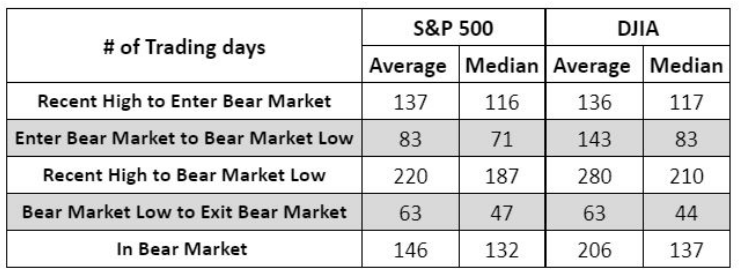

Well that escalated quickly. We are now officially in the second fastest bear market on record. Bear markets become official when stocks fall 20% or more from their peaks. Ordinarily this takes months to play out. Bad news comes out, stocks sell off a bit. Everyone goes home, thinks about it, and comes back the next morning. More bad news comes out, stocks fall a bit further, and so on. Here’s some data from Marketwatch on how long it typically takes to enter a bear market:

With the Coronavirus driving the U.S. and much of the world to shelter in place, our economy has come to a screeching halt. Some forecasters are guessing that we’ll see a 5% drop in GDP this quarter, others are predicting as much as a 30% drop.

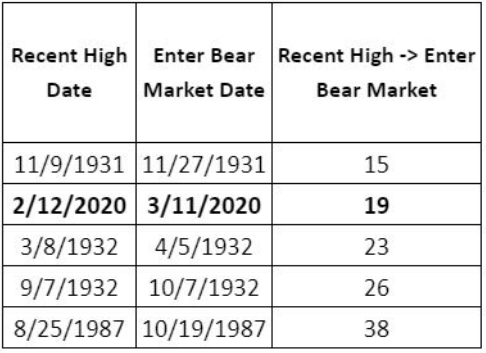

Whatever camp you reside in, the picture is not pretty. Markets did not take long to notice. Whereas it takes on average 136-137 trading days to enter a bear market based on the data above, it only took us 19 to get there this time – the second fastest on record:

So where do we go from here? A stimulus package is just about to be passed (finally). Markets rebounded as much as 12% yesterday and another 4.5% today. Even though the public health picture still looks bleak, we are starting to wrap our heads around how long the pandemic may continue.

Here are a few things I’m reading and my thoughts on what happens next.

What to Make of the Economy Right Now

Any time we enter a recession, it doesn’t take long for the discussion of what the ensuing recovery will look like to begin. It’s no different now, especially with the president declaring that he wants the country open for business again by Easter.

The argument for a “V-shaped” recovery path is simply that the world will be back to normal by the end of Q2. Vanguard’s chief economist Joe Davis believes this will be the case, with swift recovery following a sharp 17% drop in GDP.

The argument for a “U-shaped” recovery path I think is best made by Mohamed El-Arian, the former CIO of PIMCO. Basically, he thinks that the Coronavirus will take longer to recover from because it’s shocking both the supply and demand sides of the global economy, which takes longer to recover from. He also argues that many countries around the world were ill-equipped to handle such shocks. And if it weren’t for COVID-19, some other source of turmoil would have thrown Germany, Italy, Japan, and other countries into an economic tail-spin.

One of the biggest wild cards, in my opinion, is the possibility of another wave later in the year. I’m obviously no public health official. But it stands to reason that if we go back to work too early, without fully squashing the possibility for further spread, we could be right back to square one. As much as we want everything to return to normal, our leaders cannot be trigger happy here.

My Take At This Point

Here’s the good news. All our infrastructure is pretty much intact. Electrical grid, water, road system: all in good shape. As is our financial and banking system. Thanks to banking regulation and improved management since the mortgage crisis, I’m not seeing much risk that the banking system collapses. Especially with the Federal Reserve announcing that they will pull out all the stops to support the economy.

Supply chains are looking OK too….for the moment. By supply chain, I mean the systems in place to help move a product from a supplier to a buyer. Picture an ice cream parlor. Entrepreneur sets up shop in their home town & leases a place on Main Street. They buy ice cream & chocolate sauce, and sprinkles wholesale from a distributor, scoop it into a cone, and sell it to the foot traffic that walks in.

The wholesaler buys its products in bulk from a variety of sources. They buy ice cream from a number of dairy farms. They buy chocolate sauce from Hershey’s. They buy their sprinkles by the palette from some place in Indonesia.

The supply chain is the link that gets the ice cream, chocolate sauce, and sprinkles to our local ice cream parlor and into our mouths. If COVID-19 went away tomorrow, the ice cream shop probably wouldn’t have an issue opening for its normal hours, working off its current inventory.

The real risk is that the longer our economy is on hold, the more these chains start to break down. Let’s say our ice cream parlor remains open for take-out orders. The store’s sales fall 75%, but at least it’s some revenue in the door.

Even if the store is able to stay open in a limited capacity (perhaps with SBA or other financing), it’d be a major challenge if its distributor went out of business. The store owner would need to find another distributor with similar products, and negotiate a reasonable deal in a short amount of time.

Those connections, those relationships are the supply chain. The longer our economy is dormant, the more links in the chain disappear, and the longer it’ll take us to pick things up again. This concept is “financial de-leveraging”, and is what will happen the longer we shelter in place. This, I believe, is the crux of El-Arian’s position that I linked to above.

Policy Will Be The Lynchpin

Our leadership is in a very difficult position. As much as we want to get everyone back to work & help out everyone in the service industry, we need to be balanced and consider the long term. Is it worth it to open the country back up ASAP to minimize de-leveraging, if it means heightened risk of another wave later in the year?

As I write this, a massive fiscal stimulus package is about to passed. It will include a $2 trillion dollar injection of cash into the economy, through checks to taxpayers, bailouts of afflicted industries, and loans to small businesses. Who knows whether it will be enough. But hopefully it’ll get enough cash into the hands of our local restaurants & barbershops to minimize closures.

Stay tuned.