A few years back, I had a friend approach me at a BBQ. He had some questions about how his financial advisor was managing his accounts.

Friend: “Yeah, I just don’t know if this guy is doing the right thing for me. We talk every now and then, he seems like a nice guy, but my portfolio hasn’t really gone anywhere.

Plus, every time we chat he has some brand new investment idea he tries to sell me on. And every single time, he talks up his new idea like it’s the Michael Jordan of portfolio management. (My friend is a big NBA fan). His ideas sound good….I’m just not sure I’m in the right situation. I feel like there’s more going on behind the scenes that I don’t see, but I don’t know what questions to ask.”

Me: “Well how did you find him?”

Friend: “A coworker recommended him. Said the guy made him a ton of money a few years ago.”

Me: “How are you paying him?”

Friend: “Well, I’m not really sure. Everything gets wrapped through the account somehow.”

Me: “OK. Let’s take a step back. Maybe it’d help to identify what you’re looking for in an advisor. If you were starting fresh, what would you like an advisor to help you with?”

Friend: “Hmmm. I guess manage my money and help it grow, make sure I’m on track for retirement, and make sure I don’t run out of money after I stop working.”

Me: “So if you were starting from scratch, what qualities would you look for in an advisor? What criteria would you use?”

Friend: “I really have no idea. I’ve never thought of it that way. Plus there’s about a million financial advisors around here, I get information overload. I guess I’d go with someone I know and like, and seems to have a good reputation. What should I be looking for?”

I had to think about my friend’s question for 10 seconds or so. At the time, I was working at Charles Schwab, but strongly considering starting my own firm.

Me: “I think if I were looking for an advisor, I’d try to find someone who’s competent, trustworthy, unbiased, enjoyable, and looks after for my finances for a fair and transparent price.”

Friend: “Whoa whoa whoa. Slow down with the laundry list. That’s a whole lot of stuff I don’t understand. It sounds GOOD though. I need to tend the grill, but let’s reconvene in a few minutes.”

Coincidentally, this was one of the very reasons I was considering starting my own firm. There are about 300,000 professionals in the U.S. today who call themselves “financial advisors” or “financial planners.” But in my opinion, only a small portion of them have the qualities and service model I’d look for in an advisor.

I’ve had this question come up many times in the years since, and my friend isn’t the only one who’s not sure how to evaluate a potential advisor. And without knowing what questions to ask, how can you be sure you’re finding someone trustworthy and competent?

Because of this, I thought it’d be helpful to build a checklist you can use to evaluate financial advisors & planners. If I were looking to hire someone for help with my finances, these are the exact qualities I’d look for and the exact criteria I’d use. And at the very least, hopefully you’ll be armed with a few good questions to ask.

1) Fiduciary

In the financial industry, advisors have two different “standards of care” they’re legally held to when working with clients: a suitability standard of care and a fiduciary standard of care.

Being a fiduciary is one of the very first things I’d look for in a new advisor. You’ve probably heard this term before. It can be confusing though, so let’s back up a bit and explain exactly what it means.

Suitability Standard

An advisor held to a suitability standard of care is only permitted to sell their clients products that are suitable their clients’ needs. They do not necessarily have to act in their clients’ best interests.

This is pretty obviously sub-optimal. Advisors held to a suitability standard of care aren’t required to help you minimize account fees, avoid or manage conflicts of interest, or even act with professional prudence.

Fiduciary Standard

The fiduciary standard of care means that an advisor is required to act in your best interests – even when that puts your best interests ahead of theirs.

According to the law, fiduciaries must also:

- Act with the skill, diligence, and good judgment of a professional

- Not mislead clients, and provide full and fair disclosure of all material facts

- Avoid conflicts of interest

- Fully disclose any unavoidable conflicts of interest

The suitability standard of care includes none of these requirements.

Application

So who exactly is held to a suitability standard of care, and who is a fiduciary?

The fiduciary standard mostly applies to the delivery of financial advice, whereas the suitability standard applies to product sales and transactions. Essentially, anyone who is paid for giving you advice must act in your best interests at all times. Someone selling you a product doesn’t have to.

It comes down to what type of firm the advisor works for and how they are licensed. Here’s the breakdown:

- Brokerage firms are held to a suitability standard of care. Their chief business is executing transactions on their clients’ behalf, and are therefore considered salespeople. This category includes all the major brokerage houses and investment banks that you hear of in the national news, as well as smaller regional broker/dealers. Brokerage firms are all regulated by the Financial Industry Regulatory Authority (FINRA).

- Insurance companies are regulated by the individual states, and standard of care varies among them. This includes major national insurance companies and smaller regional companies alike. In my experience, the standard of care for advisors selling insurance does not differ much from the suitability standard of care.

- Registered Investment Advisory firms (RIAs) are held to a fiduciary standard of care. RIAs are technically in the business of delivering advice, as opposed to transacting on their clients’ behalf as brokerage firms are. And while all the major national firms we tend to think of when we hear “investment company” are brokerages, RIA firms tend to be small and regional businesses. RIAs are regulated by the SEC if they manage over $100 million, and by their home state if they don’t.

A good analogy I’ve heard here is that you wouldn’t expect your butcher to give you objective dietary advice. If you want advice about what to eat, you go to a dietician. And when you want financial advice, you go to a fiduciary.

If I were looking for a financial advisor, I’d by default want someone who is required to act in my best interests 100% of the time by working at an RIA firm. I repeat: I would not take advice from someone who is not a fiduciary.

**Word of Caution**

When you ask an advisor whether they’re held to a fiduciary standard, some will say “Yes, but not all the time.” Others will say that they aren’t legally required to be a fiduciary, but they act like they are anyway.

This is industry speak for “don’t look over there, look over here.” Anyone who isn’t required to be a fiduciary ALL THE TIME has a big gray area to operate in. While it doesn’t happen often, this gray area can be exploited.

The question to ask a potential advisor is “Are you required by law to be a fiduciary to your clients at all times?”

This is a simple, yes or no question. Any dancing, wriggling, or stalling in response to this question is a big, fat, NO.

2) Objectivity

When seeking an advisor, I’d certainly look for someone who can deliver objective advice. And while being a fiduciary is a good start, there are a few other things to look for too.

Here’s where it gets confusing:

Some firms are actually both RIAs and brokerage firms. And their advisors are compensated for both delivering financial advice and selling financial products.

I don’t know about you, but I HATE being sold. And if I were looking for financial advice, it would be mighty hard for me to choose someone who makes a commission selling me a product when that same person is advising me which product to buy. Even though they might be held to a fiduciary standard of care by virtue of working in an RIA firm, it’s not difficult in my opinion for commission dollars to influence an advisor’s thought process.

In practice, you’ll run into tons of advisors out there who are fiduciaries at RIA firms, but also sell investment and insurance products. The majority of these advisors are ethical, do great jobs for their clients, and are able to stay completely objective when delivering advice.

Just remember that any time an advisor receives a commission for a sale, there is potential for that commission to influence their advice. And whenever commission dollars are at stake, it will take a small leap to faith to trust that the advisor will be objective when developing recommendations and giving you guidance.

Whether you’re comfortable with this arrangement and take that leap of faith is up to you.

How Do I Know Which is Which?

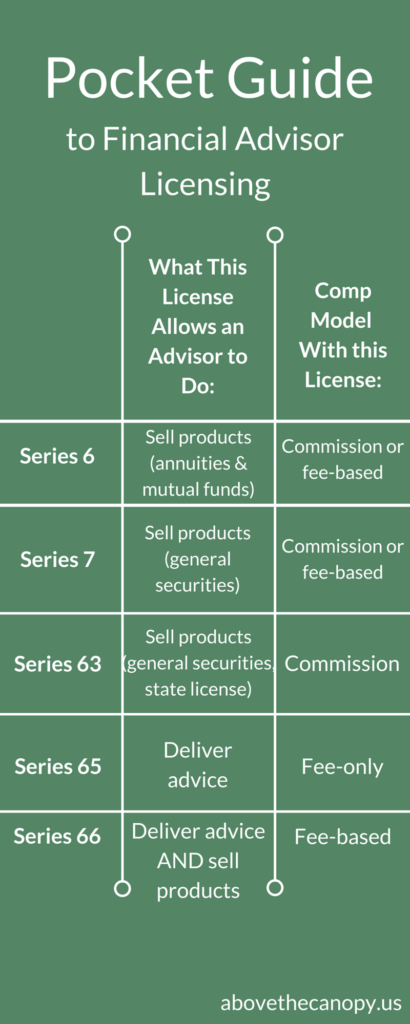

Beyond the type of firm an advisor works for, you can tell how they’re set up by the licenses they hold. We’ll cover this in more detail in background checks a little later. For now here’s a graphic that might help:

3) Transparency

In the financial industry transparency is becoming an increasingly critical issue. And like my friend, I speak with far too many people who have no idea how their advisor develops recommendations or is compensated for their advice.

And if I’m hiring someone to help me with my finances, I’d want an advisor who puts everything on the table and has nothing to hide. I’d also want an invoice that tells me what fees I’m paying, and if there are commissions generated from a recommended strategy, I’d like to know what they are. Without an invoice it’s difficult to assess the true cost of an advisor’s services, since you don’t have the same visibility into what you’re paying.

Again, I’m not saying that all salespeople are bad. Only that I’d think hard about an engagement that didn’t clearly state what an advisor was making for servicing my account.

Compensation Models

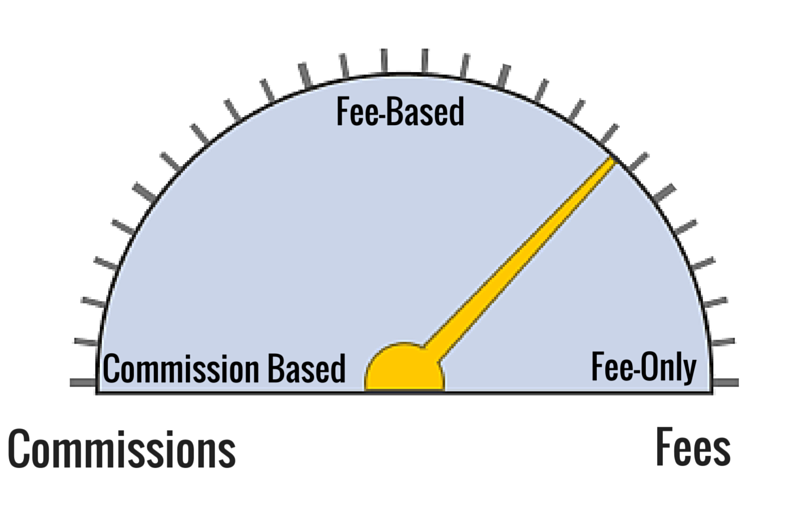

There are three compensation models in the financial world: commission based, fee-only, and fee-based.

Commission Based

Commission based advisors are compensated only by commissions from the products they sell. They might also receive some kind of stipend or salary, but commission based advisors are salespeople, pure and simple. Commission based advisors are most often found in brokerage firms and insurance companies.

Fee-Only

Fee-only advisors are on the complete opposite end of the spectrum from commission based advisors. Fee-only advisors do not accept any commissions from product sales. They believe that commissions taint an advisor’s ability to deliver objective and unbiased advice. Fee-only advisors normally work in RIA firms, since this philosophy tends to align with a fiduciary standard of care.

Fee-Based

If commission based and fee-only compensation are at the two ends of the spectrum, fee-based is anything in between. Fee-based advisors are licensed to deliver advice for a fee, but also receive commissions on sales. They might work in a brokerage, insurance, or RIA firm. When someone tells you they’re a fee-based advisor, a good question to ask is what percentage of their compensation comes from fees and what percentage comes from commissions. This will give you a better idea of where they fall on the spectrum.

How Can I Tell?

Advisors should always tell you how they’re compensated, and nearly all will use one of the three terms from above. Fee-only and fee-based advisors will also typically express their pricing in three ways:

- A flat dollar amount for financial planning

- A percentage of the assets an advisor manages for you

- A quarterly retainer for their ongoing services

Additionally, this is another area where an advisor’s licensing will give you some insight into how they’re set up. For example, a fee-based advisor might be licensed to sell products and deliver advice. A fee-only advisor will only be licensed to deliver advice, since they’d have no use for a license allowing them to sell products. Here’s another helpful graphic:

What’s the Best Model?

The fee-only model is easily the most transparent. You know exactly how much you’re paying your advisor because they send you an invoice for their services. There’s never any guessing as to whether the advisor is making a recommendation based on their own compensation; you know their only compensation is coming directly from you.

When your advisor is compensated with commissions in a fee-based or commission based situation, you might not know exactly how your advisor is being paid, or how much. Again, this isn’t necessarily bad, but you should understand the differences.

This also doesn’t mean fee-only is the best model by default. Some people believe that fee-only advice is also biased because it incentivizes advisors to recommend investing extra money over other strategies.

For example, let’s say you inherit $200,000. A critic would say that a fee-only advisor would recommend you invest the money with them in the market instead of paying down your mortgage, since the advisor’s assets under management and fee revenue would be higher.

In my practice, I offer fee-only advice because I believe in total transparency. My clients never have to guess how much they’re paying me, or whether I’m making money from them in ways they don’t know about. But that doesn’t mean it’s the only way. There a lot of great fee-based and commission based advisors. If you’re considering one just make sure you understand where they fall on the “compensation spectrum”.

4) Competency

Saying that you want an advisor who is smart and capable is a no brainer. But how do you actually gauge competence? What should you look for? What questions do you ask?

Licenses

Reviewing the licenses an advisor holds is a good start, since they also give you some insight into how the advisor is compensated. A word, of caution here though, more licenses does not mean the advisor is more competent.

Holding a securities license only means the advisor has passed the minimum requirements to sell certain products or deliver advice. And believe me, that bar is not high.

The most common licenses you’ll run into are the “series” exams administered by the Financial Industry Regulatory Authority (FINRA) that we alluded to earlier. If you have questions about a specific license, check out FINRA’s guide here.

I’ll cover how to look up an advisor’s licensing history in the background check section below.

Professional Credentials

Professional credentials are a much better way to gauge competence. Unfortunately, these days there is a litany of professional credentials for financial advisors. I’ve seen advisors pass around business cards with no less than 6 sets of letters after their name.

Saying this is confusing is an understatement. A ton of professional credentials might appear impressive, but few of them actually have substance (many can even be obtained over a weekend!).

Here are the three professional credentials that hold weight. To obtain one of these credentials, advisors have to pass rigorous exams, meet education and experience requirements, and abide by a code of ethics. These are far and away higher bars of competence than the requirements for obtaining one of the FINRA licenses:

- CFP®: CERTIFIED FINANCIAL PLANNER™ is the most common industry designation for advisors and planners. You might recognize this credential from the TV commercials where the DJ dresses up like a financial advisor. This designation requires a bachelor’s degree, three years of full time work experience as a financial planner, and a comprehensive exam. Certificants must also abide by the CFP Board’s code of ethics. The CFP® covers most of the basic financial planning topics an advisor runs into on a day to day basis, like investments, retirement, taxes, insurance, and estate planning.

- CFA: The Chartered Financial Analyst designation is usually thought of as the golden standard in portfolio management credentials. To become a CFA charterholder, advisors need to reach a combination of work experience and education, pass three consecutive six-hour exams, and abide by the CFA code of ethics.

- CPA / PFS: Certified public accountants who want to work in financial planning may earn the Personal Financial Specialist (PFS) designation. The PFS designation is largely the same the CFP® designation, but is administered by state accountancy boards. The PFS also has an exam and ethical requirement (in addition to the CPA exam).

If I were hiring a financial advisor, I would almost disregard any professional credential outside of these three. These are the three industry credentials that carry weight, with the CFA being the most difficult to obtain. All three have exam, education, and ethical requirements, and prove that the advisor has a decent baseline of knowledge to help you.

If you have questions about other designations, FINRA has a good comparison tool you can use.

Awards & Industry Recognition

Lots of advisors will tout industry awards and other recognition when you speak with them. A few examples I’ve seen are “Top Wealth Manager”, “Barron’s List of Top Advisors”, “Five Star Advisor”, and “Champion’s Circle”.

Disregard these completely. Nearly all of these awards are based on an advisor’s sales and revenue earned for their firm. They are not at all a reflection of an advisor’s competence.

5) Experience

You’ll also want to assess the experience level of the advisor, including their experience working with people just like you. How long have they been an advisor? How long have they been in the financial industry? What other professional experience do they have? Do they have experience solving the types of issues you need help with?

These are all pertinent questions to ask. You want someone who knows exactly how to solve your specific problems & improve your financial situation.

My suggestion is to ask them to give you an example of a situation where they helped a client with a similar problem. They don’t need to give you names or any personal information, just explain what the problem was and how the advisor helped solve it. This will give you a good idea of whether the advisor knows what they’re talking about.

While I don’t think it’s necessary to find someone who’s been in the industry for 20 years or more, I’d suggest finding someone who’s been around for at least 5. There are so many moving parts in the financial markets. It takes new professionals at least a few years to understand how the markets work, and then another few to learn how to apply that knowledge in a way that helps their clients.

6) Enjoyable

At the end of the day, it’s important to find the right fit. If you can’t see yourself working with an advisor for a long period of time, it’s probably time to interview someone else.

Personality fit is a big factor here, but so is convenience and service model. Is the advisor’s office building easy to get to and park in? Does the advisor meet with clients virtually? How often will you meet with the advisor?

These are all important questions. And if you don’t have a good feeling about the situation, it’s pretty hard to justify trusting an advisor with your finances.

7) Background Checks

License Checks

There’s a lot of due diligence you can do on an advisor before you meet with them in person.

First and foremost, make sure they don’t have any blemishes on their permanent record. FINRA and the SEC maintain databases that reflect licensing history, client complaints, terminations, or other regulatory events.

If the advisor holds a series 6, 7, 63, or 66 license, their activities will be regulated by FINRA. You can check out their records on FINRA’s Brokercheck.

If the advisor holds a series 65 or 66 license, their activities will be regulated by the SEC. Remember, lots of advisors will hold all of the above licenses. In this case, their sales will be regulated by FINRA, but their advice will be regulated by the SEC in its Investment Adviser Public Disclosure site. Make sure to check out both databases.

You can look up an advisor’s insurance license with your state’s insurance division. Unfortunately, insurance divisions don’t show any details about client complaints.

Credential Checks

You can also validate the status of an advisor’s professional credentials. If the advisor has demerits for ethical violations, some professional boards will display this information publicly.

Here’s where you can check an advisor’s credentials:

CFP Board: CFP® Certification Background

CFA Institute: CFA Member Directory

State Accountancy Boards: CPA Verify

Other Background Checks

Beyond the above, you’ll probably want to do a thorough Google search of the potential advisor to cover your bases. There are plenty of advisors out there with checkered pasts that you’d probably want to know about.

References

References are always good if you have lingering doubts, but I’d beware of putting too much stock in them. Advisors will always cherry pick their best clients when asked for a referral. If you ask for a client referral, they will always shoot you to someone who they’re sure will give them a glowing review.

There You Have It

If I were evaluating a financial advisor, that’s exactly what I’d look for. If you found this helpful, be sure share it! You can also download the pdf checklist by clicking below: