If you’ve been paying attention to financial headlines or the brokerage industry at all, you may know that competitive pressures have been heating up recently. Last year Charles Schwab announced it was reducing commission rates for stock trades to $0, hoping to capture market share and thwart momentum from upstart firms like Robinhood. Oh, and once the pressure on competitors began to sink in, Schwab purchased TD Ameritrade.

Since then more chips have begun to fall. Vanguard and Fidelity both decided to follow suit and reduce their own commissions to $0. As the brokerage industry continues to mature, I’m certain we’ll see more changes that benefit investors. In the meantime, you may be asking how these brokerage firms are even able to offer trading for free. Isn’t that how they make money? How can brokerages be profitable when they don’t charge anyone for trading?

Over the last decade or so brokerage firms have transitioned steadily away from commission revenue and toward net interest margin. Just like a bank, the idle cash sitting in your investment accounts is reinvested by your broker.

You don’t see this, of course. All we see as investors is the paltry monthly interest that accumulates in our accounts. But just like a bank your brokerage firm is taking that cash, reinvesting it in various bonds, collecting somewhere between 3%-5% per year, and paying you a fraction of that.

Is this a nefarious activity? Absolutely not. But it does mean that brokerage firms have a major incentive to suppress the interest paid to everyday investors. And with equity market valuations stretching further and the business cycle growing more gray hairs, it’s becoming more important to command an adequate yield on our cash.

This post will cover how you can go about it.

What’s that Interest Rate Again?

When’s the last time you logged into your bank account and checked the interest rate on your savings account? If it’s been a while, you might be shocked at low it is.

This probably isn’t a big deal if you have just a few bucks sitting in your checking account. But for anyone with a fully funded cash safety net of 6-24 months’ worth of living expenses, the rate you earn on your cash starts to matter a little more.

Obviously, banks make money by borrowing funds at one rate, and then lending it back out at higher rates. This is known as interest margin: banking 101. As I mentioned above, brokerage firms operate in the same fashion. The idle cash in your brokerage account is reinvested to produce an interest margin.

When you open an account at a brokerage firm these days, most accounts auto-enroll you in some type of “sweep” program. The purpose here is that your broker has several limitations with regard to how it may reinvest the idle cash in your account. By “sweeping” the cash into a different financial instrument, many of these limitations go away. More flexibility = greater spreads = higher returns.

This kind of description may make you think your bank/brokerage firm is being whimsical with your cash. I don’t believe that’s the case (at least like it was pre-2009). The destination for sweep programs is almost always a money market mutual fund. Money market funds are mutual funds just like any other. A portfolio manager invests your cash in different securities pursuant to the strategy stated in the fund’s prospectus. The difference is that money funds may only invest in short term government debt, and/or short term highly rated corporate paper.

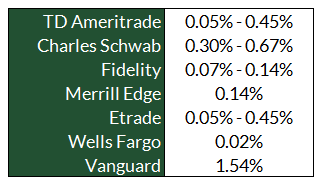

They’re still very safe, very liquid investments. They’re just a little more flexible than the restrictions imposed on ordinary brokerage account deposits. That said, the rates offered through these sweep programs are still terribly low. Here’s a look at the rates several of the major brokerage firms are currently paying on cash in their default programs:

The only firm currently offering a decent rate is Vanguard. All the others sweep you into some type of program with low to very low yields. The good news is that each of the firms above offers many stronger alternatives with better rates. You just need to take action to use them.

Cash Alternatives

So what’s the best way to manage your cash? My suggestion is that once you’ve built up your cash safety net (again, 6-24 months’ worth of living expenses), park that cash in one of the options listed below. All of these do the job of commanding a reasonable yield without taking much risk. Remember, your safety net should be liquid and accessible at all times.

Money Market Mutual Funds

Most brokerage firms have an array of different money market funds you can choose to invest your cash in. Some are restricted to investing only in short term U.S. government debt. Others may also invest in short term, highly rated corporate paper. Right now many of these funds might yield anywhere from 1.5% to 2% per year. Unfortunately, they’re just not the funds that sweep programs typically use.

The opportunity here is to proactively use your cash to purchase one of the higher yielding funds your firm offers. By simply buying shares of a similar money fund proactively (rather than sticking with the option you’re defaulted into) you can very likely boost your yield closer to the 1.5%-2% that we’re seeing today.

High Yield Bank Accounts

Banking has changed a lot in the last 20 years or so. (What hasn’t?). With the rise of the internet, online banking is really commonplace, and has led to opportunities for better & more efficient operating models.

Whereas your behemoth mainstay banks like Chase, Wells Fargo, and Bank of America have branches on every corner, others have decided to eschew brick and mortar locations entirely. By avoiding the additional overhead of maintaining physical locations, they’re able to pass on the savings in overhead to customers through much higher yields.

Because of this, high yield savings accounts from online banks are a pretty compelling place to stash your cash. The yields compare with money market funds, and your deposits are FDIC insured. As best I can tell, the two banks consistently offering the highest yields are Ally and Capital One. As I write this, Ally is offering 1.6% on their high yield savings accounts, while Capital One is at 1.70%.

The downside for customers, obviously, is that you don’t have the option of walking into your neighborhood branch and talking to a banker face to face. If you need extra help you’ll be routed to a 1-800 number, and have the pleasure of dealing with hold times and automated directories.

[Aside: I’ve heard good things and bad things about Ally Bank’s customer service over the telephone. Most clients of mine who use them have had no issues. But two different clients did have very poor experiences recently when trying to execute transactions outside of Ally’s normal operating procedures. If you have a lot of these needs, an online bank may not be the best fit. I haven’t heard much feedback either way about Capital One.]

Bond & CD Ladders

CD ladders are also somewhat popular amongst people I tend to speak with. The idea here is that if you want to keep $100,000 in cash as your rainy day fund, you might choose to buy 11 different certificates of deposit at your local bank. You would keep $100,000 / 12 = $8,333.33 in a savings account, use another $8,333 to buy a one month CD, another $8,333 to buy a two month CD, and so on. Then, as each CD matures, you take the proceeds and roll it into a new 12-month CD.

Since you typically get better yields the longer you lock up cash in a CD, the laddering strategy:

- Keeps you relatively liquid (if you need the rainy day fund, you have $8,333 plus interest becoming available)

- Gets you a better yield than a savings account or short term CD

In general I’m not a huge fan of this strategy. It can work, but you’ll usually find higher rates in high yield savings accounts or money market mutual funds. Plus, you have to monitor it constantly. Yes, you can structure a ladder to mature less frequently, like quarterly or semi-annually. But it still takes babysitting. Why spend extra time for less yield?

Same goes for bonds. You could create the same ladder using short term government bonds, but the yields are as good as you’ll find elsewhere. They’re not FDIC insured, either.

Moral of the Story: Pay Attention to Your Cash

The underlying theme here is that it’s important to pay attention to your cash. Everyone should have some cash sitting around for a rainy day. Whether it’s 6 months’ worth of living expenses or 24, it pays to pay attention to your yield. Banks and brokerage firms are more than happy to “sweep you off your feet” if you don’t. Taking a few minutes a year and weighing your options could easily be worth a couple thousand dollars each year.