Since the crisis in 2008, regulators have paid extra attention U.S. financial markets. Sweeping changes like Dodd-Frank and the Department of Labor fiduciary ruling will change the way Americans save for retirement. While these two examples have received tremendous media coverage, others haven’t. SEC money market reform efforts have important implications, but seem to have flown under the radar. Here’s what you need to know:

Background

Money market funds are a type of mutual fund developed in the 70s, which invest in short term fixed income securities. Their objective is two-fold:

- Never lose money

- Provide a higher yield than interest bearing bank accounts

The money fund market is comprised of three types: government funds, tax exempt funds, and prime funds. As you can guess, each type describes what securities the fund may invest in.

Government money funds invest in government securities only, and as a result are thought to be the safest of the three types. Tax-exempt funds invest in municipal securities that are exempt from U.S. federal income tax, while prime funds may invest in both corporate and U.S. government debt. So, while government funds may be safer, prime funds normally offer a higher yield in exchange for slightly more risk.

Reserve Primary Fund

Many investors have historically viewed all three types of money market funds as safe alternatives to cash. This view changed during the financial crisis in 2008. At the time, the Reserve Primary Fund was the largest money market fund in America, with assets of over $55 billion.

Being a prime fund, the Reserve Primary invested in an array of corporate debt issues. And in 2008, its portfolio included sizable chunk of securities issued by Lehman Brothers – which wasn’t seen as an overly risky proposition at the time.

As you probably know, the Lehman Brothers investment did not turn out well. Lehman Brothers was in far more trouble than its management let on, and the company eventually went bankrupt and could not repay its debts. This meant the Reserve Primary Fund lost its entire investment in the debt securities, striking a blow to its portfolio value.

Breaking the Buck

The hit was large enough to cause the fund to lose money, as its net asset value fell from a stable $1.00 to $0.97 per share. Also known as “breaking the buck,” only three other money funds had lost money in the 37 year history of money market mutual funds.

The reaction from the fund’s investors was fierce, as the consensus opinion at the time viewed the Reserve Primary Fund as a safe alternative to cash. Investors ran for the exits and demanded millions in redemptions. The fund lost over 60% of its assets in a mere two days, compromising its ability to meet other redemption requests and further spreading market contagion.

To diffuse the situation, the U.S. Treasury Department stepped in and offered to insure money market funds much like the FDIC insures bank deposits. Investors in funds participating in the Treasury’s program would be guaranteed at least a $1.00 net asset value if their fund broke the buck. This support helped limit liquidation pressure, and helped stabilize money markets until the crisis subsided.

SEC Money Market Reform

Unsurprisingly, the government does not want to be in the business of insuring money market funds today. So, the SEC has responded with reforms to help avoid this situation in the future. In July of 2013 the SEC amended Rule 2a-7, which will be enacted in October of 2016 and change the market structure of money funds.

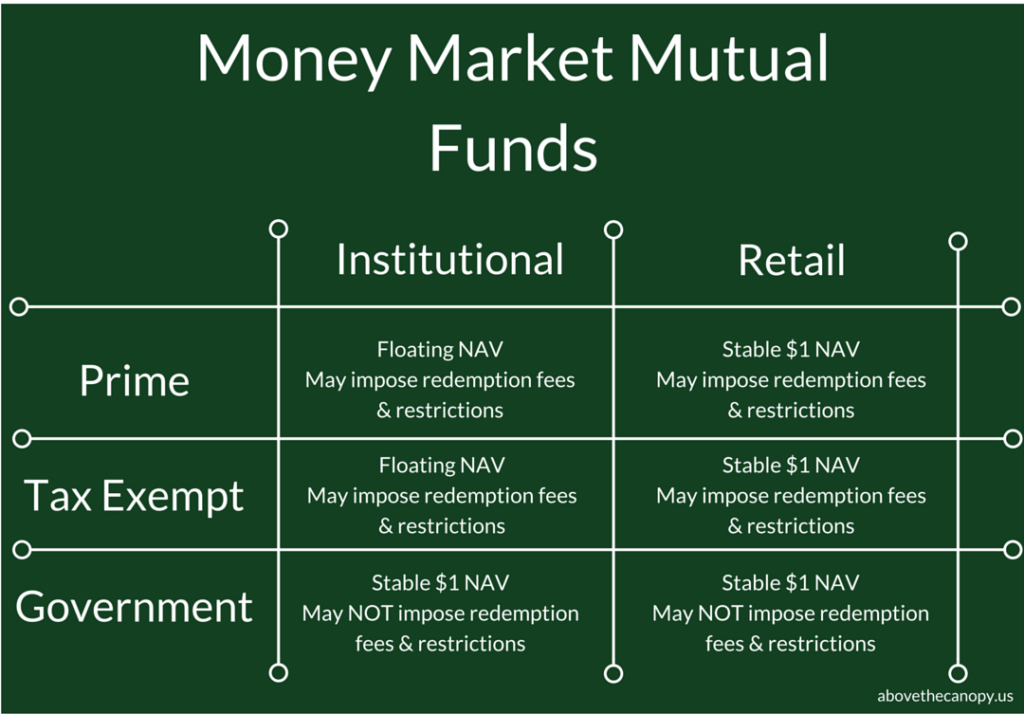

The amendment essentially bifurcates money funds into two broad categories: retail and institutional. The previous classifications of government, tax-exempt, and prime will still exist, meaning that each will be further partitioned into retail and institutional classes.

Net Asset Value

Additionally, the regulation imposes floating net asset values on some classes of funds and allows others to impose “exit gates” on investor liquidations. Money market funds prefer to use stable net asset values of $1.00, due to operational convenience and tax advantages for investors. By moving to a floating net asset value, all share sales become tax-reportable transactions to investors – making the funds altogether less appealing.

The exit gates included in the regulation allow some funds to charge a redemption fee or temporarily halt redemptions altogether if fund liquidity falls below regulatory limits. Specifically, a fund can impose a 1% withdrawal penalty if its assets fall 10%, and a 2% fee if they fall 30%. Funds may also suspend redemptions altogether for 10 days if their assets fall 30% or more. This is an important distinction since many people see the funds as cash that can be withdrawn at any time.

The bifurcation of retail and institutional share classes is meant to sort out which funds the new requirements apply to, which is summarized below:

Retail vs. Institutional Funds

So what classifies as a retail or institutional fund? Retail funds are available only to “natural persons”, and not to corporations or other organizations. Defined contribution retirement plans, like 401(k)’s, and individual retirement accounts are considered to be “for the benefit of” individuals, making retail share classes available. Defined benefit plans are not, and will be remanded to institutional share classes.

Implications

As a result, investors and retirement plan sponsors should closely examine their money fund strategy before the rules are enacted in October of 2016. A decision must be made regarding the trade-off between additional yield a prime fund may offer versus the freedom to redeem shares during times of financial stress. Retirement plan sponsors should be deliberate in this decision. 63% of 401(k) plans in the U.S. contain a money market fund as an investment option, and over 4% of all balances are invested in money funds.

The safe route for sponsors would be to choose a government fund to ensure that plan participants can redeem shares at all times. It may even make sense to disallow prime funds in the plan’s investment policy statement altogether. Those opting for a higher yielding prime fund should operate with increased scrutiny when monitoring the fund. Whatever their decision, retirement plan sponsors must ensure that it’s documented appropriately.

I hope this post was helpful! If you’d like to know more about how the ruling will affect you, feel free to shoot me a message.