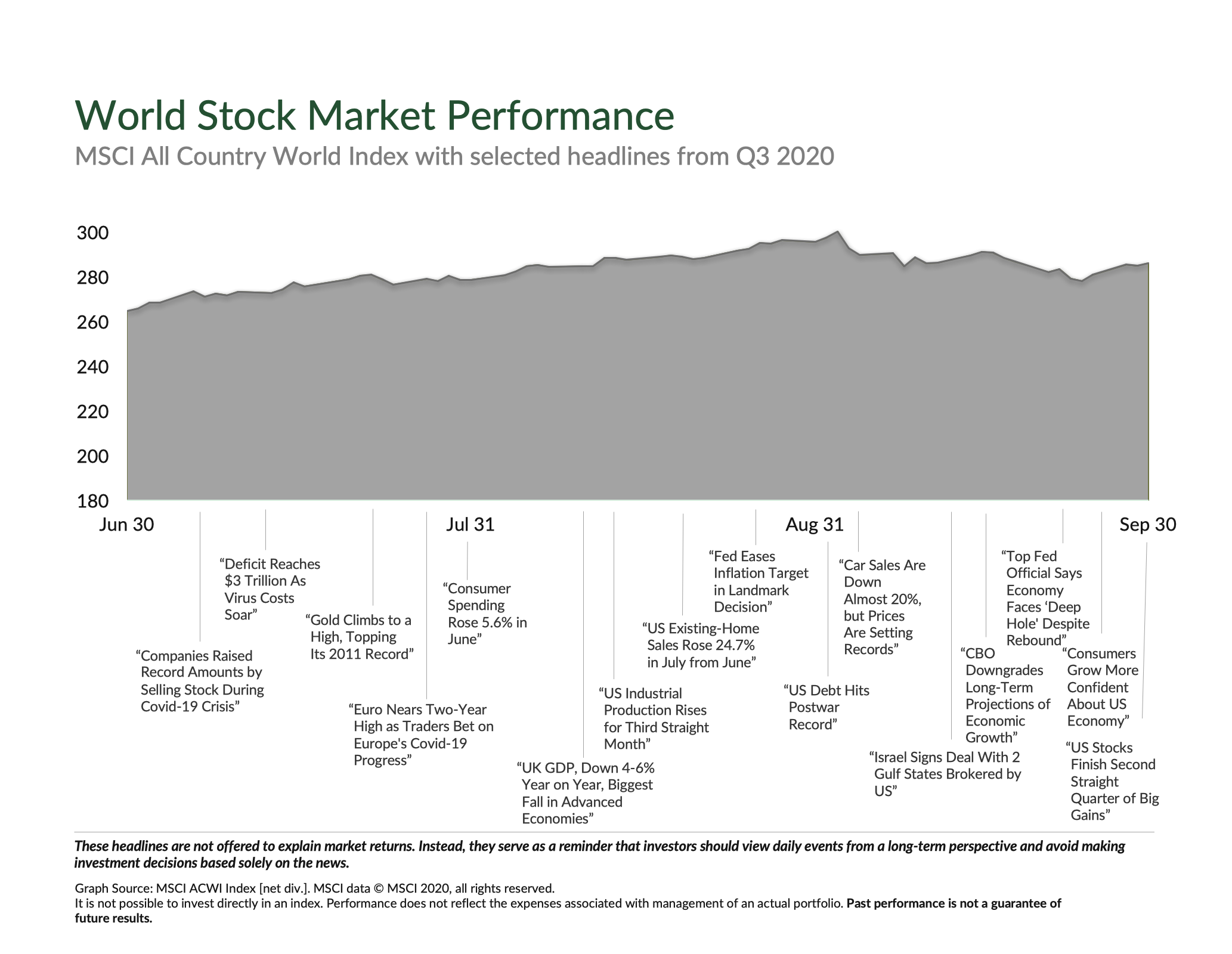

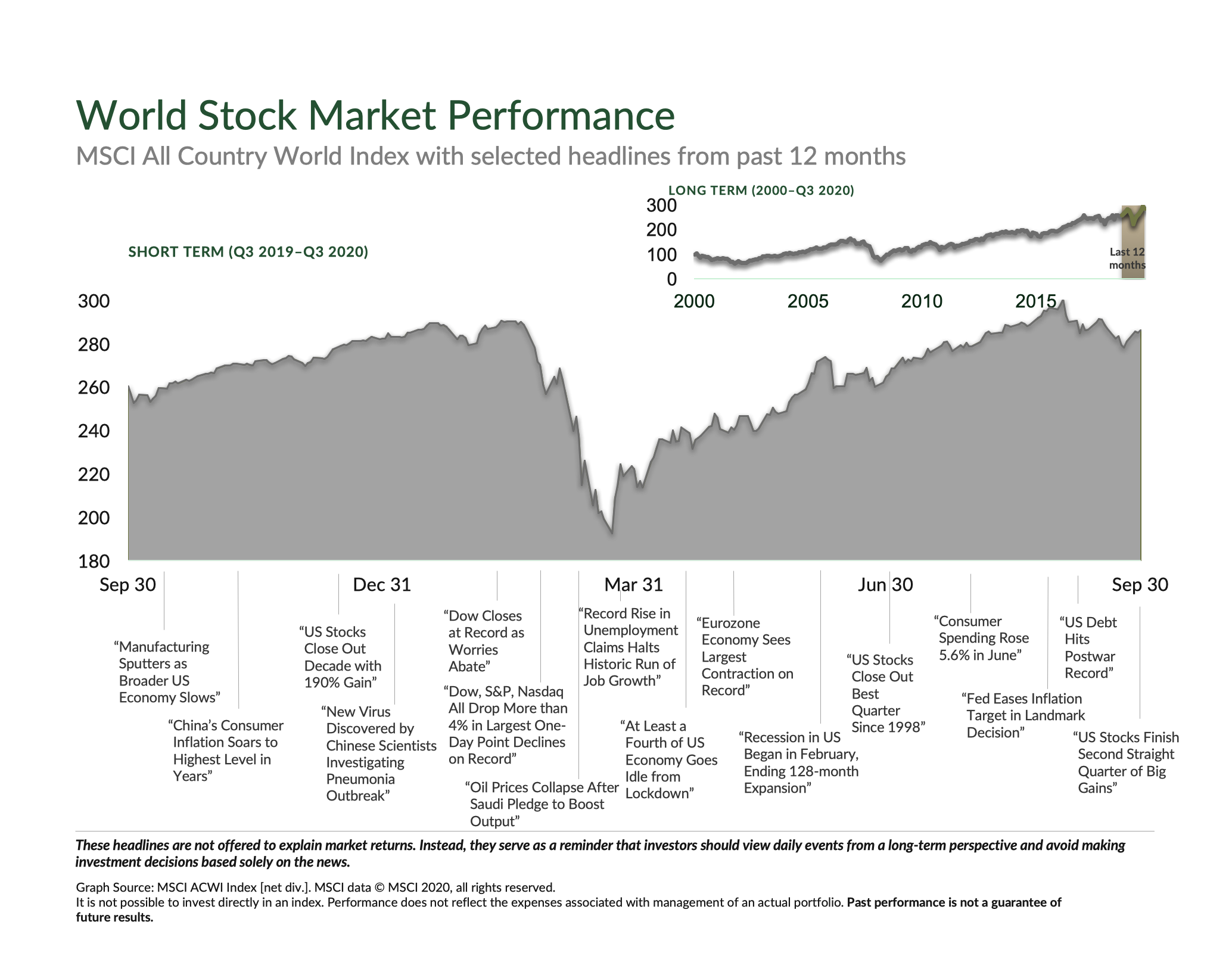

With the election right around the corner, Q3 was another hot quarter for global capital markets. U.S. stocks appreciated considerably, and the bond market’s outlook for the economy improved as the yield curve steepened. At the moment it seems like the markets are expecting another round of stimulus sometime soon. Rumors of different packages have swirled around both sides of the aisle over the last three months. As I write this, there appears to be a strong possibility that a bill is passed by the election. If that doesn’t happen, we may be in for the volatility so many investors are expecting in early November.

This is an odd time, an odd year, and it’s hard to believe that stocks and bonds are both in positive territory after everything that’s happened. But here we are. Now is a good time to remind ourselves of a few core investment principles:

- Diversification is your friend. Both globally and across different asset classes.

- Create a long term plan you can stick to.

- Stick to that plan no matter what.

Easy enough, right? Here’s this quarter’s market summary.

U.S. Stocks

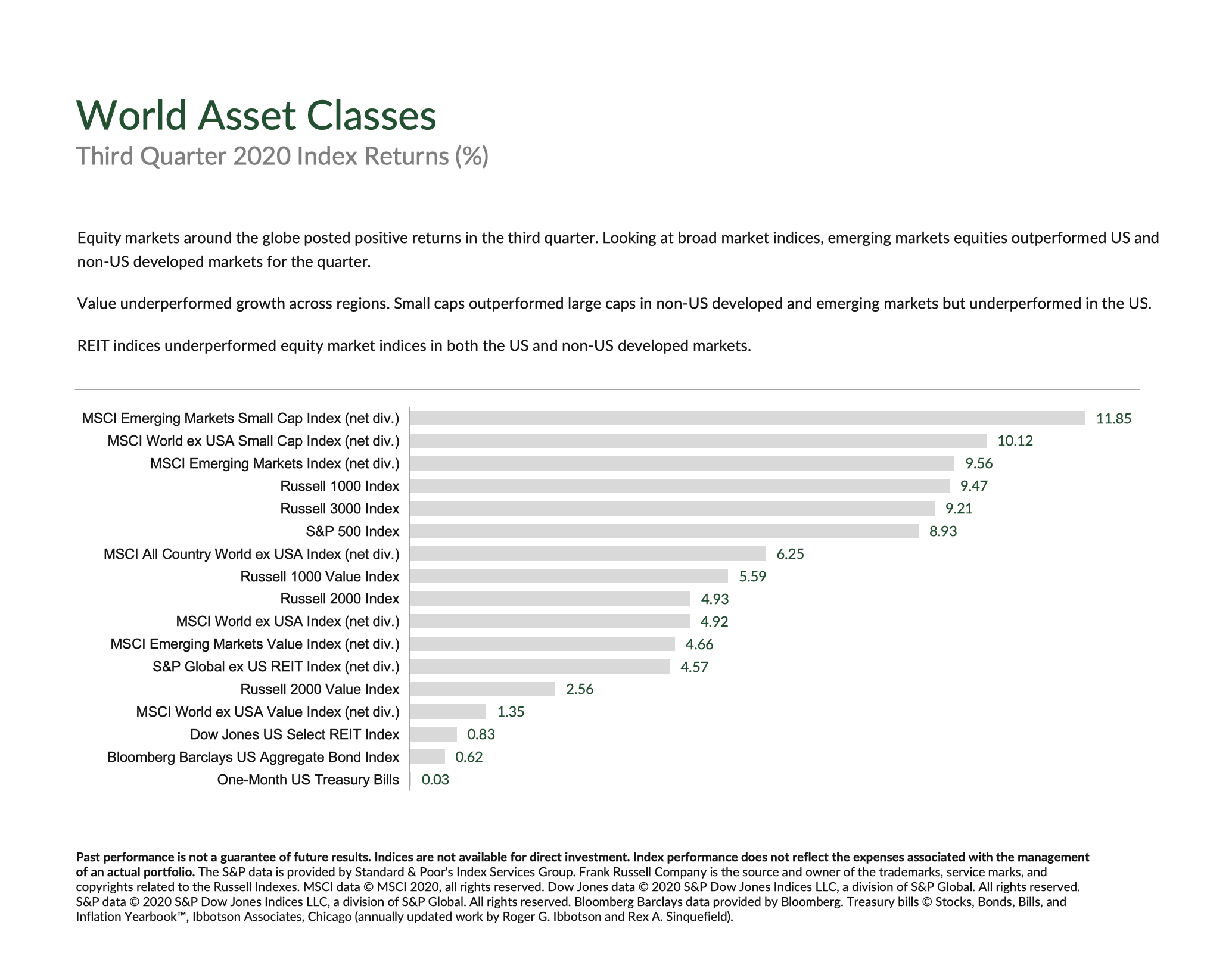

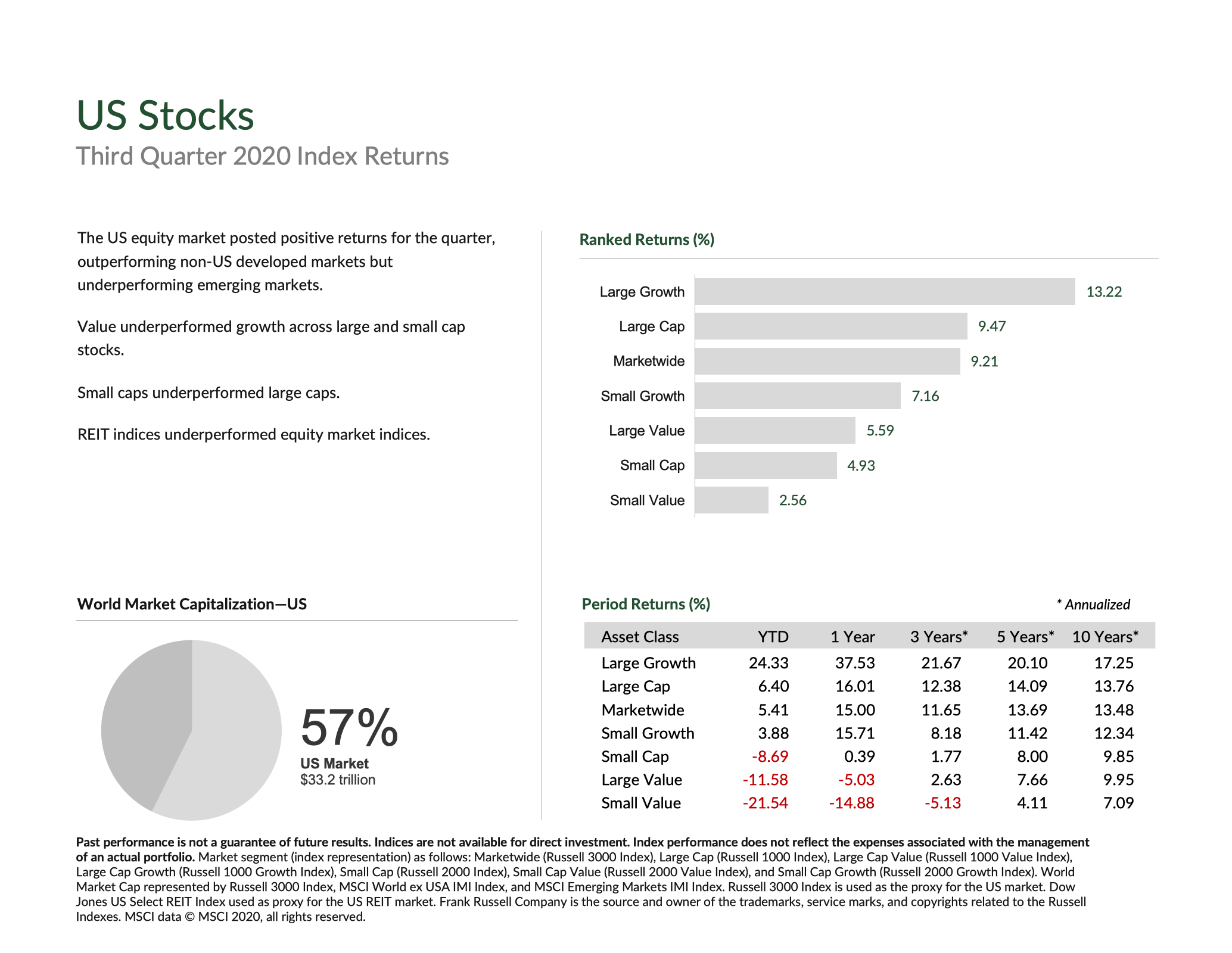

Equities here in the U.S. performed quite well in Q3, with large cap shares up another 9.47%. Some of that is no doubt due to expectations of another stimulus package, as the economic rebound has started to slow a bit of late. There also seems to be widespread speculation that the markets will either skyrocket or plummet around election day. It’s easy to jump to the conclusion with all the, let’s call it “craziness”, that 2020 has had to offer.

I don’t believe that’s a foregone conclusion. Even though a Biden victory would mean higher taxes on corporations and higher income individuals, several reputable researchers think Biden would be better for the economy. A Trump victory, of course, would almost certainly mean four years of similar fiscal policy.

Not to mention the fact that the Fed is still snatching up bonds (and even bond ETFs) at a healthy clip, which I’m sure is driving up prices of risk assets like stocks. So while it wouldn’t necessarily surprise me to see volatility over the next few weeks, I’m not counting on it.

International Developed Stocks

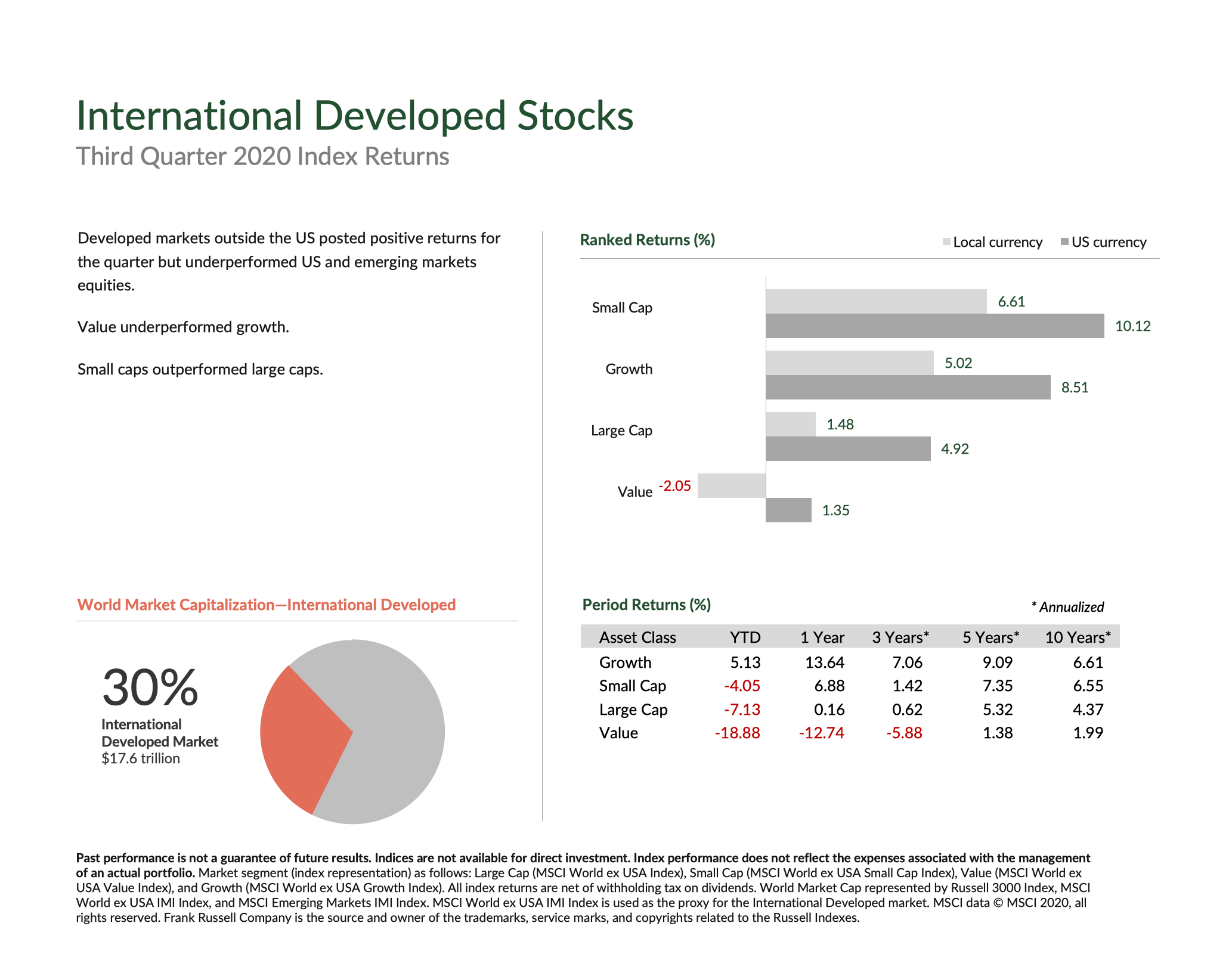

The story for stocks in developed markets other than the U.S. is confidence. Each of the U.S. ISM index, German IFO Business Climate Index, and French INSEE climbed back above pre-COVID levels at the end of Q3 after bottoming out in Q2. Stock analysts have raised earnings per share targets as well, as the U.S. ISM index has historically been a fairly strong leading indicator of upcoming earnings announcements.

This is all good news, as you can see by the Q3 performance charts below. Small cap and growth sectors both performed exceptionally well, especially in U.S. dollar terms. And while value and large cap did lag, they were still both in positive territory.

Emerging Markets Stocks

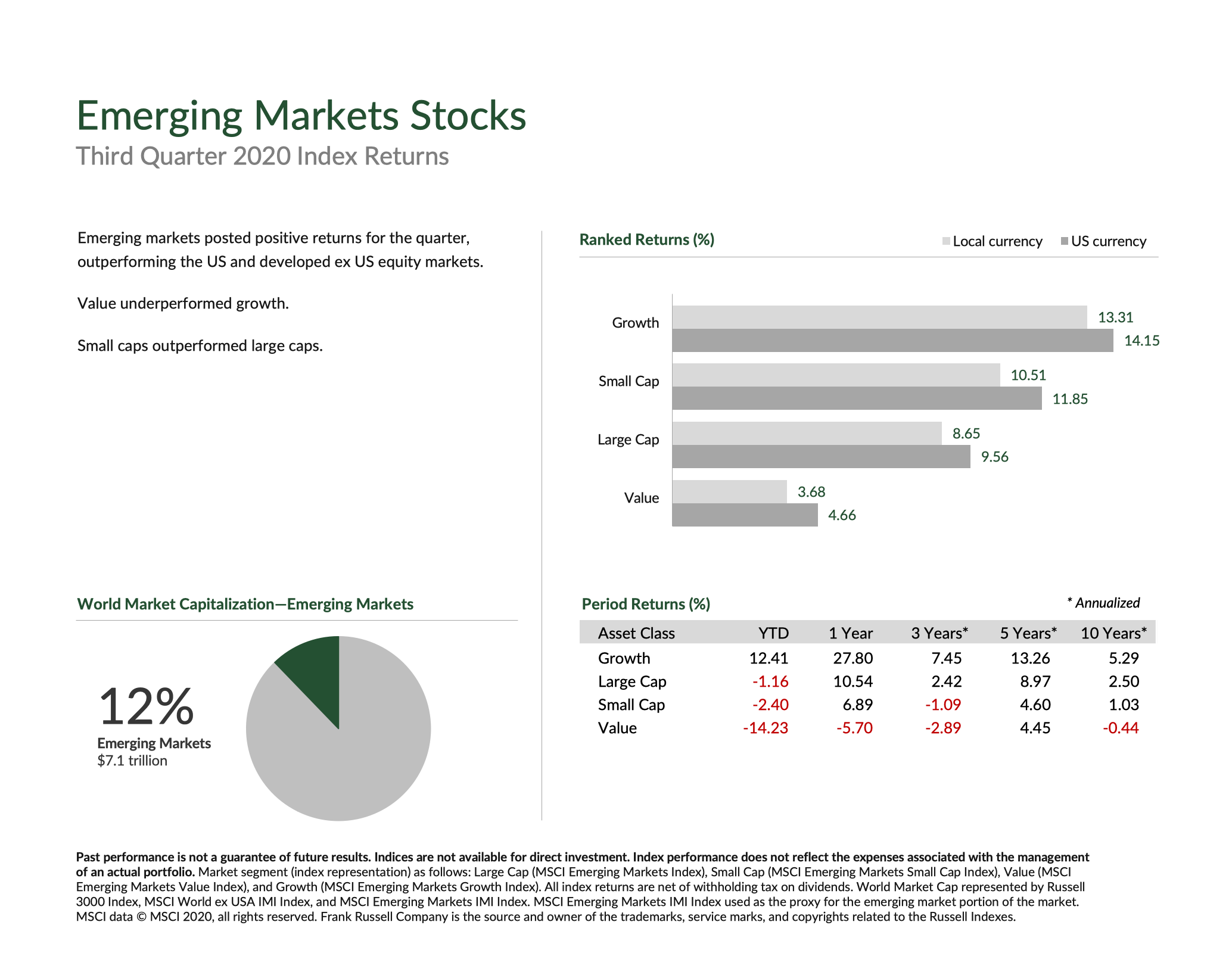

While many economies across the world are still reeling with COVID-19 related shutdowns, China found its economy back on track in Q3. After economic output contracted 6.8% in Q1 & expanded 3.2% in a quick Q2 rebound, the country continued the recovery by expanding another 4.9% in Q3. Although it’s hard to trust the numbers coming out of China, this is impressive. The International Monetary Fund (IMF) is projecting China’s economy to expand 1.9% over the entire year, which is astounding. By contrast, the U.S. economy is projected to shrink by 4.3%, and the Eurozone is expected to shrink by 8.3%.

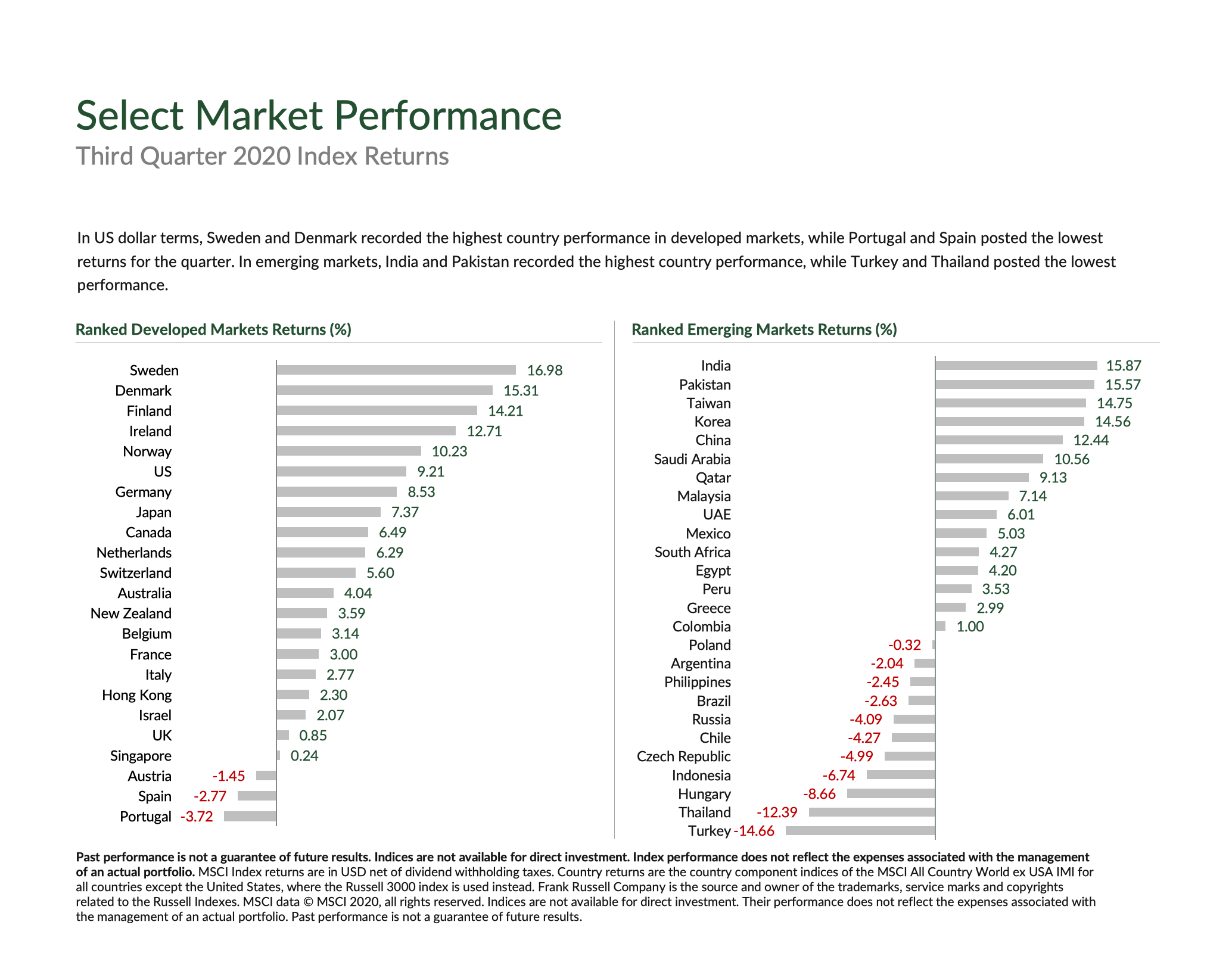

While this news wasn’t announced until several weeks into the fourth quarter, the third quarter was a very strong three months for Chinese equities. The country saw a 12.4% appreciation of equity shares, aside strength in several other Asian economies.

There is different news elsewhere. And while it seems like the equities in some emerging economies had a horrendous third quarter, much of that thanks to currency performance against the dollar. Turkey, for example, shows returns of -14.66% in Q3. Relative to the Turkish Lira, the country’s equities were actually up on the quarter. But due to unorthodox central banking practices in the country the U.S. dollar has trounced the Lira over the same period. In fact, the U.S. dollar is up 33% year to date over the Lira.

U.S. Fixed Income

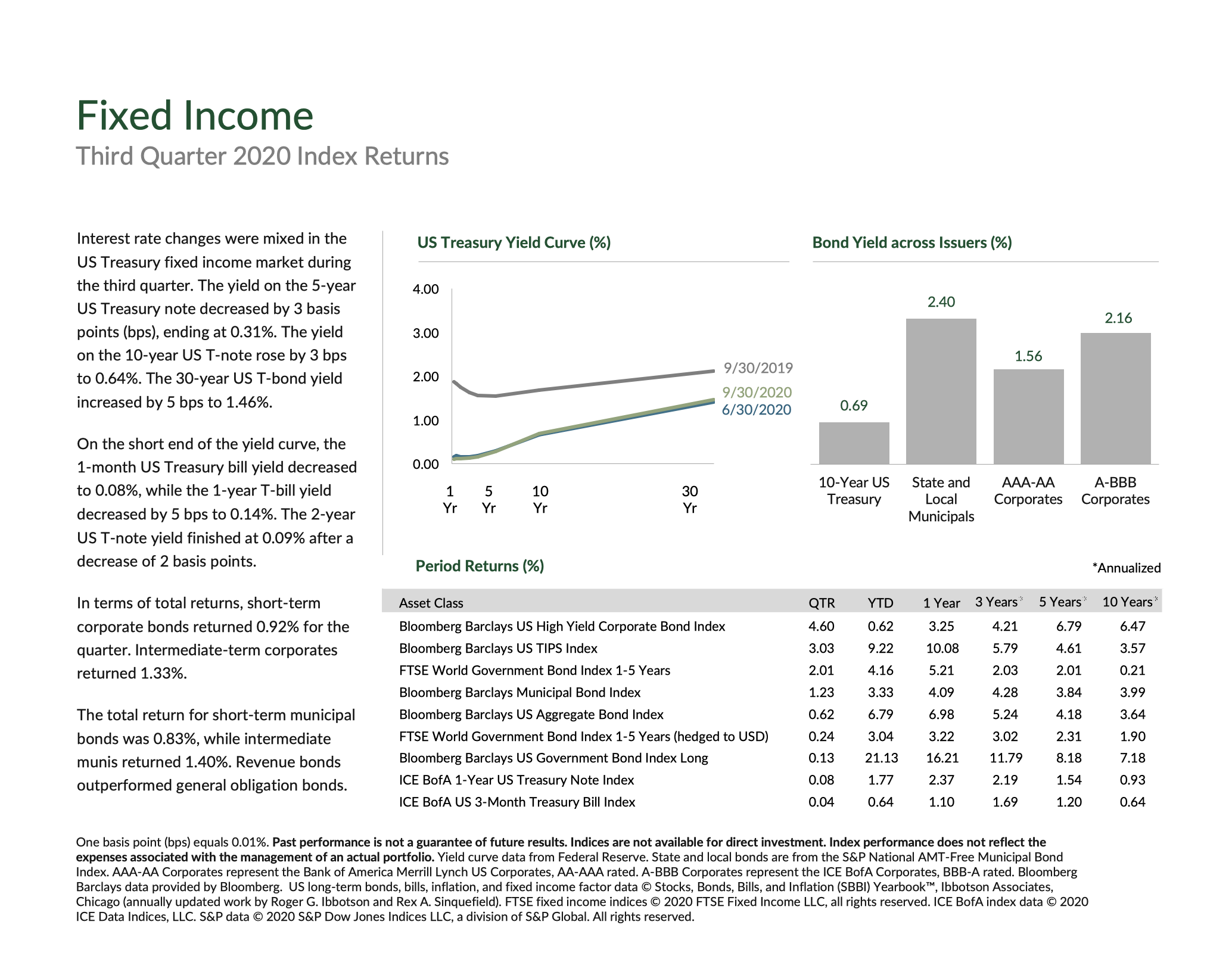

It’s difficult to see in the chart below, but the bond market grew slightly more optimistic over the third quarter. You’ll notice that the line signifying 6/30/20 is just a touch flatter than the line corresponding to 9/30/20. Even though short term rates ground just a hair lower in Q3, long term rates rose. The the 5-year US treasury yield fell 3 basis points, 10-year US treasury yield rose 3 basis points, and the 30-year US treasury rose 5 basis points.

This may not seem like much, but highlights a “steepening” yield curve, which is generally a good sign. Flatter yield curves tend to signify that investors don’t think the economy will be much stronger in the future than it is now. Steepening curves indicate the opposite.

There are a couple reasons for this. The first is an expectation of more fiscal stimulus. Even though congress was not in session in late July and late September, rumors of a new stimulus package never escaped the major new outlets. While there still hasn’t been a bill passed, it seems fairly likely to happen before the election. This would be good news for our economy, which bond markets like.

On top of stimulus possibilities, the Federal Reserve recently made a substantial change to its inflation target. Rather than setting an inflation target of a fixed 2%, Jerome Powell announced in late August that the Fed would start using an average target of 2% instead. This is a fairly big deal. It gives the central bank more flexibility, and enables the bank to maintain ultra low rates for a longer period of time. This signals more accommodative policy, which bond markets tend to like. I’d without a doubt expect this stance to continue for as long as inflation doesn’t creep into the picture.

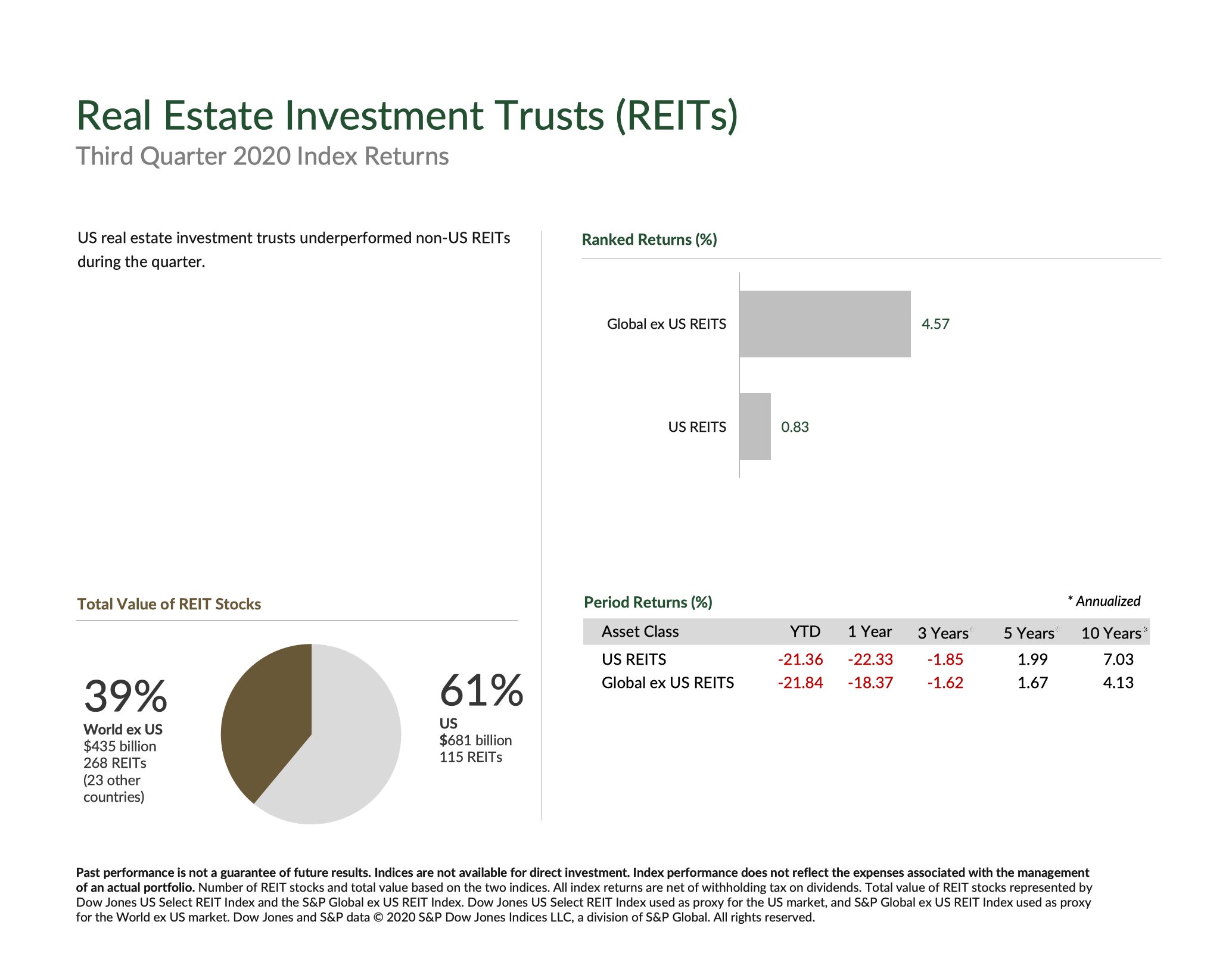

Real Estate Investment Trusts (REITs)

REITs are the third worst performing equity sector so far this year, with US REITs down over 21%. Global REITs have tracked pretty closely to their US counterparts year to date, but rebounded strongly in Q3, gaining 4.57% vs. 0.83%.

The pandemic has created a large dispersion of returns across publicly traded REITs. It shouldn’t be surprising that retail REITs (with holdings like shopping malls and strip malls) have performed terribly. Industrial REITs on the other hand have actually outperformed the stock market year to date, as tenants & leaseholders in this sector were less impacted.

Going forward it wouldn’t be surprising to see some of the oversold retail REITs bounce back substantially as the economy reopens. This may take 6-12 months to occur, but there may be some reasonable opportunities in the largely discarded pile.

Another narrative to follow here is the pressure on New York City’s commercial real estate industry. The Wall Street Journal recently published an article on the state of the commercial mortgage backed securities business. To summarize, things are…..not good. While stock markets continue to test record highs, securities backed by loans for hotels & shops in New York City are showing fallibility. Lenders are being more cautious and bracing for a hard hit, and market prices of existing debts are starting to wane. While there may be opportunities in certain retail REITs around the country, New York City could be a region to avoid. As more people exit the city and escape to the suburbs, the recovery there could be a longer term ordeal.

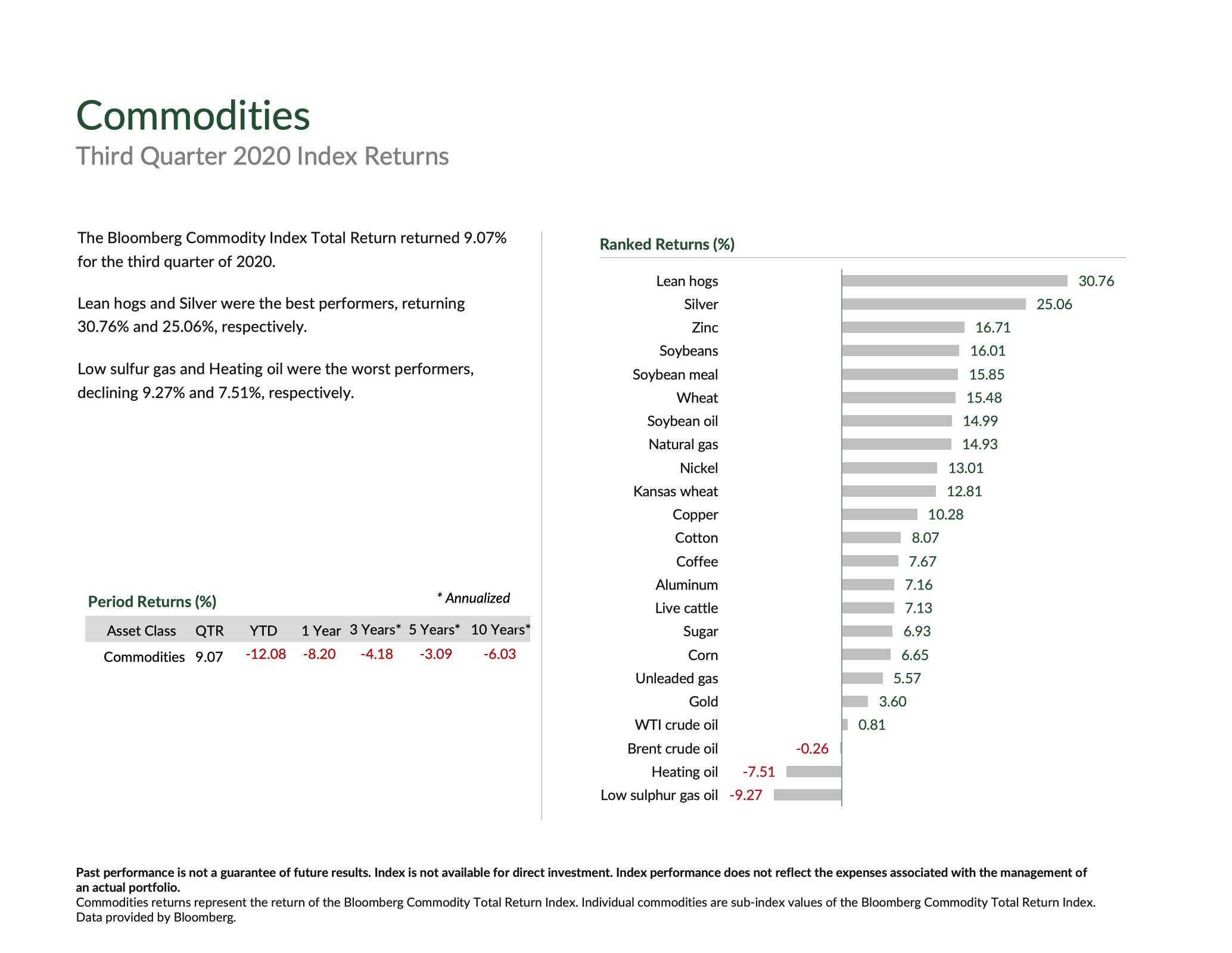

Commodities

Wheat and soybeans were Q3 leaders in the commodities markets thanks to dry summer weather & global food insecurity, but gold has grabbed more of the recent headlines. Gold set an all-time record in August, after the Fed’s change in inflation stance (see above). Up 24% on the year, the metal is seen by many investors as a stable alternative that’s not subject to central bank manipulation. I’ve not been a huge fan of gold as an investment over the years because it doesn’t do anything. You don’t get interest or dividends on a gold investment. There’s no corporate oversight driving revenue or earnings. You just kind of sit on it and hope it goes up.

But with interest rates so low that argument doesn’t carry as much weight. It’s not like you’re giving up on a substantial amount of risk free interest by investing in gold instead of a US Treasury bill. I’m not personally recommending gold investments yet, but can understand why it appeals to some. It can provide a nice balance to equity holdings if and when the markets correct again. With bond prices so high (due to the low yields), gold may be one of the few reasonable asset classes that truly provides diversification to equities. But it’s not in my portfolios yet.