It’s no secret that small businesses are often short on resources. And my guess is that keeping close tabs on your 401k plan is not at the top of your to-do list.

As you likely know, sponsoring a 401k plan comes with certain responsibilities, and neglecting them can get you in hot water with the IRS and Department of Labor.

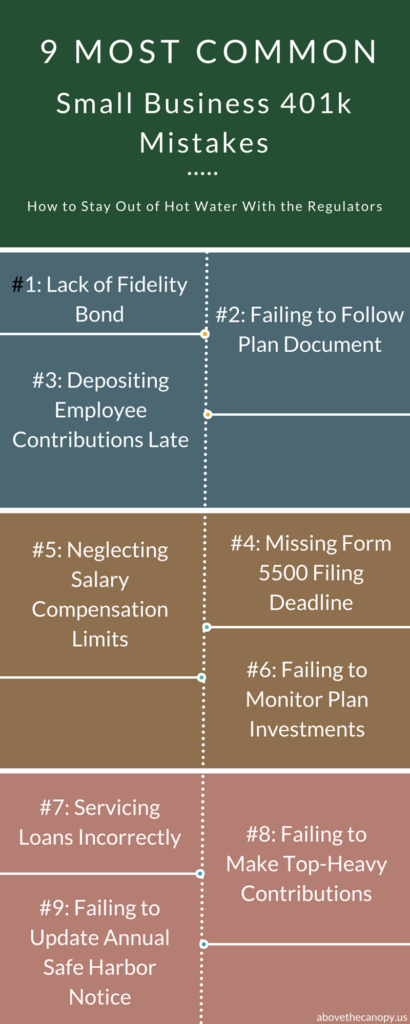

If you’re wondering whether your bases are covered, here are the 9 most common small business 401k issues I see in my practice:

1) Lack of Fidelity Bond

Many 401k sponsors forget that ERISA requires them to be bonded. ERISA fidelity bonds protect the plan against losses caused by acts of fraud or dishonesty.

The fidelity bond must cover anyone who handles funds or property of the plan. The bond coverage must be at least 10% of plan assets, with a minimum of $1000 and maximum of $500,000. This maximum goes up to $1,000,000 for plans that include employer stock.

It’s easy to forget about the coverage minimums, and many sponsors find themselves under covered after their plan outgrows their fidelity bond coverage. Best practices are to review your coverage as part of an annual 401k review.

2) Failing to Follow the Plan Document

Your plan document is meant to help ensure your 401k complies with ERISA. As long as your document is up to date, you will be in compliance by following it to the letter.

Many sponsors inadvertently disobey their plan document. This can happen when you miss an employee eligibility period or allow an employee into the plan too soon.

Remember, these are both parameters you can customize as long as they’re reflected accordingly in your plan document.

3) Depositing Employee Contributions Late

According to the Department of Labor, you should deposit employee contributions to your 401k plan as soon as you can reasonably segregate them from your company’s assets.

In all circumstances this should occur no later than the 15th business day, of the month following the month the contributions were deducted from pay.

It’s not the end of the world if one of your deposits is late. Be sure not to make it a habit though.

4) Missing Form 5500 Filing Deadline

5500 forms are due the last day of the seventh month after your plan year ends.

For calendar year plans this falls on July 31st.

Plans that file late can be penalized by the IRS – usually up to $750 for plans with fewer than 100 participants, and $2,000 for others.

5) Neglecting Salary Compensation Limits

It’s easy to forget about the annual compensation limit for 401k contributions. For 2016 this limit is $265,000.

That means that if you make $500,000, you won’t be able to apply $235,000 of your compensation when calculating your contribution limits.

6) Failing to Monitor Plan Investments

As you likely know,you have certain fiduciary responsibilities to the participants in your 401k as the sponsor of the plan.

One of these responsibilities is monitoring the investment options in your plan, and replacing them if they become inadequate. Investment options can become inadequate for several reasons:

- It becomes too expensive relative to peers

- It underperforms for a long period of time

- The fund’s star manager leaves, disrupting the fund company

- The manager strays outside the fund’s stated objective, otherwise known as “style drift”

This is only a few of the many reasons an investment option might need to be replaced. Ultimately, your investment options should be matched to the objectives of the plan. Every plan is a little different.

The important thing is to have adhere to a consistent and periodic monitoring process. This is what you’ll point to if your plan is audited by the department of labor.

7) Servicing Loans Incorrectly

401k loans have certain parameters that must be followed in order to avoid penalties.

Repayment must usually occur in 5 years. The loan must also have a specific interest rate applied, and payments must be made quarterly.

Plans that don’t adhere to the rules put their participants at risk. The IRS might consider a loan a taxable withdrawal, subject to penalty, if the rules are not followed appropriately.

8) Failing to Make Top-Heavy Contributions

Key employees aren’t allowed to hold more than 60% of a 401k plan’s total assets under top-heavy rules.

If a plan is top heavy, employers must make a corrective contribution on behalf of non-key employees.

This is an easy rule to overlook, but is an important one – failure to comply can get you in hot water with the Department of Labor if your plan is audited down the road.

9) Failing to Update Annual Safe Harbor Notice

Sponsors using a safe harbor 401k plan are required to communicate whether they’ll make a matching or non-elective contribution each year.

This disclosure must be made 30 to 90 days before the beginning of your plan year.

Fixing Up A Small Business 401k Plan

If any of these issues sound familiar to you, don’t fret. Most minor problems can be fixed without an issue.

If you have concerns about your plan, check out the IRS’s guidance in it’s fix-it guide or feel free to email me directly at [email protected].