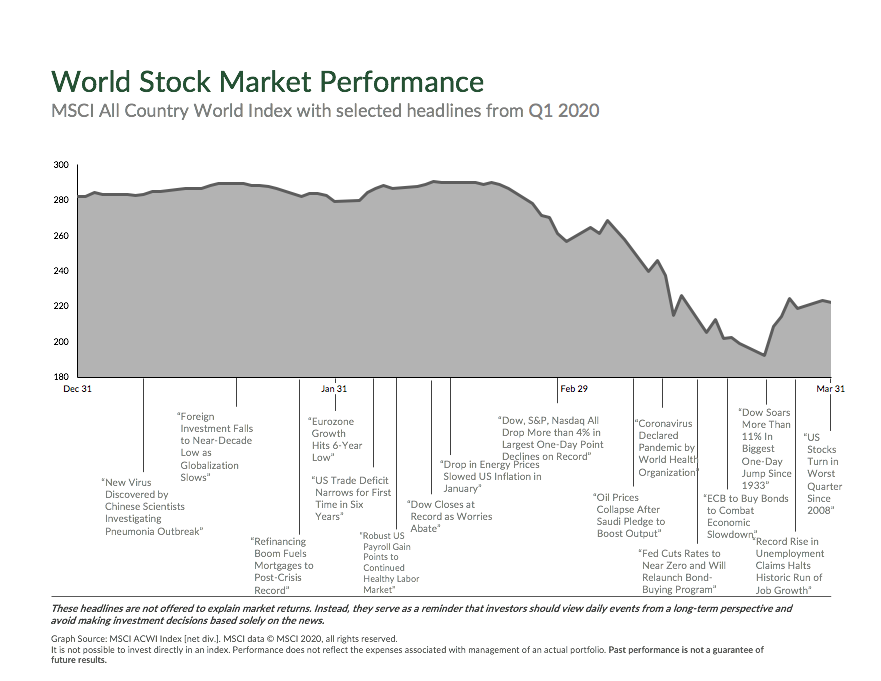

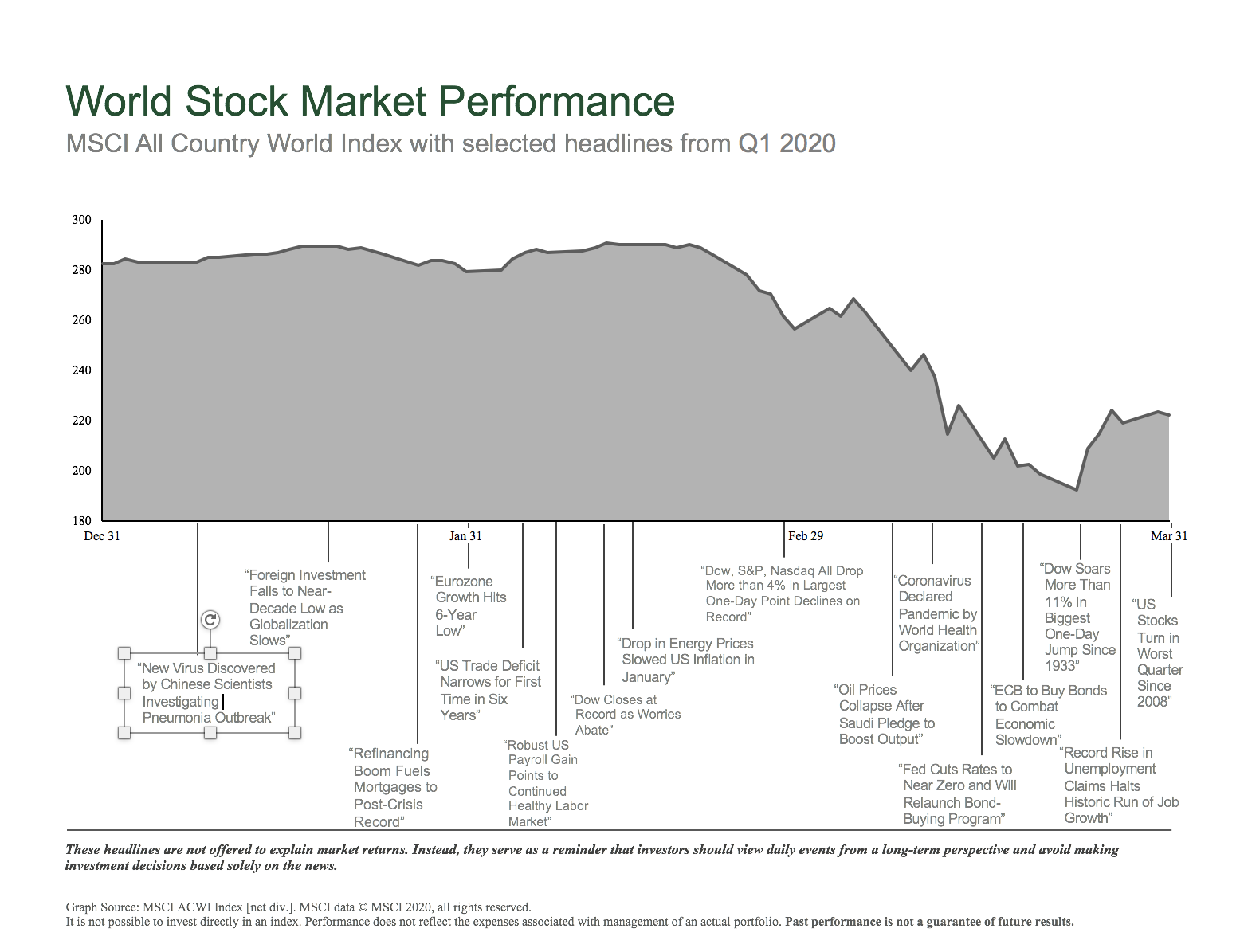

Well here we are….one quarter into 2020, and the risk event we’ve all been waiting for has finally arrived. Volatility as measured by the VIX Index touched all time highs over the first quarter as the Coronavirus spread from China to Italy and the rest of the world.

The stock slide here in the United States was fierce, but a late quarter bounce regained a substantial portion of the lost ground. More ground, in my opinion, than the numbers really support.

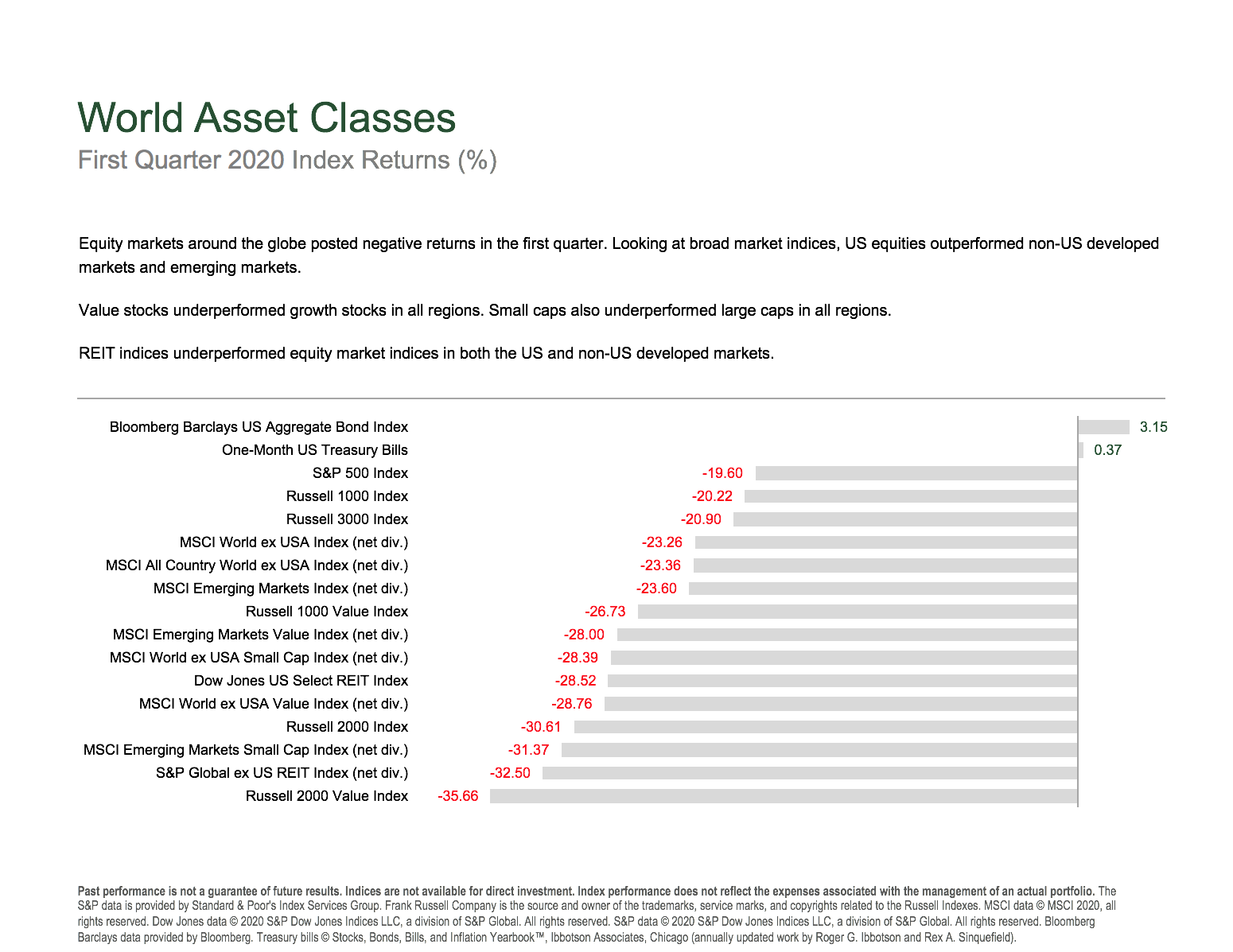

From here, small cap and emerging markets are starting to look like wonderful bargains. But without knowing the extent of the economic damage & how long the world will be sheltering in place, it’s difficult to make that argument with too much confidence.

Here’s this quarter’s market update.

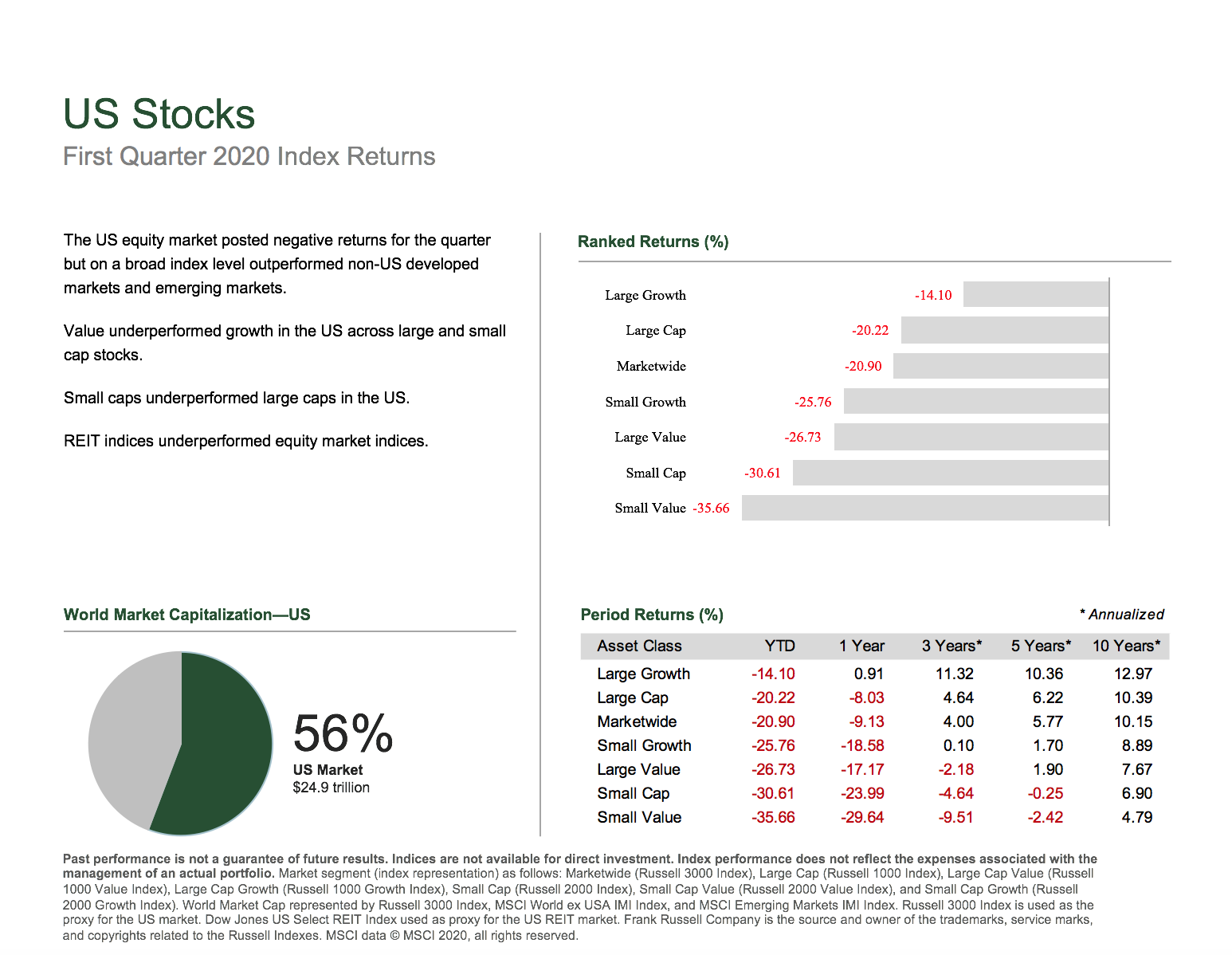

US Stocks

By the end of Q1, large cap US stocks were off 14.1% year to date, and small cap were off nearly 30.1%. As you’ve probably noticed, we’ve experienced quite a rebound in the first few weeks of April since this low. With volatility still very high, the fundamentals are beginning to diverge from what the markets are telling us. Picture this:

- Unemployment has jumped from 4% to 15%

- Oil is down 70%

- Interest rates have plummeted across the board

- Volatility (measured by the VIX) is more than twice its typical level

Yet large cap equities are now down less than 10% on the year, at the time of this writing. Everything around stocks are crumbling, yet the historically risky asset class is the one holding its ground.

We haven’t made it through earnings season yet, and the amount of economic fallout from the pandemic is still be counted and argued about. At the moment stocks are pricing in economic numbers that are not as bad as we fear. If they are as bad as we fear, we should prepare for another stark drop in equities.

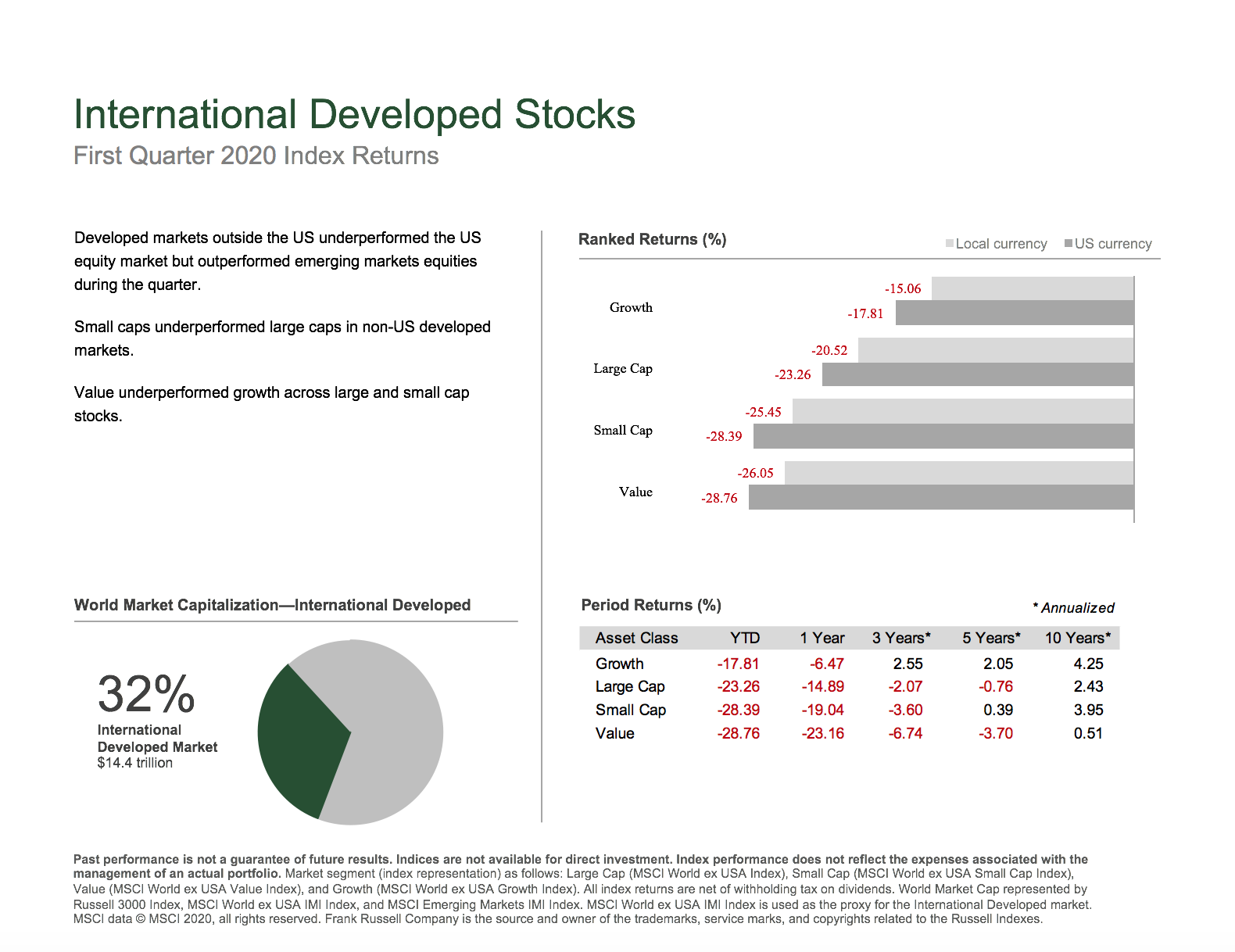

International Developed Stocks

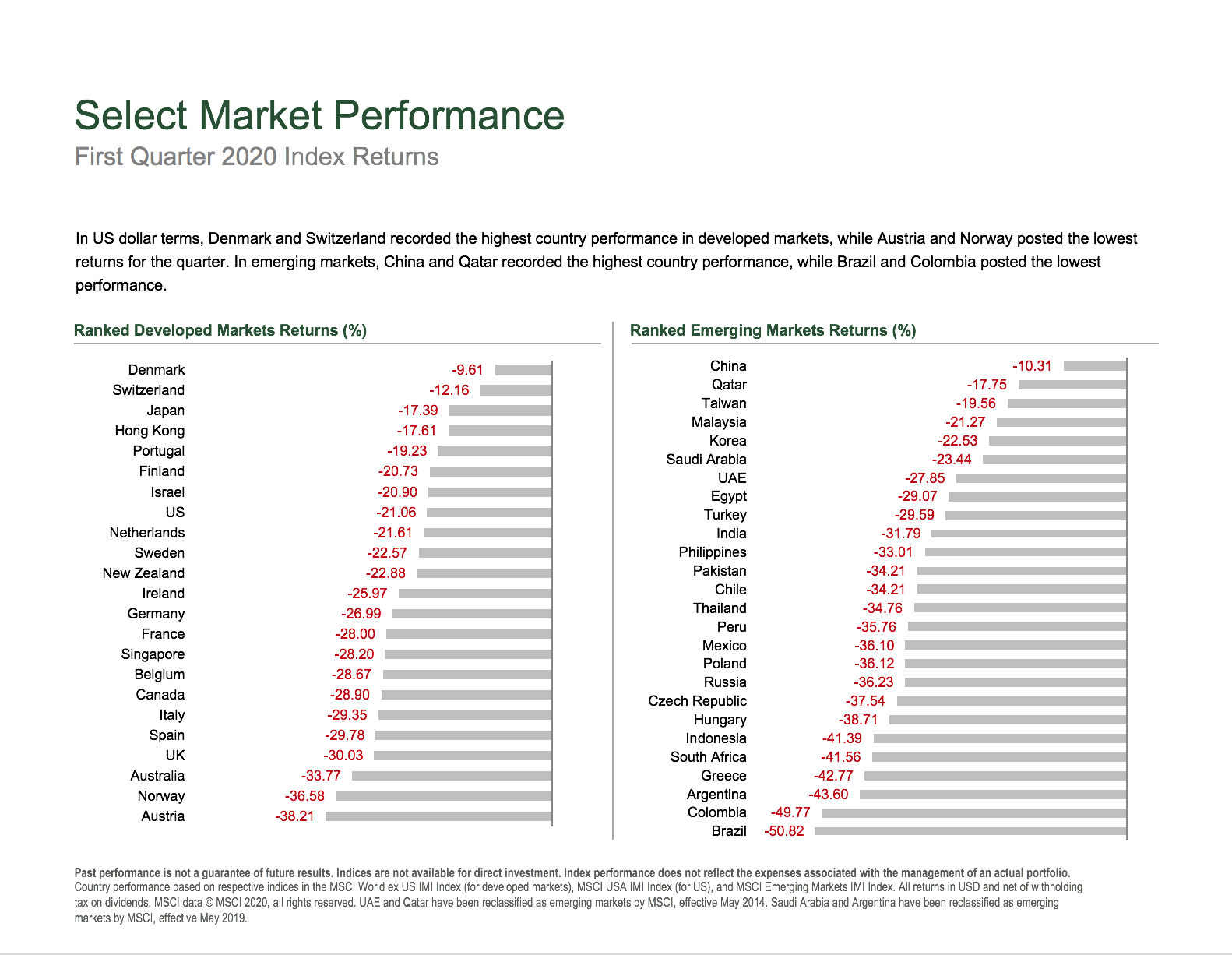

In other parts of the world, several Asian and Scandinavian countries saw their equities markets fare better in Q1. Japan, Hong Kong, Denmark and Finland were among the countries with markets sliding less than 20% on the quarter. On the other end of the spectrum we have the UK, Austria, Norway, and Australia, all losing more than 30%.

Why the difference? Likely how far along each is on the curve. With the virus coming out of Asia, Hong Kong and Japan are likely ahead of the US and other western countries. (Granted, I’ve not spent much time looking into this data set). It is interesting that Norway lost so much more ground than Finland, Denmark, and Switzerland. Looking ahead, there appears to be value in many of these countries. Like here in the U.S. the economic fallout from this thing is pretty murky. But comparing Europe & Asia to the US appears to show some opportunity in equities.

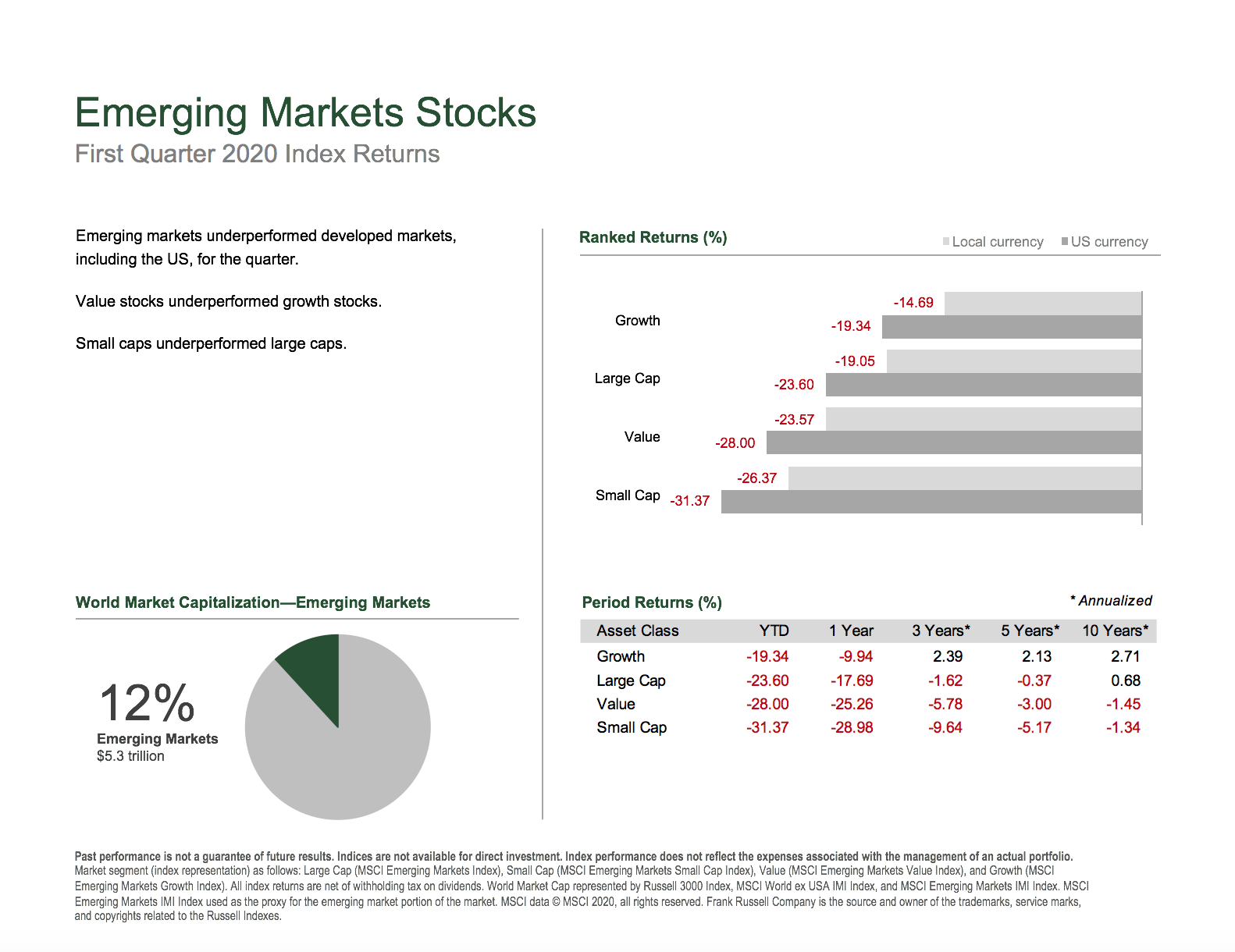

Emerging Markets Stocks

Like Japan and Hong Kong, China’s equity slide was far less by the end of Q1 than other countries in the emerging markets. South American countries were hit particularly hard. Argentina, Colombia, and Brazil all fell more than 40%.

We should expect this kind of volatility from the asset class. Many investment managers use a mix of valuation metrics to keep a running tally of 5, 7, and 10 year expected returns across asset classes. Nearly every one I’ve seen recently has emerging market and small cap US stocks toward the top of their lists. Here’s GMO’s, for example. Yet another argument in favor of global diversification.

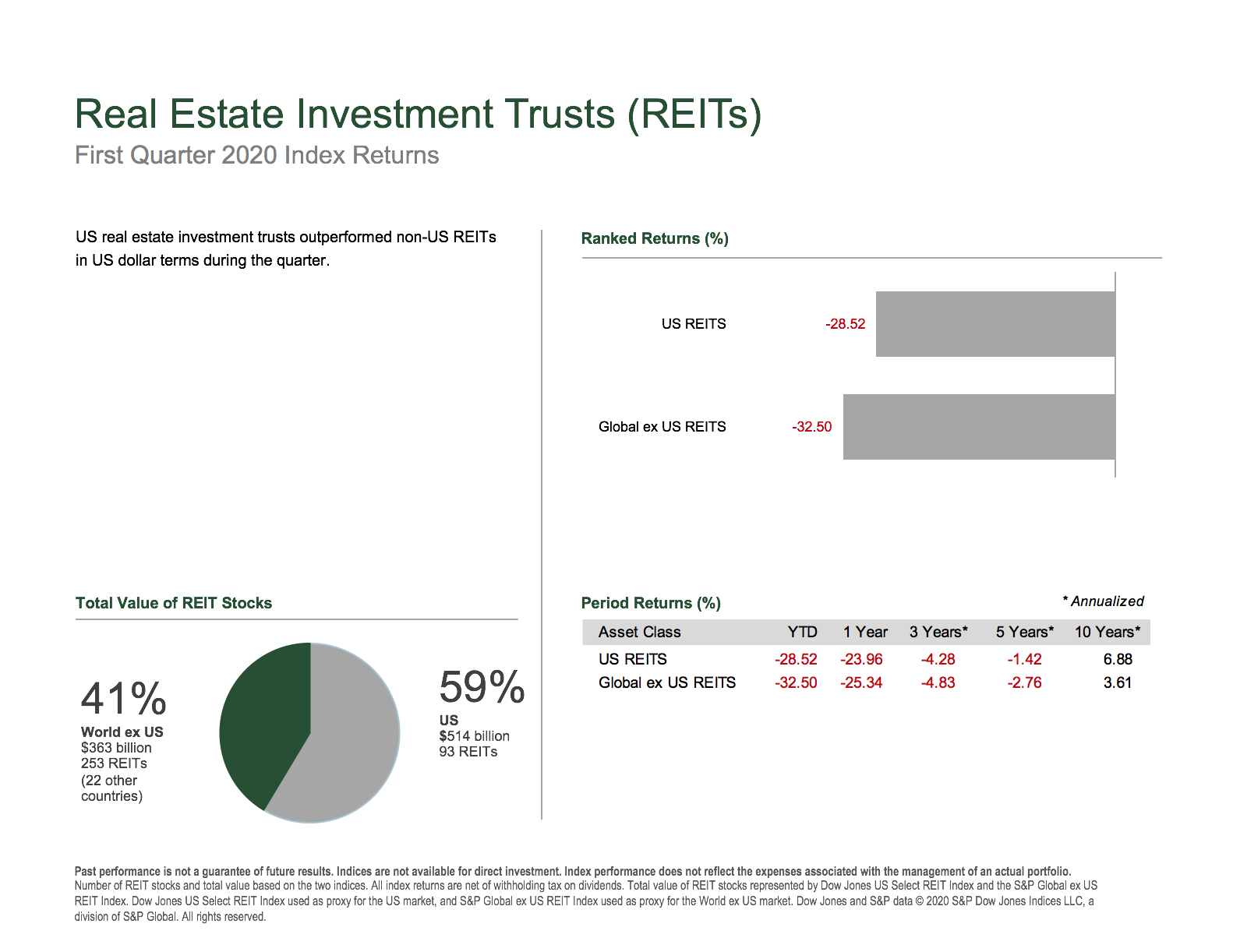

Real Estate Investment Trusts (REITs)

As you can guess, commercial real estate investments have not fared well since the pandemic began. Office buildings are largely unoccupied at the moment and will likely stay that way for the foreseeable future, as white collar jobs taking place in such buildings can more easily be performed remotely. The one segment in the REIT universe that could perform OK are hospitals…..for obvious reasons.

Going forward, I would be concerned if I were managing a large commercial office space. This doesn’t represent 100% of the REITs out there, of course. Even so, many are making the case that the way we perform our work in the world has been forever changed. If you believe that COVID-19 will open employers’ eyes and allow more employees to operate from home, you probably shouldn’t be loading up on REITs right now. Don’t use this argument as a reason to avoid rebalancing or maintaining your positions, of course.

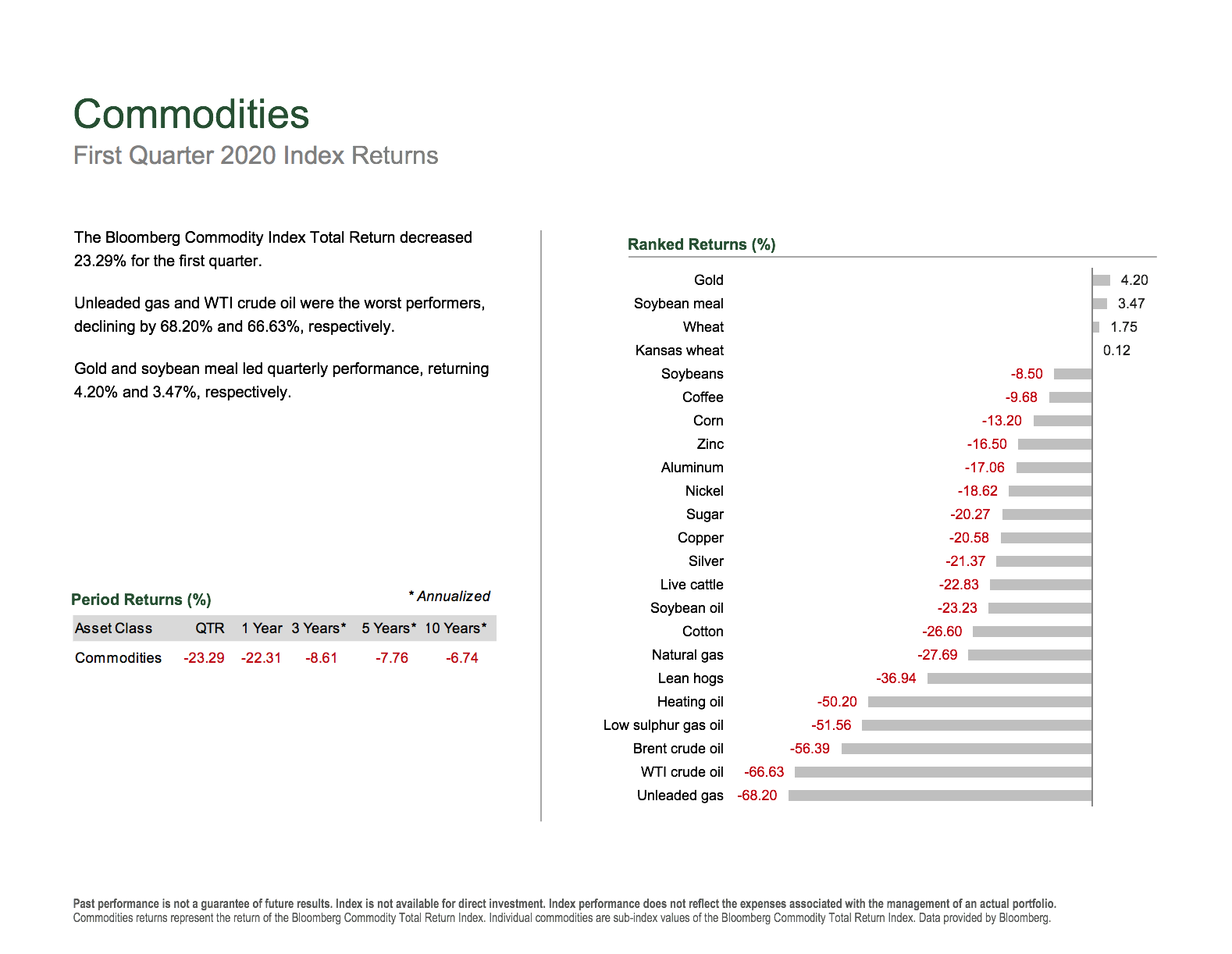

Commodities

Commodities are not an asset class I typically cover in our quarterly market updates. But there’s been some history made in oil recently, prompting the review today. As you may have heard, oil futures recently traded as low as NEGATIVE $40. With oil demand dropping off the table in recent months oil producers across the world have chosen to store extra oil production, rather than bringing it to market and driving prices down further. With only a day or two left in the most recent futures contract cycle, the same producers began running out of space to store production. Nor could they find a “home” for it. Prices were driven down into negative territory, where producers actually had to pay buyers to take it off their hands.

While the entire oil market, including spot prices (price of oil today) and futures contracts further into 2020 were dragged down with April futures, they all remain in positive territory. As you can guess, this has produced some poor returns for the asset class over the quarter. Not all commodities were down though, as precious metals are put in the same category. Gold was up modestly in Q1, while silver and copper were down sharply.

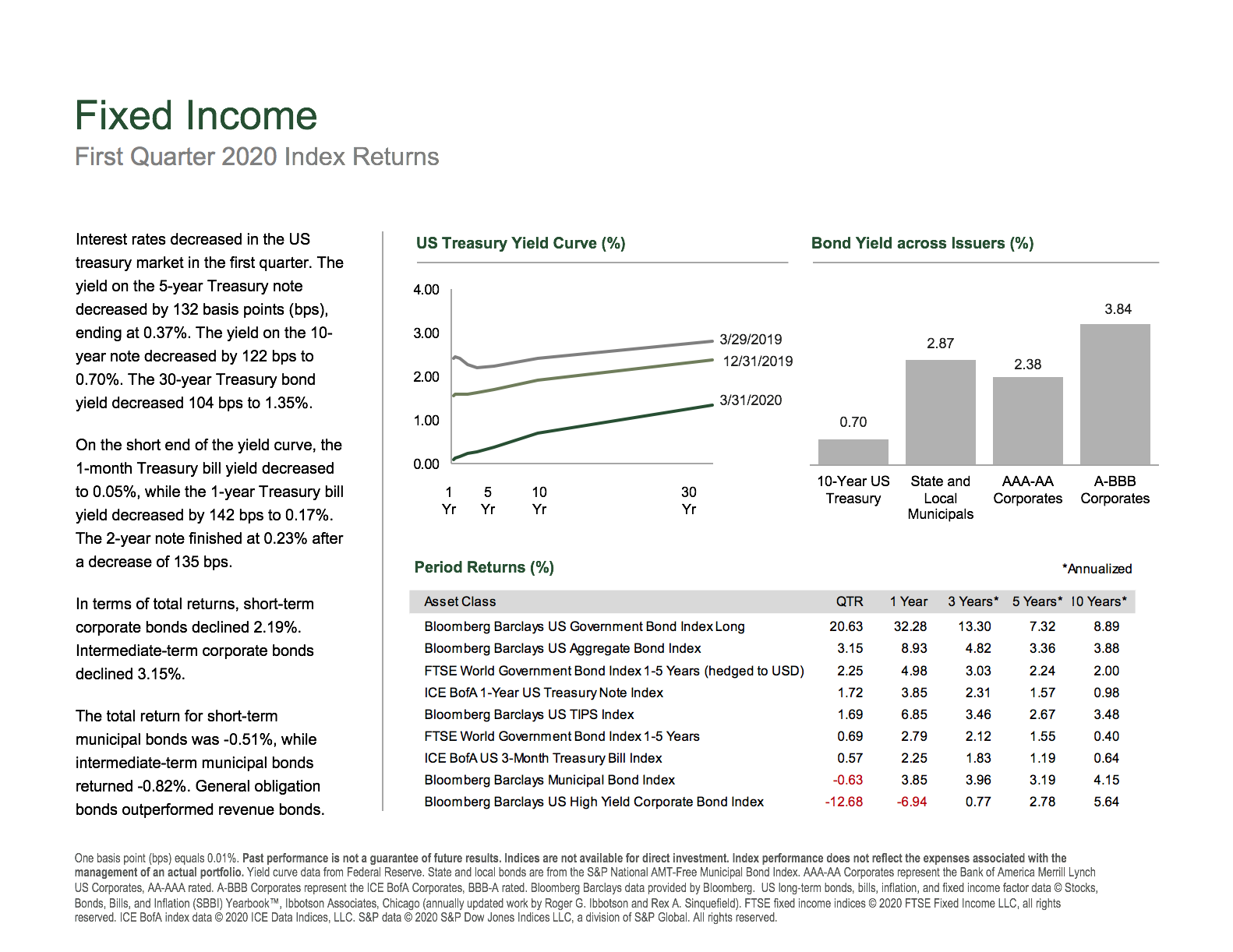

Fixed Income

Amid the turmoil this quarter interest rates across the board have fallen precipitously. As you may have heard, the Fed lowered the fed funds rate pretty early on in the pandemic to a range of 0% – 0.25%. Across the yield curve 5-year US notes are yielding a paltry 0.37%, and the 10-year now yields around 0.7%. While not currently an all time low, the 10-year bond yield has brushed up against it several times in the last three months.

What’s more interesting on the fixed income side to me is how the Fed has decided to engage in the bond markets. In an effort to shore up confidence and prove to the world that it was prepared to provide liquidity, the Fed announced a few weeks ago that it’d start buying up broad bond ETFs. By interacting in the market directly, the fed has already closed the gap between bond fund NAV and ETF pricing, which had been growing in disparity in late February and early March. Will stock ETFs be next? Hopefully not. But at least the low rates on the long end of the curve present an opportunity to refinance your mortgage.