and combs periodically, but don’t know for sure and have never had a reason to ask. Would they be properly disinfected if Coronavirus lived on them? Likely not.

But the risk isn’t great for my son and I, as far as I can tell. I’m 36, he’s 3.5, and we’re both in strong health. Not exactly high risk demographics if did get infected.

Then I thought about the barber shop. Yes, the barbers themselves are exposed to a ton of clients every day, and are at risk of contraction. But I’m more concerned about the owner of the barbershop. If this thing continues to spread, we’re going to see a lot of people hanging out at home, having Whole Foods and Amazon Prime delivered to their door, streaming Netflix until the risk blows over.

If the Saturday barbershop crowd of 50-70 falls to 10-20, how long can the owners pay their barbers? Two weeks? Four? Ten? At $8 per hair cut (which is why we go there), I’m guessing they’re not exactly flush with cash.

This is the demographic I’m more concerned about: small businesses. How many locally owned businesses in your town have three months’ worth of rent & expenses sitting in the bank for a rainy day? What happens to your local deli or coffee shop if your community begins abandoning public places?

Prudent investors should have a long term plan in place that incorporates this type of risk, and a consistent strategy to execute on it. These types of unexpected shocks are exactly what such a plan should be able to accommodate.

It’s not investors that I’m worried about. It’s the small business community.