Market Update Q3 2021

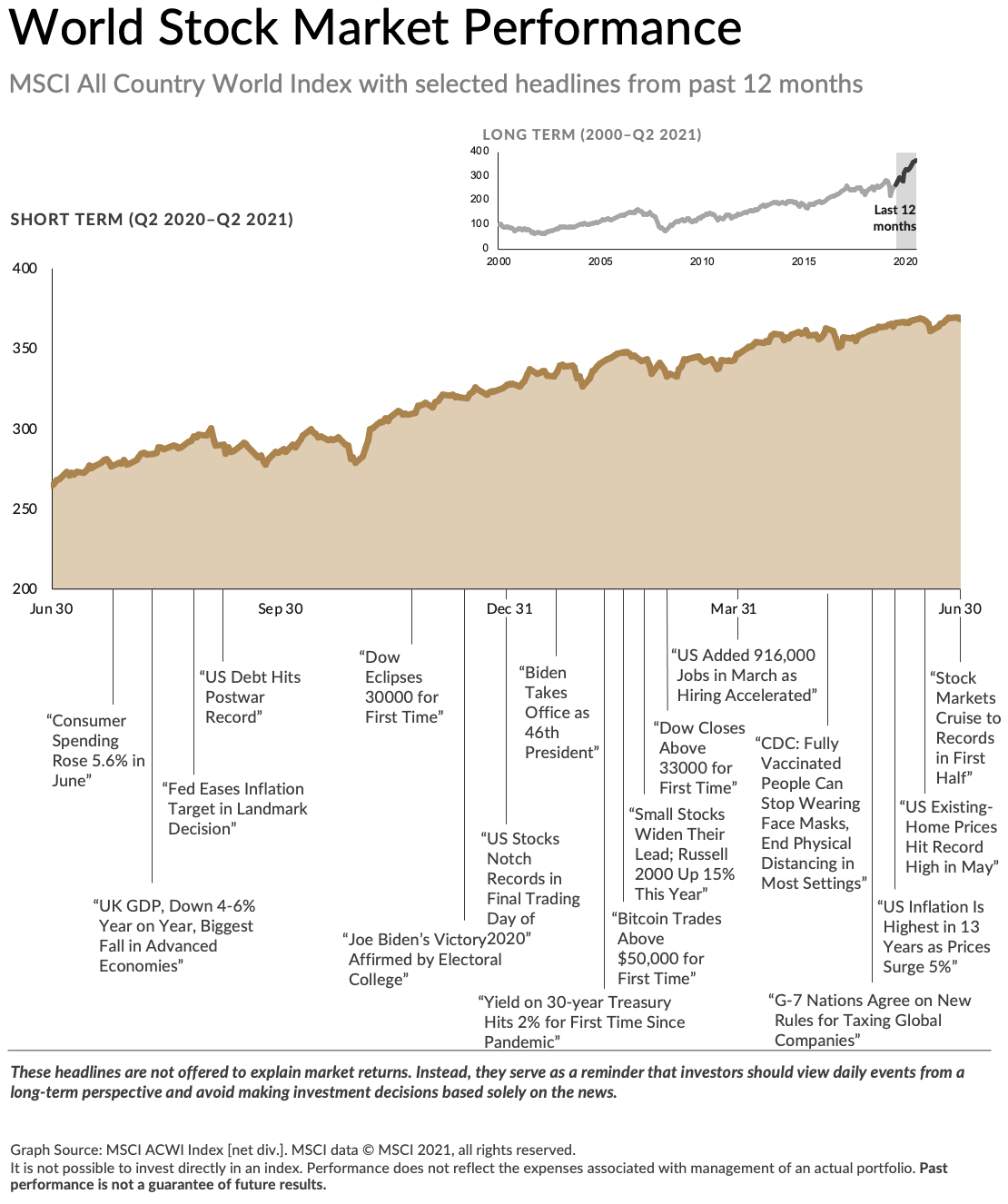

Even though the delta variant has many areas reconsidering reopening & masking protocol, the world’s economic rebound is in full force. The U.S. economy added 943,000 jobs in July, unemployment fell to 5.4% from 5.9%, and global earnings estimates continue being revised upward. These are all positive themes.

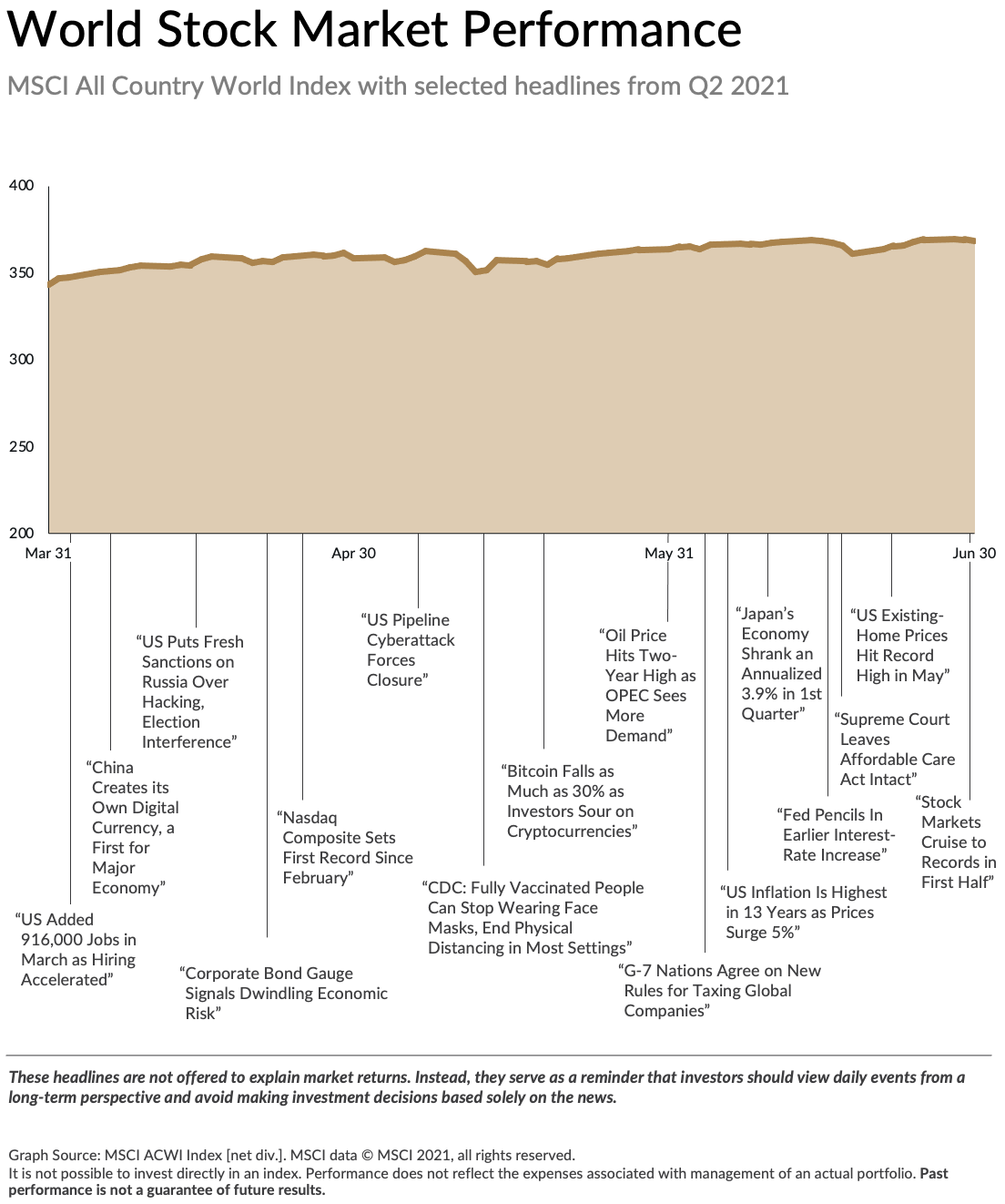

The underlying theme giving some investors pause is inflation. Monthly inflation numbers have continued to lurch upward, despite the Federal Reserve’s insistency that it’s “transitory”.

Market Update Q3 2021: Will prices continue higher? They could. We just passed a $3.5 trillion bill immediately after a $1 trillion infrastructure bill. This type of fiscal policy injects a whole lot of dollars into and through the banking system that we’ll have to borrow to finance. With more dollars chasing the same amount of goods and services available, prices tend to get pushed up.

But then again, many of the price increases we’ve seen recently are supply chain oriented. Computer chip shortages have driven up used car prices. Lumber costs are still high as there’s simply not enough available to supply the glut of home improvement projects. The common thread here is that factories and manufacturing facilities are still crawling back to full capacity. Many workers used the pandemic as an opportunity to change careers or jobs. Some decided not to go back to work at all. So while prices of the goods & services we all enjoy do continue to march higher, the real question will be what happens once capacity is truly back at full strength.

Here’s this quarter’s market review.

U.S. Equities

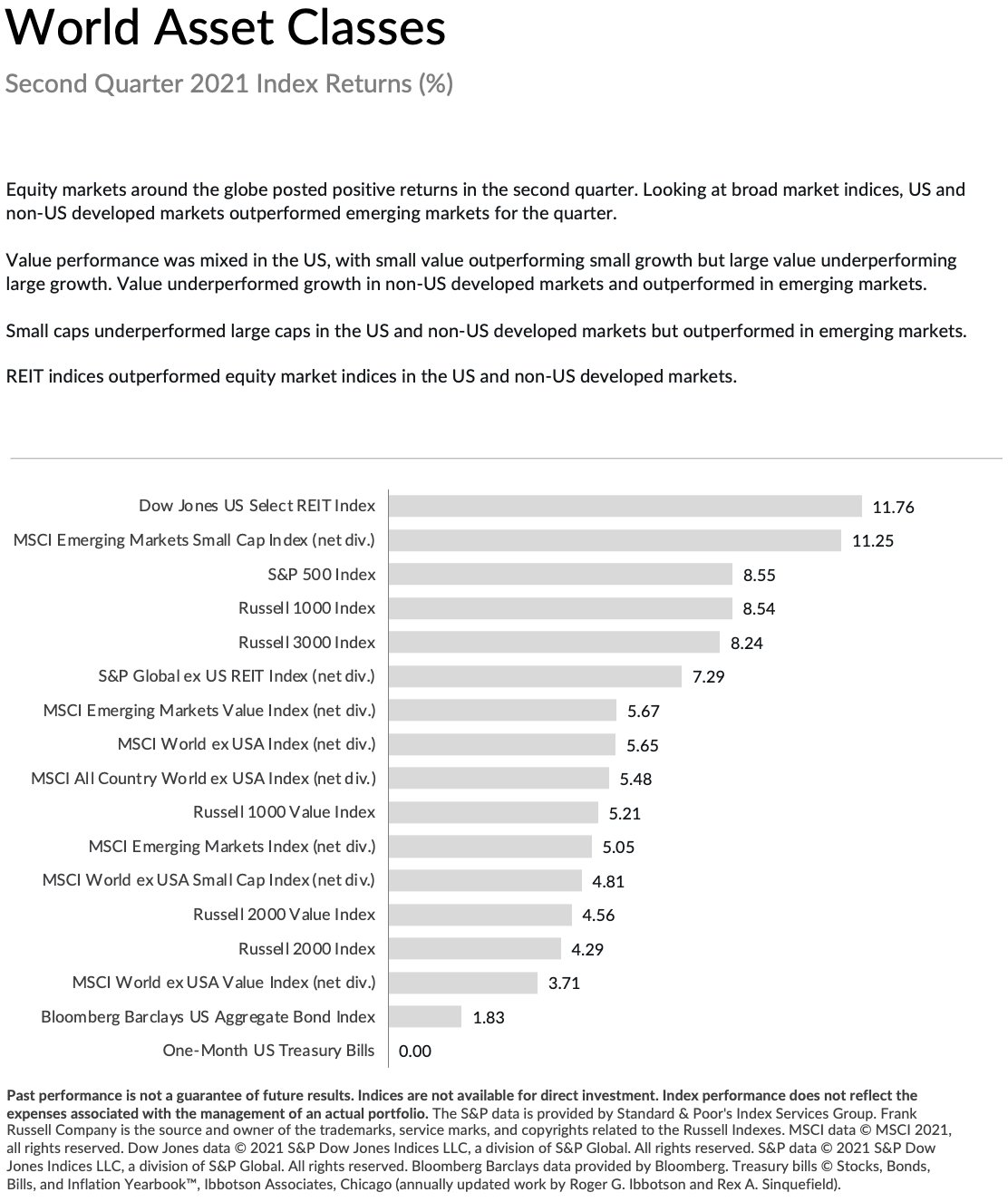

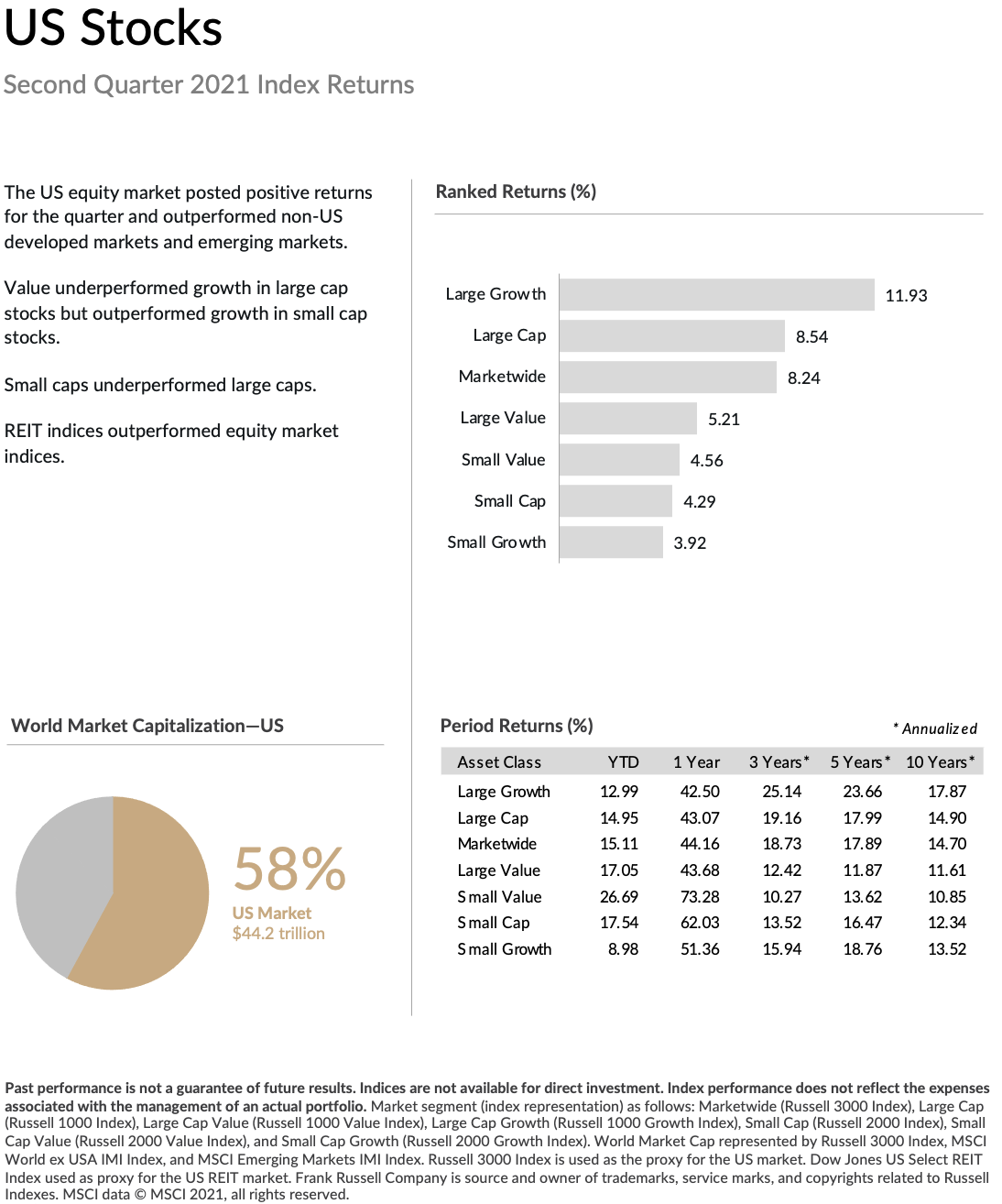

U.S. stocks had another excellent quarter, with the Russell 3000 gaining 8.24%. This index encapsulates both large and small cap stocks. And while large cap shares did outpace small caps on the quarter, the both were significantly in positive territory.

One theory I have about this is how public companies tend to perform duration inflationary periods. It’s clear that equities are strong hedges to inflation. When prices of a company’s inputs go up, it can simply turn around and raise the prices of its goods and services in lockstep.

It may also be the case that larger corporations have greater ability to raise prices than small companies. Large corporations (like those in the Russell 1000) have bigger enterprise values, bigger footprints, and bigger brands. Compared to smaller corporations (like those in the Russell 2000), it’s logical to me that mega corporations may be better insulated to pricing pressures. I don’t have data to back this up, but it could be a reason that large cap shares performed better than their smaller counterparts in Q2.

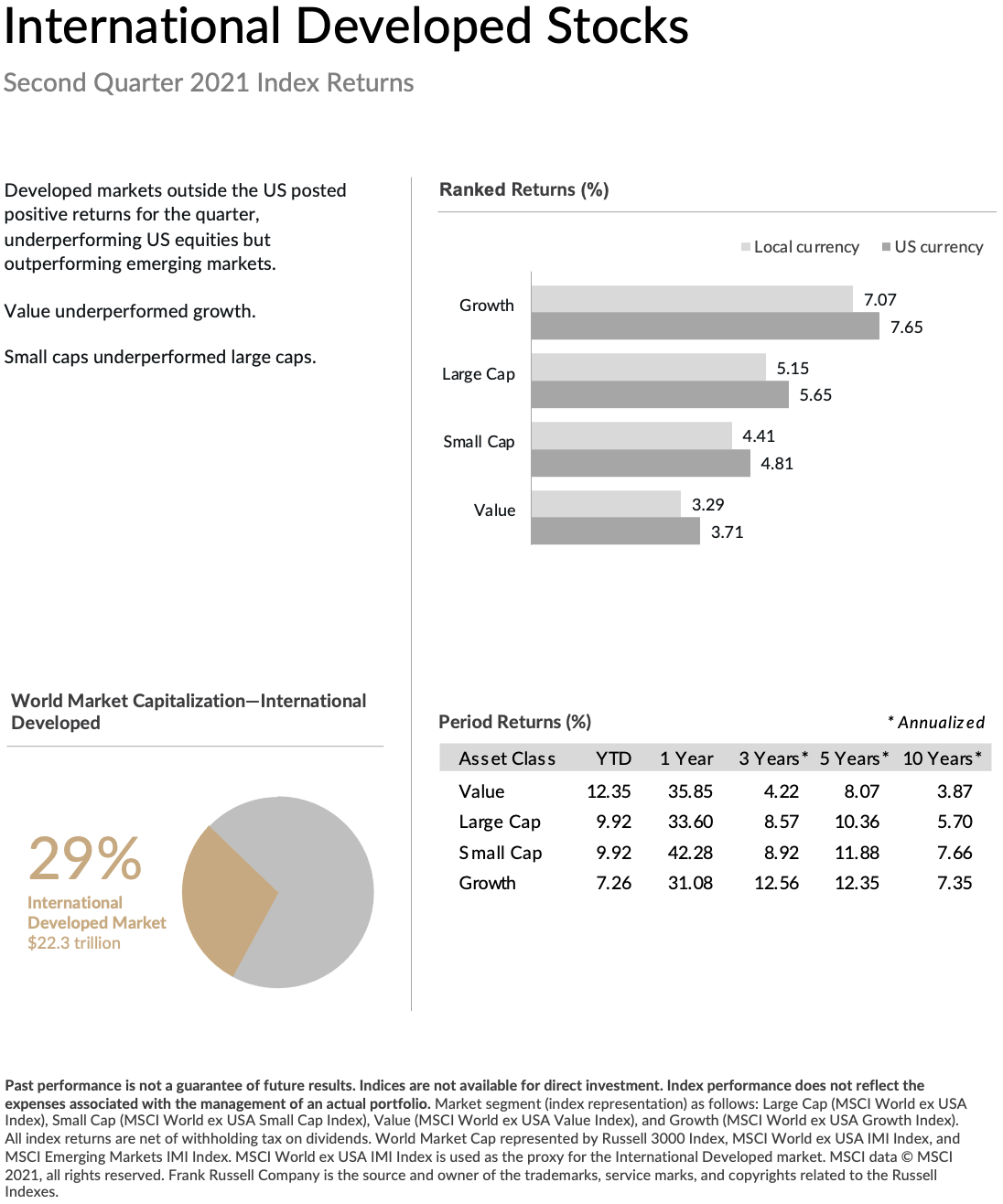

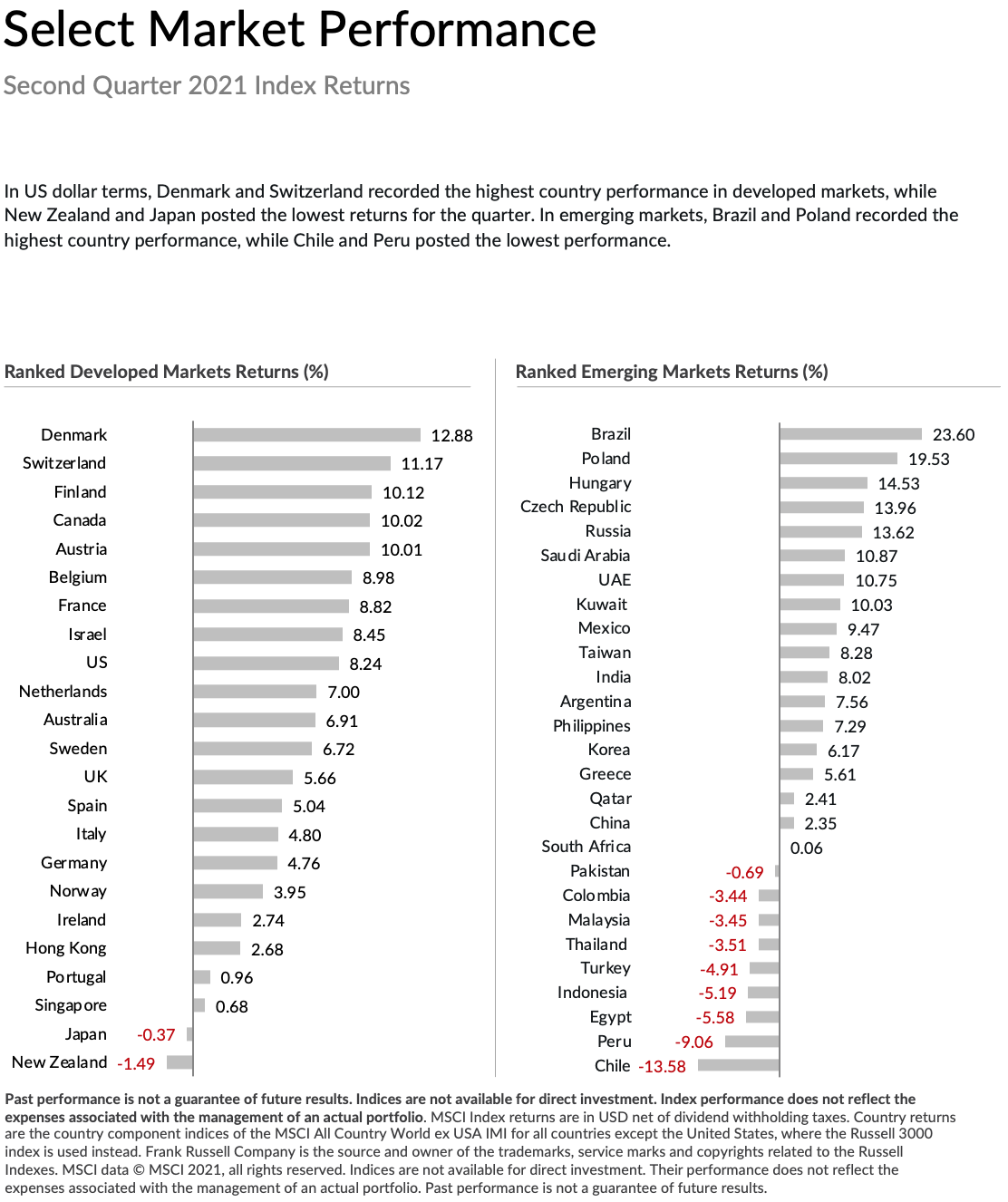

International Developed Markets Equities

Equities in developed economies outside the U.S. gained ground too, but not quite as much as those here in the U.S. This theme is interesting to me. U.S. shares have done quite a bit better than non-U.S. shares over the last decade or so. But valuations heavily favor non-U.S. stocks at this point. Valuation isn’t a great predictor of short term success, but is a strong factor in performance over the subsequent decade.

In other words, U.S. equities have become very expensive relative to earnings, equity, and cash flow. Non-U.S. equities are far less in comparison. Looking at the history here, comparing the valuation between the two asset classes is helpful in determining which will outperform over the following 10 years. But not over periods less than that.

In fact, if we looked at the difference in valuation between U.S. stocks and those in developed economies abroad, it’s close to as large as it’s even been. Which makes a great case for international investing.

As always, I’m an advocate for a balanced approach with a healthy portion of equities domiciled in non-U.S. countries. But if you don’t have any international exposure yet, now may be as good a time as any.

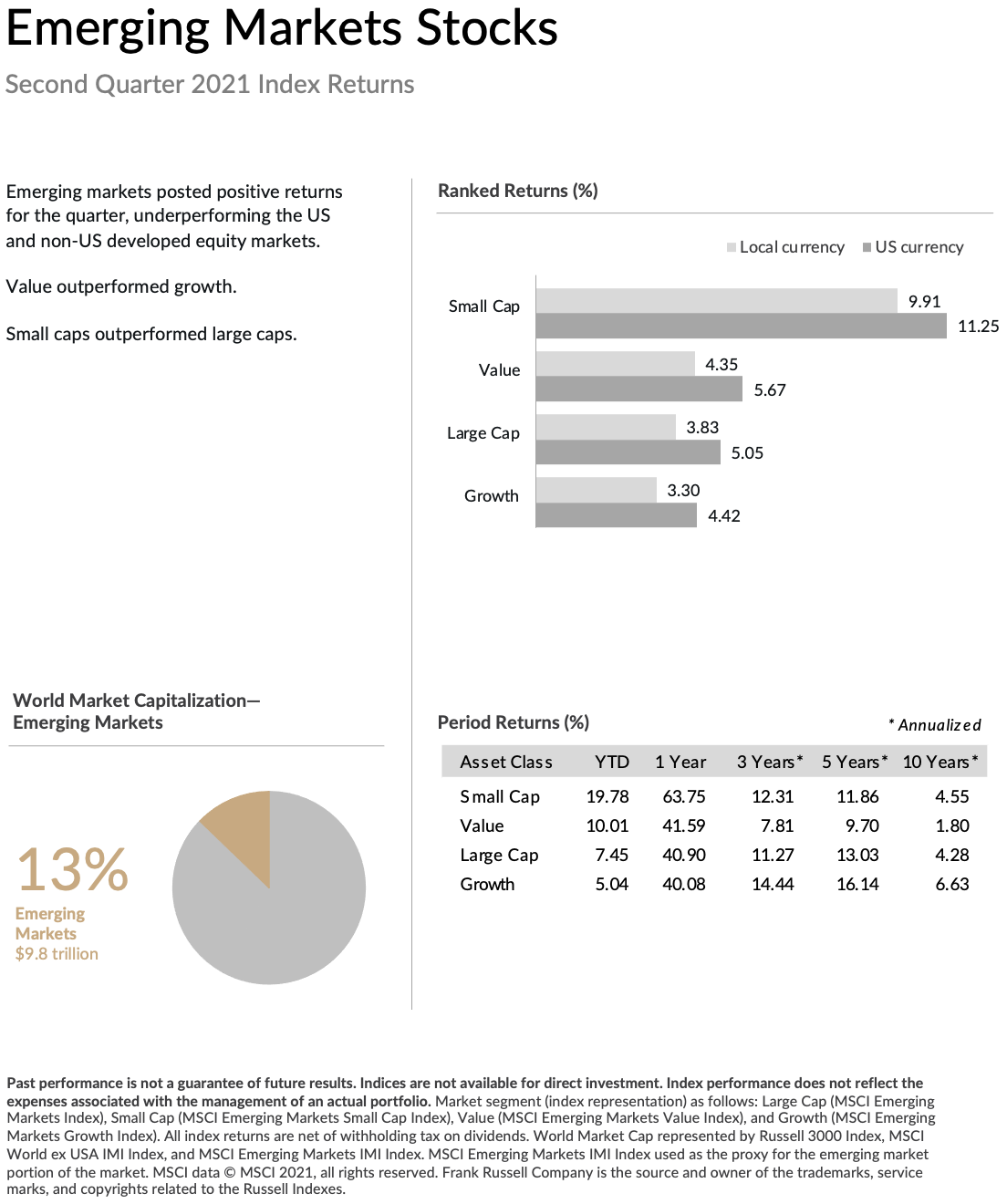

Emerging Markets Equities

Emerging markets lagged those in both the U.S. and developed economies in the 2nd quarter. Small cap shares did far better than their counterparts in emerging economies though. This type of dispersion between segments is not uncommon in the emerging markets, as it’s a high risk/reward asset class in the first place.

Stretching out the period a bit, smaller shares in the emerging markets have done phenomenal over the last 12 months. While large cap shares have grown 40.9% over the last year, smaller shares have risen 63.75%. (Keep in mind that 12 month numbers incorporate the rebound after the COVID related drop in March of 2020, but not the drop itself).

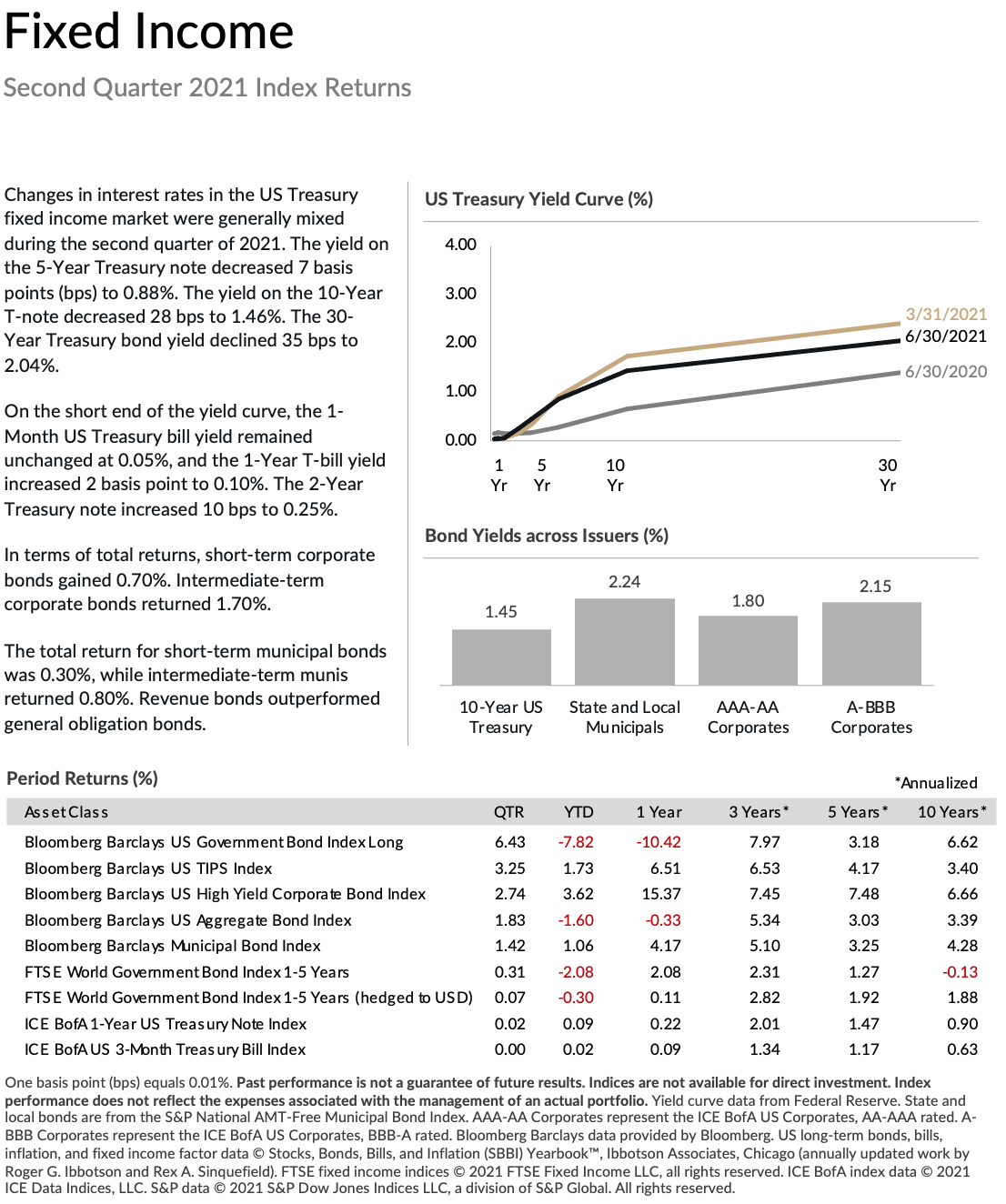

Fixed Income

Despite inflation numbers ticking higher, yields on U.S. government bonds have fallen. The 10-year yield ground to as low as 1.13% over the last 12 weeks, before jumping moderately since then.

Looking ahead, the wide expectation here is that yields will continue to rise. With stronger jobs & economic numbers being reported, it wouldn’t be the least bit surprising to see investors require a bit more return on their loans to the U.S. government. Especially in light of the inflation situation.

The other relevant factor here is the Federal Reserve and the pace of their bond purchases. The central bank has purchased massive amounts of government bonds over the last 18 months to help support the capital markets. Fed chairman Jerome Powell has announced that those purchases will slow gradually as the economic rebound continues. And without a buyer of that size in the market, it’s likely that equilibrium rates will be pushed a bit higher.

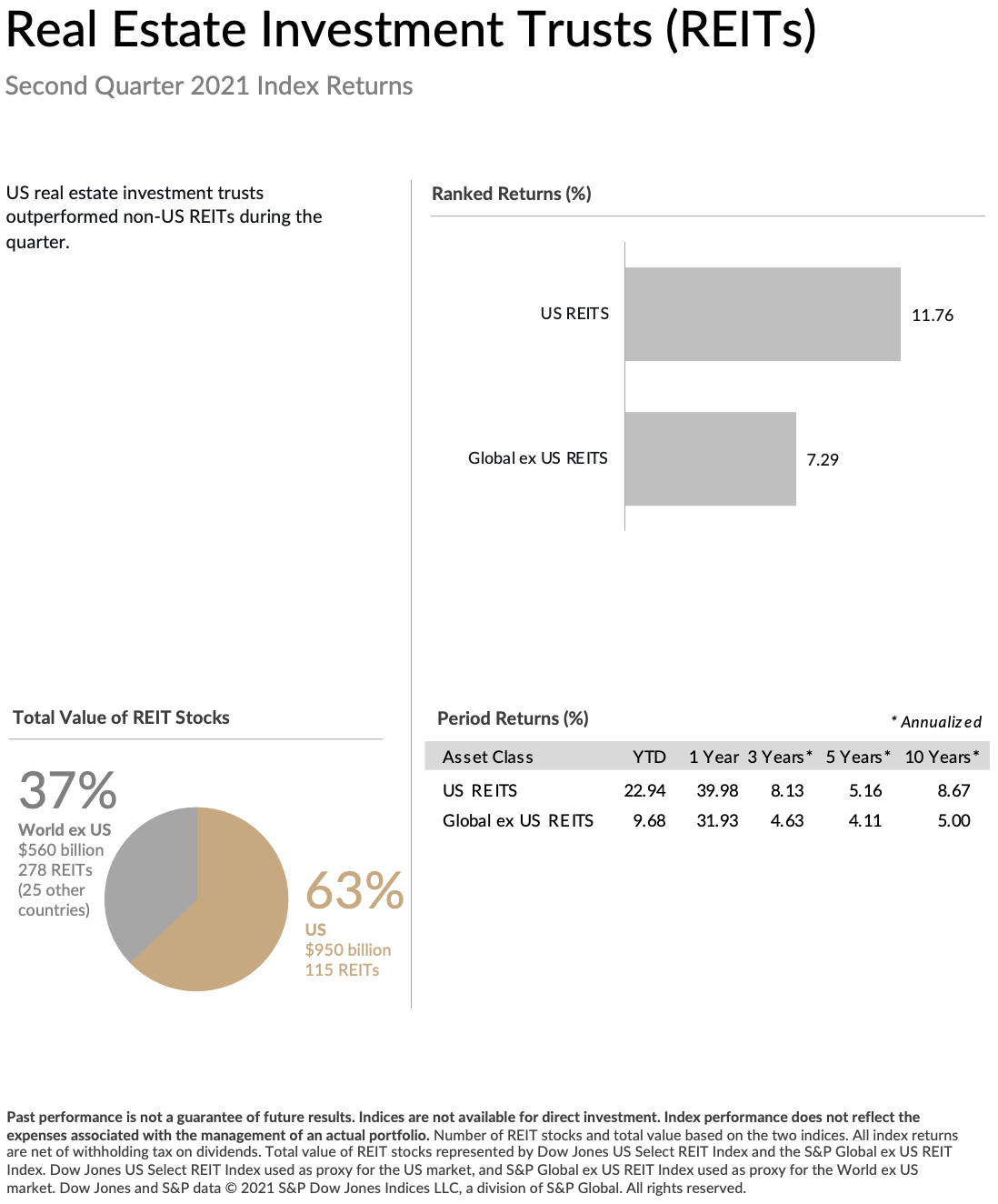

Real Estate Investment Trusts

Real estate was somewhat surprisingly the best performing asset class in the second quarter. Several clients I’ve spoken with recently have been surprised at how well real estate has done since the pandemic began.

The assumption here was that people would be reluctant to return to work, and corporations would begin to abandon large, expensive downtown office spaces. That, and the fact that shopping malls are quickly going extinct made a good bear case for real estate in general.

But what we tend to forget is that real estate investment trusts also include hospitals, warehouses, and industrial space. All of which are in high demand at the moment. So even though some sectors have indeed been hammered throughout the pandemic amid changing preferences, the group as a whole is still on strong footing.