What is Pay As You Earn Student Loan Repayment?

The Pay As You Earn (or PAYE) student loan repayment program was passed in December of 2012, and is President Obama’s spin on income driven repayment. Understanding that student borrowers faced significant challenges once they entered repayment, the President used PAYE to improve on the preexisting Income Based Repayment in several different ways.

Although it has rather strict qualification standards (only the classes of 2012 and later qualify), PAYE is a terrific option for those who can use it.

How it Works

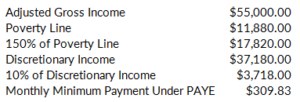

Pay As You Earn is just like Income Based Repayment in how your monthly payments are calculated. Monthly payments under PAYE are 10% of your discretionary income, which is the difference between your adjusted gross income and 150% of the poverty line in your area.

Again, poverty guidelines are set by the Department of Health and Human Services, and are updated annually. You can look up the poverty line in your area here.

Like IBR, PAYE has an interest subsidy component and forgiveness of any remaining balances after 20 years of qualifying payments. But, remember that any amount forgiven is taxable as income unless under the public service loan forgiveness program. If you’re counting on forgiveness outside of PSLF, it’s best to plan for the resulting tax bill.

Here’s an Example of PAYE in Action:

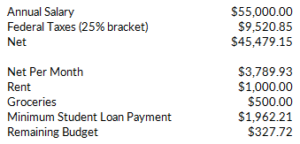

Let’s say you’re a new graduate with $185,000 in federal student loan debt, with an interest rate of 5% per year. You just got hired at a job that pays $55,000, are single, and the poverty line in your area is $11,880. Pay As You Earn could come in very handy if you qualify.

Your minimum monthly payment using the standard 10 year repayment plan would be $1,962.21. This is pretty darn high, considering your gross monthly income of $4,583. A modest rent and grocery bill of $1,000 and $500 would only leave you $327.72 extra change each month:

If you qualified for PAYE you could cut your monthly payment by about 85%:

$309.83 instead of $1,962.21. Pretty neat, huh?

Spouses

Like IBR and ICR, your monthly payments under PAYE are based on the combined income and debt of you and your spouse if you file your taxes jointly. You can keep them separate by filing separately, but consider the tax ramifications if you do since you’ll usually pay more tax filing separately than filing jointly. Plus, you’re pretty much excluded from contributing to a Roth IRA since the income limit is $10,000 when filing separately.

Interest Capitalization

Capitalization of interest is an important component you should be aware of before choosing any income driven repayment plan. If your monthly payments under PAYE are less than the interest that accrues each period, that interest will build over time. It won’t compound though (you won’t be charged interest on your interest) unless it’s capitalized. Once interest is capitalized it’s added to the principal balance of your loans, which is the factor used to calculate your interest each month. And of course, the higher your principal balance, the more you’ll pay in interest.

Here’s an example:

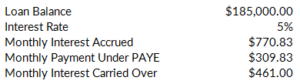

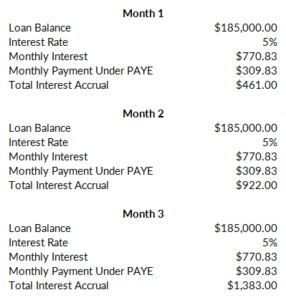

Continuing our example from above, with $185,000 in loans at an interest rate of 5%, you’ll pay $770.83 in interest each month. Since your payment is only $309.83, $461.00 will accrue and build each month:

Let’s assume here that all your loans are unsubsidized, and therefore don’t qualify for the three year subsidy (explanation below). Each month that your payments don’t cover the interest, your accrued interest will continue to build:

Now, this accrued interest won’t be charged interest itself unless it’s capitalized and added to the balance of your loans. This should be avoided at all costs. Under PAYE, interest will be capitalized if:

- You no longer have a partial financial hardship. In other words, your income rises to the point where your payments under PAYE exceed what they would have under the standard 10-year repayment plan when you entered PAYE. Accrued interest will capitalize if this happens, and your monthly payment would revert to what it would have originally been under the 10 year option.

- You forget to recertify your income one year. This is treated in the same way as if you no longer had a partial financial hardship.

- You leave the PAYE program.

Another reason PAYE is mostly superior to IBR is that PAYE has a 10% cap on interest capitalization. The maximum interest that can be added to your loan balance is 10% of your original loan balance when you entered the program. In our example, this would be a maximum of $18,500.

Interest Subsidy

Also like IBR (but unlike ICR), under PAYE the government subsidizes accrued interest for your first three years in the program. If your monthly payments don’t cover the interest on your loans, the government will pay the difference on your subsidized loans for three years.

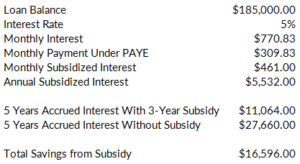

This is a huge benefit. In our example, your monthly payment of $309.83 wouldn’t cover the interest of $770.83. If you were repaying subsidized loans, the government would step in and pay the extra $461.00 for three years. This adds up pretty quickly ($5532.00 per year). So, you’d save $16,596.00 in accrued interest just by virtue using Pay As You Earn instead of IBR:

Who is Eligible

The one downside of Pay As You Earn is that it’s only available to newer borrowers. To qualify, you must be considered a new borrower (meaning you didn’t have any outstanding federal loans) as of October 1st, 2007. Additionally, you must have received a Direct Loan disbursement on or after October 1st, 2011. This basically limits PAYE to the class of 2012 and later.

If you meet these initial qualifications you must also have a partial financial hardship, just like under IBR. This means that your payment under PAYE is less than it would be under the standard 10 year repayment plan. If your income later rises to where you no longer have a partial financial hardship, you can remain in PAYE. Your payments would just be capped at what they would have been under the 10 year standard repayment plan when you entered PAYE, and your interest would capitalize.

Loans Eligible for PAYE:

- Direct subsidized and unsubsidized loans

- Direct PLUS loans made to graduate or professional students

- Direct consolidation loans that did not repay any PLUS loans made to parents

Loans Eligible for PAYE if consolidated:

- Subsidized and unsubsidized Federal Stafford loans

- FFEL PLUS loans made to graduate or professional students

- FFEL Consolidation loans that did not repay any PLUS loans made to parents

- Federal Perkins loans

Loans Ineligible for PAYE:

- Direct PLUS loans made to parents

- Direct Consolidation loans that repaid PLUS loans made to parents

- FFEL Consolidation loans that repaid PLUS loans made to parents

When PAYE is a Good Idea

PAYE is one of the best income driven repayment options due to the low monthly payment calculation. The benefits don’t end there though. The interest subsidy, 10% cap on interest capitalization, and 20 year forgiveness period make PAYE an extremely attractive option.

The problem with PAYE is qualifying. The plan is only available to more recent borrowers – basically the class of 2012 and later. If this is you, it’s hard to wrong with Pay As You Earn.

How You Can Sign Up

To sign up for PAYE you can apply online at studentloans.gov. You’ll need to prove your income, which can be done using the IRS retrieval tool as long as you filed a tax return in the last two years. You can also fill out a paper application if you prefer. Just keep in mind that just like the other options, you need to recertify your income each year. Forgetting to recertify will mean that any accrued interest is capitalized and your monthly payment will jump. Student loan servicers tend to make a lot of mistakes, so make sure to keep copies of the paper trail.

Other Things to Consider

Remember that Pay As You Earn was passed by executive order – which does not require congressional approval. This means that future presidents could just as easily repeal PAYE if they choose. Hopefully, if this does happen existing borrowers in the program will be grandfathered in and shielded from changes to the program. Nothing is guaranteed though, and anyone concerned about the stability of the program might consider IBR instead. IBR was passed with approval from congress.